T4K3.news

Do Kwon pleads guilty to fraud in New York court

The Terraform Labs founder pleads guilty in a U.S. court to fraud linked to TerraUSD and Luna; sentencing set for December 11.

Terraform Labs founder admits to fraud tied to TerraUSD and Luna after a long legal fight.

Do Kwon pleads guilty to fraud in New York court

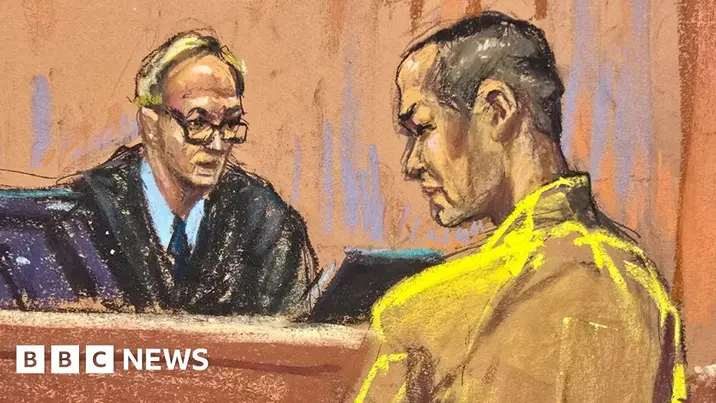

Do Kwon appeared in a New York court wearing a yellow prison jumpsuit and pleaded guilty to two counts of fraud as part of a plea deal. Prosecutors say he orchestrated a multi-billion dollar crypto asset securities fraud connected to Terraform Labs’ TerraUSD stablecoin and its Luna token, which collapsed in 2022 and triggered a broad sell-off in crypto markets.

Under the plea agreement, prosecutors will refrain from seeking a sentence longer than 12 years. Kwon is due to be sentenced on December 11. He fled South Korea after an arrest warrant was issued in 2023, was held in Montenegro, and later extradited to the United States.

Authorities say Kwon misrepresented features meant to keep TerraUSD pegged at $1 without outside intervention, and that in 2021 he arranged for a trading firm to surreptitiously purchase millions of dollars worth of the token to prop up its value while telling investors the Terra Protocol algorithm was responsible. The TerraUSD and Luna crash followed in 2022. Kwon had originally pleaded not guilty to nine counts and faced up to 135 years in prison if convicted. He must forfeit up to $19.3 million plus interest, several properties, and pay restitution. He still faces charges in South Korea.

Key Takeaways

"In 2021, I made false and misleading statements about why TerraUSD regained its peg."

Kwon's admission in court

"What I did was wrong and I want to apologise for my conduct."

Kwon's apology in court

"orchestrating a multi-billion dollar crypto asset securities fraud"

Prosecutors' claim

The plea marks a milestone in how courts handle crypto crises. It signals that investors will demand accountability even when markets run on algorithms and rapid trading. Yet the deal also raises questions about whether a capped sentence and forfeitures are enough to deter future misconduct in a fast-changing sector with complex technology.

For investors and risk watchers, the case underscores the ongoing need for stronger disclosures and clearer regulatory guardrails. It could influence how prosecutors approach crypto fraud and how regulators frame rules for stablecoins and related tokens, potentially shaping future settlements and enforcement strategies.

Highlights

- Accountability is not optional in digital finance

- Promises that crumble cost real money

- Crypto markets need clear rules and real consequences

- Trust earned today shapes tomorrow's exchanges

Crypto case carries investor and regulatory risk

The guilty plea and the scale of losses underscore the vulnerability of crypto investors and the growing need for stronger oversight and cross-border enforcement.

The path to accountability in crypto markets is long, but cases like this push it forward.

Enjoyed this? Let your friends know!

Related News

Do Kwon pleads guilty in crypto collapse

Do Kwon pleads guilty in Terra collapse case

Fashion startup CEO charged with fraud released on bail

Pawn shop owner pleads guilty for fencing stolen items

Cassie Ventura Posts on Instagram After Diddy Trial

NYC pawn shop owner pleads guilty in high-profile theft cases

New York pawn shop owner pleads guilty to selling Burrow's stolen items

Cassie testifies against Diddy regarding abuse allegations