T4K3.news

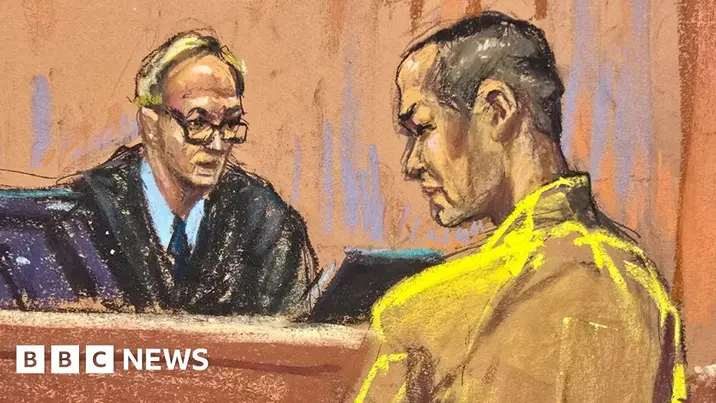

Do Kwon pleads guilty in Terra collapse case

The crypto founder pleads guilty to fraud charges tied to a 40 billion dollar collapse, with sentencing due in December.

South Korean crypto founder Do Kwon pleads guilty to fraud charges tied to the Terra collapse.

Do Kwon pleads guilty to fraud charges over Terra collapse

Do Kwon, 33, pleaded guilty in Manhattan federal court to one count of conspiring to commit commodities fraud, securities fraud and wire fraud, and a second count of wire fraud. The plea agreement caps the sentence at no more than 12 years if he meets the terms, well below the usual guideline range. He was extradited from Montenegro after an arrest for traveling on a false passport. The case centers on TerraUSD, a stablecoin that collapsed in May 2022, erasing about 40 billion dollars in value for TerraUSD and Luna investors. Kwon co founded Terraform Labs in 2018, and prosecutors say investors worldwide faced billions in losses.

Prosecutors say the plea shows a strong stand against fraud in the fast moving crypto world. The deal also requires Kwon to forfeit more than 19 million dollars and give up his stake in Terraform and its tokens. Sentencing is set for December 11. The case tests how far traditional law enforcement will reach into digital assets and what regulators may demand as the crypto sector grows. The extradition from Europe under a false passport underscores the cross border complexity of enforcement.

Key Takeaways

"used the technological promise and investment euphoria around cryptocurrency to commit one of the largest frauds in history"

U S Attorney statement

"takes responsibility for misleading the Terra community"

Kwon's defense team statement

"investors around the world suffered billions in losses"

U S Attorney statement

"the case tests whether crypto hype can survive real law enforcement"

Editorial takeaway

Beyond the individual at the center, the Terra case highlights how investors trusted a high flying project and how quickly that trust can crack when a token fails. The collapse puts a spotlight on the need for clearer rules around stablecoins and cross border activity as the market expands.

As crypto markets mature, enforcement actions like this may set a template for accountability. The outcome could influence other projects and shape how promoters frame risk and promises to investors. The tension between technological hype and legal duty remains a central question for the industry.

Highlights

- Trust in crypto must be earned again

- Promises without proof end in losses

- Technology is not a shield for fraud

- Investors deserve real safeguards not hype

Crypto fraud case raises questions about oversight

The plea brings attention to investor protection, cross border enforcement, and potential policy responses as crypto markets grow. Outcomes could influence regulation and market trust.

The road ahead for crypto remains unsettled and watchers will look for clearer guardrails.

Enjoyed this? Let your friends know!

Related News

Do Kwon pleads guilty in crypto collapse

Do Kwon pleads guilty to fraud in New York court

Former killer faces new sentence after Liverpool bar attack

Arkansas man pleads guilty to plot to murder teenage girl

Teacher pleads not guilty to capital murder in Arkansas hike killings

Alex Mashinsky sentenced to 12 years in prison

Erin Patterson found guilty of murder and attempted murder

Dr Salvador Plasencia pleads guilty in Matthew Perry case