T4K3.news

Federal Reserve maintains key interest rate amid dissent

The Fed opted to keep rates steady despite dissent from two Trump-era appointees.

The Federal Reserve's decision not to cut interest rates reflects political pressure from the Trump era.

Trump's influence seen as two Fed appointees dissent on rates

On Wednesday, the Federal Reserve decided to keep its key interest rate unchanged, a move expected amidst significant pressure to lower rates from the Trump administration. While the Fed described economic growth as moderating, inflation remains comparatively high, described as ‘somewhat elevated.’ In an unprecedented act, two Federal Reserve officials, both appointed by Trump, voted against the decision. This marks the first dissent in over thirty years. Fed Chair Jerome Powell acknowledged the uncertainty brought by Trump’s tariffs, affecting the economy's downward trajectory. Despite recent stronger economic activity reports, inflation data revealed significant increases compared to prior estimates, complicating the Fed’s position. Analysts are now closely monitoring economic indicators over the next two months to gauge the likelihood of a rate cut in September as the Fed navigates a challenging landscape influenced by political demands and inflationary pressures.

Key Takeaways

"The economy is not behaving as if it’s being held back by the Fed’s current interest rate level."

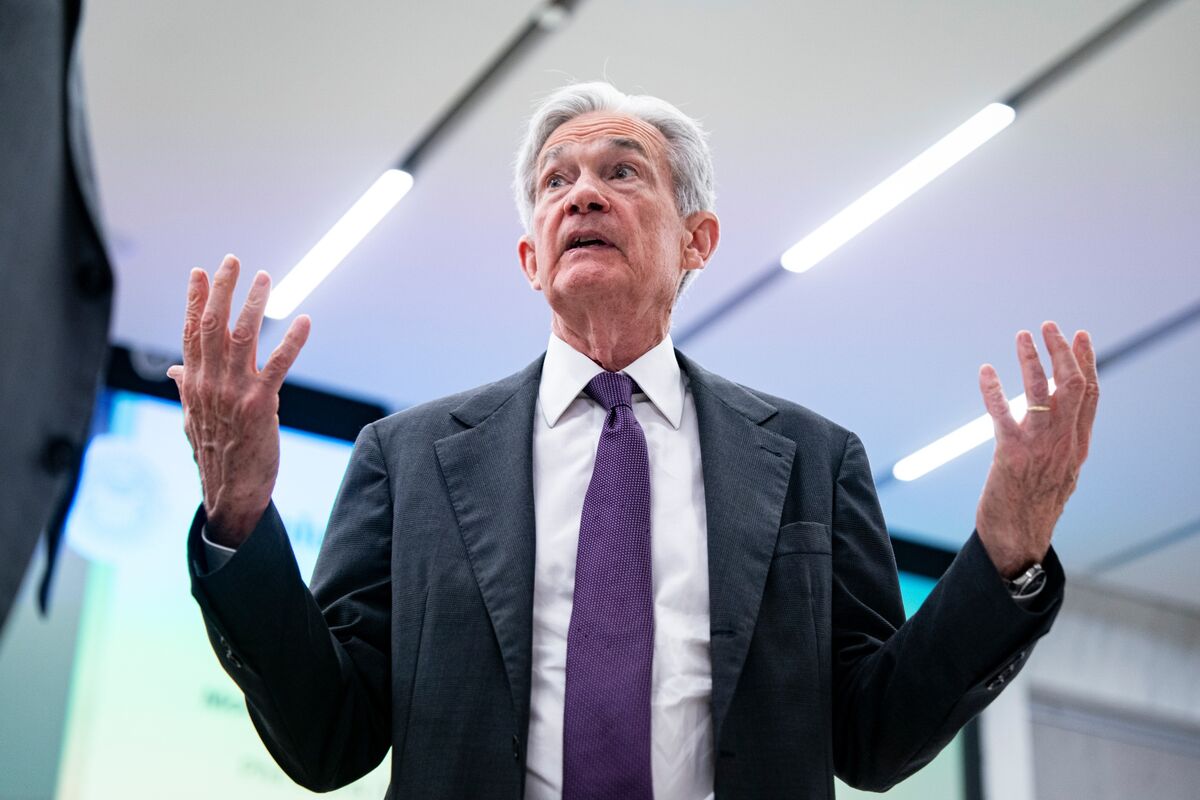

Jerome Powell addresses the effectiveness of current rates in a press conference.

"This is not a catastrophic recession or inflation but it is a cause for serious concern."

Jason Furman comments on the current economic state following the GDP report.

"The Fed now knows that its preferred inflation measure is running a touch hotter than it had appeared yesterday."

Analysis from JPMorgan highlights changing inflation dynamics that affect Fed decisions.

"I don’t think people appreciate just how much re-inflation we’ve had."

Jason Furman discusses inflation realities that may challenge policy decisions.

The Federal Reserve's decision reflects a tense intersection of monetary policy and political influence, specifically from the Trump administration, which has aggressively lobbied for lower rates. The dissent from Fed officials sends a clear signal of the deep divides within the institution, emphasizing the Fed's independence is constantly challenged by external pressures. While some argue that lower rates could spur economic growth, others highlight potential inflation risks stemming from tariffs, suggesting a need for a cautious approach. The ongoing conflict between desired economic conditions and actual financial data complicates the Fed's future decisions, presenting a balancing act that could define economic policy in the months ahead.

Highlights

- The dissent from Fed officials shows the deep divisions within the institution.

- Economists warn that elevated inflation signals a challenging road ahead.

- Political influence on the Fed may reshape future economic strategy.

- The balancing act between growth and inflation will define the Fed's next steps.

Political influence complicates Federal Reserve actions

The ongoing pressure from the Trump administration on interest rates may undermine the Fed's independence and increase economic uncertainty. Dissent among Fed officials showcases critical internal conflicts.

The Fed’s next moves will depend heavily on upcoming economic indicators and ongoing political dynamics.

Enjoyed this? Let your friends know!

Related News

Federal Reserve keeps interest rates steady

Federal Reserve keeps rates steady amid tech earnings

Potential dissent at the Fed may signal policy shifts

U.S. inflation rises as tariffs influence prices

Federal Reserve Meeting Highlights Political and Economic Crosswinds

Trump escalates Fed criticism amidst economic turmoil

Trump intensifies pressure on Federal Reserve Chair

Jerome Powell faces dissent at the Fed