T4K3.news

Chancellor Reeves defends UK's tax policies

Rachel Reeves responds to calls for wealth tax amidst ongoing government debates.

Chancellor Rachel Reeves responds to proposals for a wealth tax in the UK.

Rachel Reeves defends tax strategy amid calls for wealth tax

Chancellor Rachel Reeves emphasized that the UK government has achieved an appropriate balance on taxation. This statement followed Anneliese Dodds' suggestion for a wealth tax targeting millionaire households. Reeves pointed to measures already in place that increase taxes on affluent individuals, including a higher tax rate on private jets and increased capital gains tax. She noted that previous reforms, such as eliminating non-domicile status, ensure those living in the UK contribute to the tax system. Government sources reaffirmed that no wealth tax proposal is currently under consideration, citing past failures in other nations. Conflicting views persist within the government, as some ministers express skepticism about the feasibility of such a tax.

Key Takeaways

"In the budget last year, we got rid of the non-domicile status in our tax system."

Reeves emphasized recent tax reforms aimed at increasing contributions from wealthy individuals.

"The No 1 priority of this government is to grow the economy."

Reeves expressed the importance of maintaining investment and job growth over implementing new taxes.

"Clever people and all the economists are saying it doesn’t work."

A government source pointed to the failure of wealth taxes in other countries to support their stance against such proposals.

"What if your wealth was not in your bank account?"

Business Secretary Jonathan Reynolds raised concerns about the practicality of a wealth tax in his comments, urging seriousness in the discussion.

The conversation around taxes in the UK reflects a broader struggle between fiscal responsibility and the need for equitable revenue generation. Reeves presents a view aimed at economic growth, which indicates an inclination to avoid imposed wealth taxes. However, the push from others within the Labour Party highlights a substantial concern regarding wealth inequality amid rising living costs. As the economic landscape continues to evolve, the resistance from some government officials to entertain wealth tax proposals reveals deep divisions that may impede effective policymaking.

Highlights

- The current tax strategy is balanced, says Rachel Reeves.

- Conflicting views on wealth tax highlight divisions in government.

- Equity in taxes remains a hot topic for the Labour Party.

- Investment and jobs are central to Reeves' tax approach.

Concerns over wealth tax proposal

The discussions around a wealth tax raise potential political sensitivities and public backlash given existing economic pressures. The divergence of opinions among ministers may further complicate the debate.

The debate on taxation in the UK is likely to continue as economic pressures persist.

Enjoyed this? Let your friends know!

Related News

Reeves eyes broad tax hikes in Autumn Budget

UK government appeals Epping hotel ruling

City fears bank windfall tax

Pension triple lock tests Reeves

Treasury weighs IHT tweak up ahead of budget

UK firms report record low business confidence

Business leaders urge Reeves on Autumn Budget

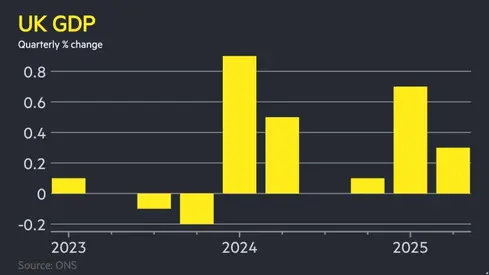

UK growth slows in Q2