T4K3.news

Fed minutes show inflation risk guides policy

Fed officials say inflation risk outweighs job losses, keeping rates steady amid tariff uncertainty.

Most Fed officials saw inflation risks as a greater concern than job losses, keeping rates unchanged amid tariff effects and uncertainty.

Fed minutes show inflation risk guides policy as tariffs loom

The minutes from the July 29-30 Federal Reserve meeting show a majority of policymakers judged the threat of higher inflation to be greater than the risk of weaker hiring. They noted that higher tariffs had become more visible in prices for some goods, but their overall impact on inflation and activity remained unclear. The group also stressed uncertainty about how, when, and to what extent tariffs would influence the economy. The Fed left the target rate steady at about 4.3 percent, even as two policymakers wanted a rate cut and others favored waiting for clearer signals.

Key Takeaways

"assessed that the effects of higher tariffs had become more apparent in the prices of some goods but that their overall effects on economic activity and inflation remained to be seen."

Minutes quote on tariff impact

"evidence so far suggested that foreign exporters were paying at most a modest part of the increased tariffs, implying that domestic businesses and consumers were predominantly bearing the tariff costs."

Minutes quote on pass-through of tariff costs

"signaled that it might take significant additional time for the Fed to determine whether Trump's sweeping tariffs are boosting inflation."

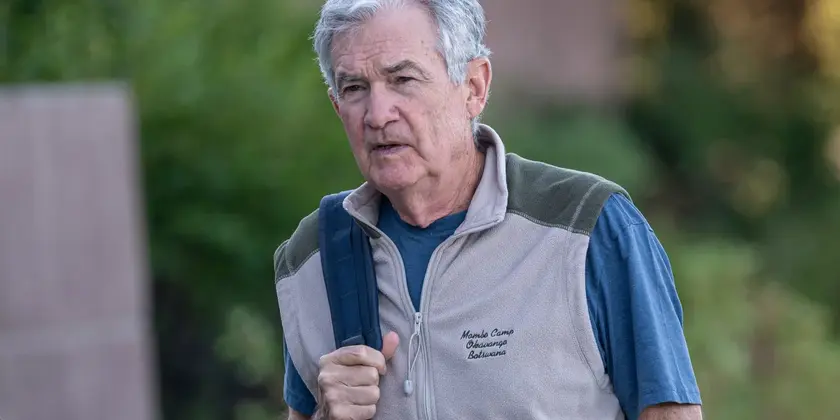

Powell’s remarks after the meeting

"Tariffs land on wallets while policy watchers wait for data."

Standalone quote candidate on tariff impact

The document highlights a cautious, data-driven approach in a politically tense environment. The Fed aims to protect inflation credibility while avoiding new shocks to growth. That tension matters because tariff changes can creep into prices gradually, complicating expectations and market pricing. The real test will come with incoming data that either confirms inflation pressures or eases them, shaping whether the Fed will cut later this year or hold firm.

Highlights

- Inflation is the bigger threat in the room.

- Tariffs will land on end customers over time.

- The policy path stays unclear until the data speak.

- The Fed moves with caution in a tariff driven world.

Tariffs and inflation risk political and market impact

The piece ties tariff policy to inflation and notes political dynamics, investor expectations, and potential backlash. This increases sensitivity around policy choices and market reactions.

The next data releases will set the tempo for policy moves.

Enjoyed this? Let your friends know!

Related News

Gold climbs as political pressure grows on the Fed

Fed holds rates steady amid tariff inflation risk

Fed minutes show tariffs shaping inflation risk

Bitcoin Falls as Inflation Fears Grow and Markets Drop

Powell speech sets tone for rate path

Powell Signals Possible September Rate Move

Oil and gold rise before crucial talks in Washington

Mortgage rates edge lower