T4K3.news

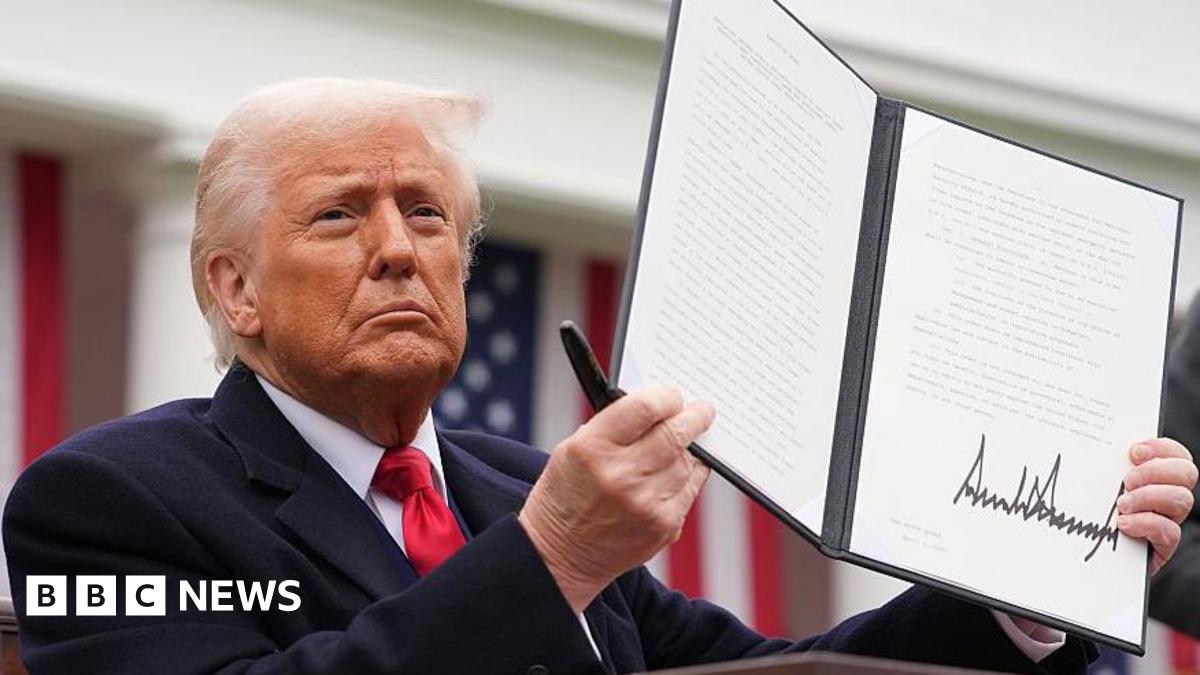

U.S. tariffs yield over $100 billion this year

Tariffs are significantly boosting U.S. revenue while influencing market dynamics.

Trump's aggressive trade tactics show early signs of success, especially with Japan.

Trump's tariff strategy leads to unexpected gains

Tariffs collected by the U.S. Treasury have surpassed $100 billion this year, accounting for approximately 5% of federal revenue, compared to the typical 2%. U.S. Treasury Secretary Scott Bessent predicts this figure may reach $300 billion annually. This influx of revenue occurs without facing retaliation from trading partners, unlike earlier fears. However, U.S. consumers may bear the weight of these tariffs through higher prices on imported goods. Although a strong dollar could help ease the cost of imports, the dollar has depreciated by 10% this year against various currencies, leading to increased import costs. The Bank of England's Governor Andrew Bailey expressed concerns about shifting market dynamics, suggesting the dollar's stability may be declining. This shift may also bolster American manufacturers, yet it has bolstered China's position as a reliable trade partner. The recent success with Japan provides a confident statement for the White House amidst a challenging trade landscape.

Key Takeaways

"The most crowded trade in the market at the moment is 'short dollar'"

Governor Bailey highlights shifting market dynamics in dealing with the dollar.

"Established safe haven patterns in markets, especially the US dollar, are essentially breaking down"

Bailey warns about the changing perception of the US dollar's reliability.

"There is a reduction of exposure to the dollar as companies and traders now take out trades designed to protect against its decline"

Bailey notes how businesses are adjusting strategies in response to dollar weakness.

"The successful negotiations with Japan push back against the narrative that Trump always chickens out"

The article emphasizes how the Japan deal counters negative perceptions of Trump's trade policies.

The recent tariff income provides a temporary win for the Trump administration, illustrating a shift in trade dynamics that may serve specific political ends. However, the long-term implications could complicate the economic landscape for everyday Americans. As more companies hedge against dollar fluctuations, the potential for a rising cost of living becomes evident. While this aggressive stance might be framed as effective policy, deeper questions about sustainability and consumer impact linger. The strategic maneuvering also hints at shifting perceptions of trade partnerships on the global stage. Juggling these elements will be key for the administration has it attempts to navigate the tricky waters of international trade.

Highlights

- Tariffs are not just a revenue boost, they come with a cost for consumers.

- The dollar's decline raises significant questions for U.S. imports.

- Japan is a notable victory in a tumultuous trade landscape.

- Market dynamics surrounding the dollar are shifting and could reshape trade.

Concerns over tariff impact on consumers

As the U.S. collects significant tariff revenue, ordinary consumers may face higher prices for imports due to both tariffs and a declining dollar.

Future developments may define the true impact of these tariff strategies.

Enjoyed this? Let your friends know!

Related News

Markets stay mixed as inflation data looms

Bitcoin declines while AI tokens rise on tech investments

Tech Rally Pushes Markets Higher

Apple Expands U.S. Manufacturing Commitment

Stocks Fall as Tariff News Shakes Market

Foreign investment in US securities hits record high

Wall Street slips as tariffs take effect

Tim Cook gifts Trump gold plaque alongside $100 billion investment