T4K3.news

Fed rate decision expected

Markets price in a rate cut as inflation cools and the labor market slows

Analysts weigh whether the Fed will ease policy this year amid softer inflation and a cooling labor market.

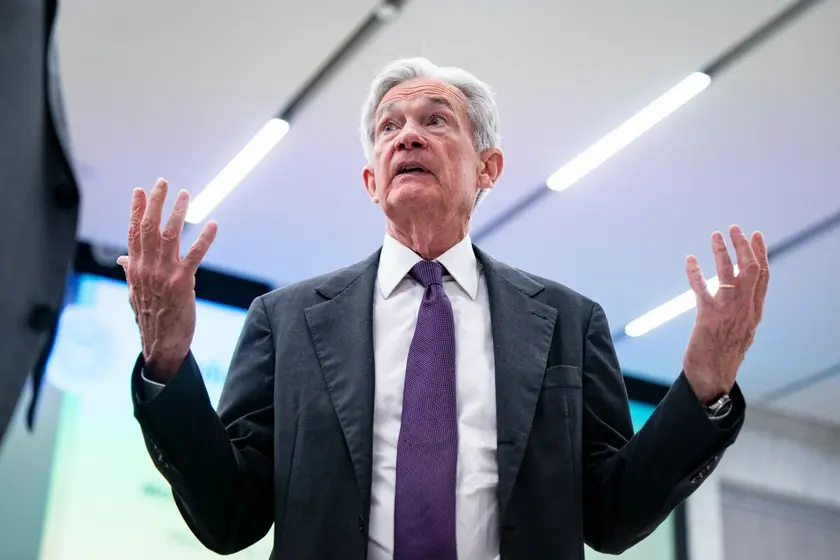

Fed poised to cut rates as inflation cools and jobs slow

The Federal Reserve held its benchmark rate steady after a softer inflation reading, signaling data dependence as policymakers monitor tariff effects and price pressures. Markets widely expect a quarter-point cut at a subsequent meeting, with futures pricing showing high confidence in an easing move.

A slowing labor market adds to the case for easing, but core inflation has shown persistence, complicating the timing of any move. President Trump has pressed against the Fed’s independence with public calls for lower rates, illustrating political pressure that officials must weigh against their two mandates: price stability and maximum employment.

Key Takeaways

"These inflation numbers give the Fed the numbers they need to start cutting"

Derek Horstmeyer on how inflation data informs the case for easing

"The Fed will probably choose to make a cut in response"

Gerald Epstein on the likelihood of a rate cut

"Jerome 'Too Late' Powell must NOW lower the rate"

President Trump on the Fed chair

The debate here centers on independence versus political pressure. The data could push the Fed toward a measured cut, yet policymakers must guard against fueling inflation if demand accelerates. The interplay between tariff-driven price effects and ongoing labor-market shifts adds a delicate layer of risk to any decision. A rate cut could stabilize growth but raise questions about credibility if inflation reaccelerates. In short, the Fed faces a waiting game where timing matters as much as the move itself.

Highlights

- Data becoming the quiet negotiator between growth and price stability

- Independence is the shield the Fed wears when politics grows loud

- Markets want certainty even as the data keeps moving the goalposts

- The next move tests how well inflation and employment align

Political pressure around Fed decision

The report highlights public calls from the president for lower rates and ongoing political discourse, raising questions about independence and potential market backlash.

The path forward will hinge on the next data flow and the Fed’s confidence in inflation staying on target.

Enjoyed this? Let your friends know!

Related News

Federal Reserve maintains key interest rate amid dissent

Fed officials meet as rate cut expectations grow

Federal Reserve maintains interest rate amid economic uncertainty

Federal Reserve to maintain rates amid geopolitical tensions

Jerome Powell's remarks will influence market expectations

Federal Reserve to keep interest rates unchanged

Federal Reserve keeps rates steady amid tech earnings

Federal Reserve holds interest rates steady for fifth consecutive meeting