T4K3.news

Do Kwon pleads guilty in crypto collapse

Kwon admitted to knowingly defrauding cryptocurrency customers and faces sentencing in December.

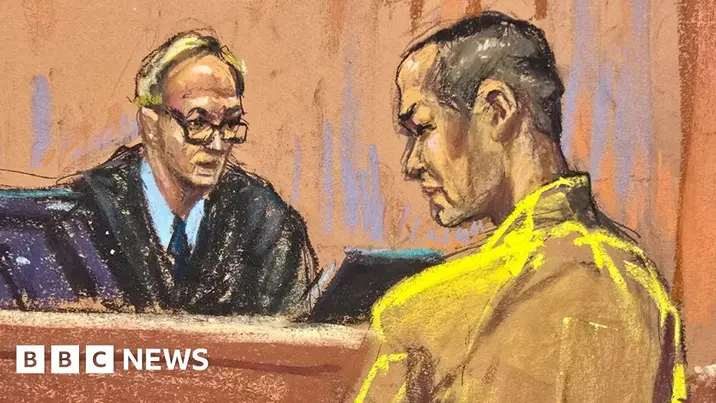

Do Kwon enters a guilty plea in a New York court as part of a deal with prosecutors over a collapse that erased about $40 billion in value.

Do Kwon pleads guilty in $40 billion crypto collapse

Terraform Labs co founder Do Kwon has pleaded guilty to conspiracy and wire fraud in a New York court. The plea comes as part of a deal with prosecutors and follows the Terra stablecoin and Luna crash in 2022 that wiped out about $40 billion in funds. Kwon was extradited from Montenegro in 2023 and was facing multiple charges in the United States.

Bloomberg noted that the plea reduces the charges he faces, with sentencing scheduled for December 11. The maximum penalties linked to the conspiracy and wire fraud charges add up to decades in prison, though the deal likely affects the final term. The case highlights offshore arrest and cross border enforcement in a high profile crypto crime probe.

Key Takeaways

"Kwon admitted to knowingly defrauding cryptocurrency customers"

From plea records as reported in Bloomberg

"This case marks a major milestone in crypto enforcement"

Editorial take on enforcement impact

"Investors who trusted Terra faced devastating losses"

Reaction to the collapse impact on participants

"Regulators are tightening the leash on crypto projects now more than ever"

Regulatory trend assessment

The plea marks a notable moment for crypto accountability. Prosecutors have signaled that they will pursue senior figures behind alleged market manipulation and misleading investors. The case could influence how startups and token projects manage risk, compliance, and investor disclosure. It also underscores the growing role of stablecoins in regulatory scrutiny as authorities look for guardrails where consumer funds are at stake.

For the crypto industry, this development may temper hype with a reminder that legal consequences are possible when a project collapses and investors lose money. Regulators could use the precedent to pressure projects toward stronger governance and clearer disclosures, even as the market still seeks innovation and growth.

Highlights

- Kwon admitted to defrauding cryptocurrency customers

- This case signals a turning point for crypto accountability

- Investors who trusted Terra faced devastating losses

- Regulators are tightening the leash on crypto projects now more than ever

Crypto case raises investor and regulatory concerns

The plea highlights ongoing concerns about investor protection, governance, and cross border enforcement in crypto markets. It could influence future regulation and enforcement strategies and affect market trust.

The outcome will influence how markets assess risk and how regulators police the crypto sector.

Enjoyed this? Let your friends know!

Related News

Do Kwon pleads guilty in Terra collapse case

Do Kwon pleads guilty to fraud in New York court

Former killer faces new sentence after Liverpool bar attack

Trump's cryptocurrency ventures face backlash

Arkansas man pleads guilty to plot to murder teenage girl

Alex Mashinsky sentenced to 12 years in prison

Erin Patterson found guilty of murder and attempted murder

Honduran man pleads guilty to child pornography charges