T4K3.news

Federal Reserve keeps rates steady amid tech earnings

The Federal Reserve has decided to maintain interest rates unchanged, focusing attention on earnings from major tech companies.

The Federal Reserve's decision to keep interest rates unchanged comes as major tech companies prepare to announce earnings.

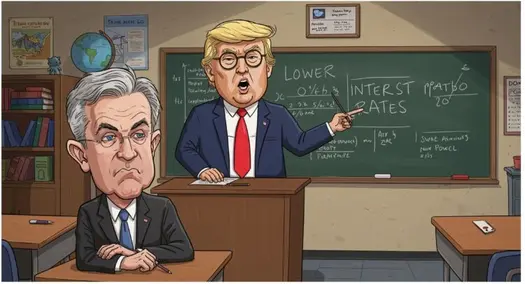

Federal Reserve Holds Rates Steady as Big Tech Prepares for Earnings Reports

The Federal Reserve announced on Wednesday that it will keep interest rates unchanged at its July meeting, maintaining a benchmark lending rate of 4.25% to 4.5%. Fed Chair Jerome Powell stated that there were two dissenting voters who preferred to lower rates. As interest rates remain stable, attention now turns to upcoming earnings reports from major tech firms like Meta and Microsoft. Analysts expect Meta to report higher revenues and a potential increase in expenses linked to its AI hiring strategy. Microsoft, projected to report significant revenue as well, will be watched closely for Azure sales growth and future guidance on fiscal forecasts.

Key Takeaways

"We're still a ways away from seeing where things settle down."

Powell reflects uncertainty over trade deals and their impact on inflation.

"You do not see weakening in the labor market."

Powell assesses the balance in the labor market despite risks.

"The consensus is at $114.5 billion; that number is probably too low."

Analysis suggests Meta may increase its expense outlook significantly.

"You see a slowing of job creation and a slowing in the supply of workers."

Powell describes the current state of the labor market and economic balance.

The Fed's decision not to change rates reflects caution amidst ongoing inflationary pressures. Powell's acknowledgment of uncertainties around recent trade deals highlights the complexity of the economic situation. With significant tech earnings on the horizon, both Meta and Microsoft are likely to face increased scrutiny from investors eager to see how they navigate a challenging landscape marked by rising costs and heightened competition. This week could serve as a critical moment for both companies, potentially influencing market sentiments ahead of further Federal Reserve meetings.

Highlights

- The Fed's caution reflects the complexity of today's economic decisions.

- Market reactions may hinge on more than just the earnings numbers.

- Tech companies are stepping into a critical moment as they report earnings.

- Investors will be closely watching for guidance on future growth.

Economic Risks Linked to Fed Decisions

The Federal Reserve's pause on interest rate changes may lead to political backlash as inflation pressures persist amid uncertain economic indicators. Investors are particularly sensitive to the Fed's future moves, with significant implications for the stock market and business environment.

The market’s response to upcoming earnings will be a key indicator of investor sentiment going forward.

Enjoyed this? Let your friends know!

Related News

Stocks Decline as Powell Shares Outlook on Interest Rates

Markets pause as inflation surprises

Markets slide as AI shares retreat

Federal Reserve maintains interest rate amid economic uncertainty

Dow Futures Slide on Trump Fed Clash

Stocks Hold Steady as Trump Dismisses Fed Governor Lisa Cook

Federal Reserve keeps interest rates unchanged

Powell to speak at Jackson Hole