T4K3.news

Bitcoin demand slows amid macro pressures

Bitcoin demand dropped sharply in August as macro headwinds weighed on the market, with bulls watching policy signals for the next move.

Bitcoin faces a slowdown in demand in August as macro headwinds temper the latest rally, with bulls looking for a rebound amid policy events.

Bitcoin Demand Slows Amid Macro Pressures

Bitcoin's demand from ETF complexes and treasury-related firms has fallen sharply, dropping from more than 170000 BTC in early August to about 50000 BTC by press time, which helped pull the price from around 124000 to 112500. CryptoQuant's head of research, Julio Moreno, says the demand slowdown largely underpins the retracement.

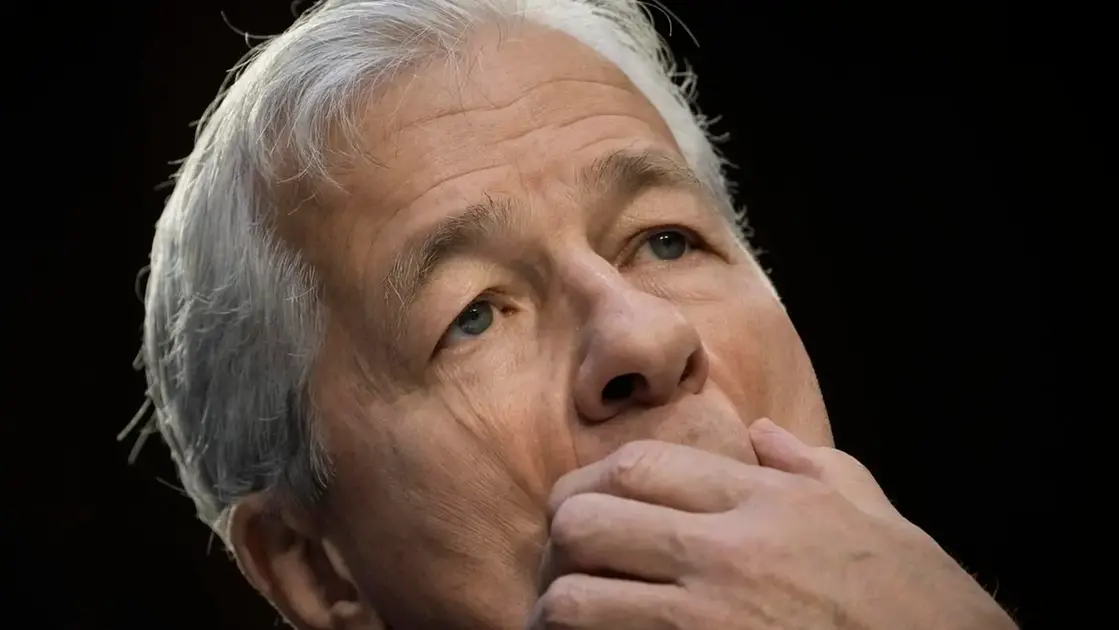

Analysts say September policy signals and liquidity concerns could add to volatility. Market watchers will focus on Federal Reserve Chair Jerome Powell'sJackson Hole speech and the possibility of rate action. Traders have positioned for higher prices, with bullish bets centered on a move to 120000–130000, while a potential uptick in U.S. Treasury borrowing could weigh on sentiment in the near term. If BTC breaks the 110000 support, attention shifts to the 108000 level as the next test.

Key Takeaways

"Liquidity will decide the next move, not just charts"

Editorial remark on macro forces driving BTC

"Bitcoin is testing whether a floor exists at 110K"

Technical level to watch in the near term

"September could reveal the true strength of demand"

Forward looking assessment of macro impact

"This pullback buys time for bulls with a longer horizon"

Outlook on investor sentiment and strategy

The August data shows Bitcoin moving with broader market liquidity rather than only its own dynamics. Policy expectations, dollar funding conditions, and treasury issuance shape risk appetite for crypto at the moment. That means a bounce may hinge less on technology advances and more on the pace of policy normalization and liquidity relief. The options market has turned into a contrarian compass, with record bullish positioning around the 120000–130000 target even as near term risk remains elevated.

Looking ahead, the big question is whether macro stability arrives soon enough to prop up prices or if macro forces push BTC into a longer pause. If the 110000 support proves fragile, traders will scrutinize the 108000 level as the next potential floor, while bulls will seek a renewed breakout once policy cues soften and liquidity conditions improve.

Highlights

- Liquidity will decide the next move, not just charts

- Bitcoin is testing whether a floor exists at 110K

- September could reveal the true strength of demand

- This pullback buys time for bulls with a longer horizon

Macro policy risks and market sensitivity

The piece links Bitcoin demand and price moves to policy signals and Treasury borrowing. This creates political and budget-related risk, along with potential backlash from investors if sentiment shifts abruptly.

The coming weeks will test whether Bitcoin can regain momentum on policy signals and liquidity relief.

Enjoyed this? Let your friends know!

Related News

Bitcoin Surges Above $120K

Bitcoin faces bearish risk as macro outlook dims

Crypto market suffers serious decline

Bitcoin Falls as Inflation Fears Grow and Markets Drop

Bitcoin Price Slump Signals Policy and Liquidity Watch

Crypto weekly movers

Ethereum expected to outpace Bitcoin

Trump escalates pressure on Fed Chair Powell