T4K3.news

China's manufacturing sector contracts in July

China's July manufacturing PMI falls to 49.3, missing expectations and indicating economic slowdown.

China's manufacturing Purchasing Managers' Index shows unexpected decline in activity for July.

China's manufacturing activity contracts sharply in July

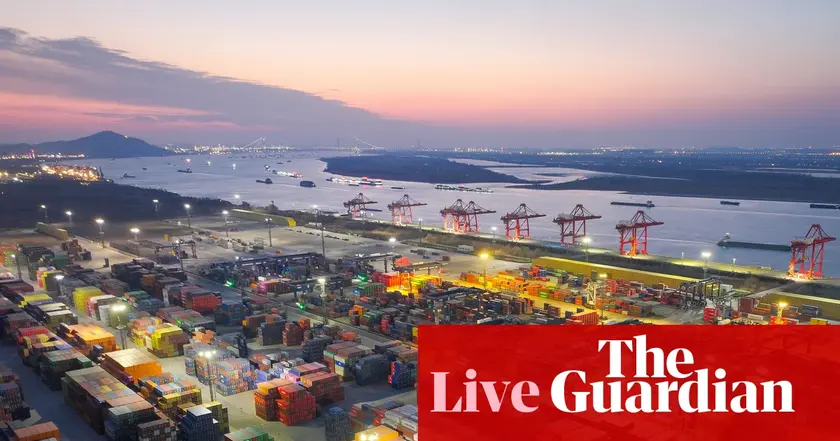

China's manufacturing sector is facing unexpected challenges as the official Purchasing Managers' Index (PMI) for July registered at 49.3, falling short of the anticipated 49.7, according to a Reuters poll. This figure indicates a contraction, as any reading below 50 suggests a decrease in manufacturing activity. The decline follows a trend since April, primarily driven by slowing economic growth and heightened tensions between China and the United States over trade issues. In recent months, both countries have imposed hefty tariffs, adding strain to the trade relationship. Although a temporary truce was reached in May with a rollback of additional tariffs for 90 days, it appears that this agreement will not be extended, as talks ended in Stockholm without a resolution.

Key Takeaways

"The recent PMI drop reflects a significant decline in manufacturing activity."

This quote emphasizes the severity of the current economic situation in China.

"Trade tensions with the U.S. complicate recovery efforts for China's economy."

This highlights the intertwined fates of the U.S. and Chinese economies amidst trade disputes.

The decline in China's manufacturing activity highlights growing concerns over its economic stability. The PMI's drop below the critical 50 threshold emphasizes a significant contraction and reflects underlying issues amplified by ongoing geopolitical tensions. As tariffs bite and economic growth falters, China's ability to rebound from these challenges may shape not only its domestic policies but also its international trade relationships. The expiration of the truce raises questions about future cooperation between the two largest global economies, potentially leading to a prolonged period of uncertainty in international markets.

Highlights

- A contraction in manufacturing signals a worrying trend for China's economy.

- The expiration of the trade truce could escalate tensions between the U.S. and China.

- China's economic stability is at a crossroads with looming trade uncertainties.

- Manufacturing sectors show weaknesses that could impact global markets.

Trade tensions pose significant risks to China's economy

Failure to extend the tariff truce with the U.S. may lead to further economic contraction, impacting global markets.

Future developments in trade negotiations will be crucial for market stability.

Enjoyed this? Let your friends know!

Related News

Mortgage approvals increase as housing market stabilizes

July 2025 Services PMI indicates slow growth

Stock markets fall sharply after Trump tariff announcement

Elon Musk awarded shares worth $29 billion

US Navy demands uncrewed warships delivered in 18 months

Trump reduces tariffs on Japanese auto imports

US ISM Services PMI drops to 50.1 in July

Trump tariffs take effect; Bank of England set to cut rates