T4K3.news

Markets stay mixed as inflation data looms

U.S. stock futures trade mixed ahead of key CPI and PPI data, with tariff talks adding policy risk.

Markets start a data focused week with inflation readings and tariff policy in focus.

Markets Mixed as Inflation Data Looms and Tariff Deadline Approaches

U.S. stock futures traded mixed on Monday as investors await inflation data that could shape the Federal Reserve's path in September. Nasdaq 100 futures slipped 0.05% while Dow Jones Industrial Average futures rose 0.20% and S&P 500 futures gained 0.04%, in the premarket at 4:54 a.m. EST. Apple led gains after unveiling a 600 billion domestic manufacturing investment, helping support sentiment across the market. The session reflected a cautious stance as traders weigh the risks to growth from higher prices and borrowing costs. In the bond market, the 10-year yield hovered near 4.25%, oil traded around 63 dollars a barrel, and gold sat near 3417 per ounce, underscoring a backdrop of mixed signals across assets.

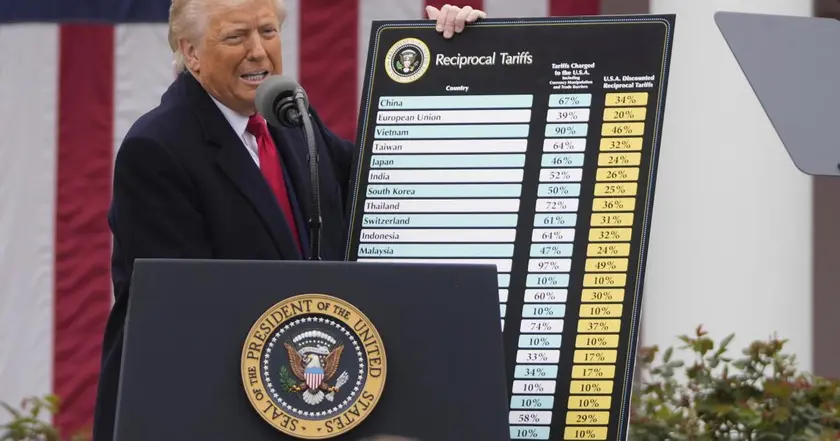

Looking ahead, traders now expect CPI data on Tuesday and PPI on Thursday to set the tone for the week. A stronger inflation print could push back expectations for rate cuts and temper the rally, while softer data might fuel further gains. The U.S.-China tariff deadline is also in focus, with any extension or resolution likely to swing sentiment. International markets opened mixed as Europe weighs policy signals and Asia rose on tariff news. With earnings season slowing, investors will watch a few remaining reports to gauge the staying power of the current market rally.

Key Takeaways

"Inflation readings will decide the Fed's next move"

Analyst view on data driving policy

"Tariffs create a layer of uncertainty markets can't ignore"

Investor reaction to tariff deadline

"Apple's investment signals resilience in domestic production"

Market response to Apple news

"Treasury yields holding near 4.25% reflects cautious sentiment"

Bond market observation

The data week will test whether a broad market rally can survive higher prices and a tighter policy path. If inflation cools, traders may push toward a firmer belief in future rate cuts, lifting shares and reducing volatility. If inflation surprises higher, expect a quick shift toward tighter financial conditions and more caution among buyers. Beyond the numbers, the tariff deadline adds a political edge that could widen swings as policy uncertainty intersects with earnings guidance and growth prospects. The balance between inflation, trade policy, and corporate results will shape the market mood over the coming days and could redefine momentum for the rest of the quarter.

Highlights

- Markets crave clarity on inflation and policy

- Tariffs add uncertainty markets barely tolerate

- Apple shows big bets move the tape

- Data week will decide the next move

Political and tariff policy risk looming over markets

The article touches on U.S.-China tariff deadlines and high level talks that could trigger political sensitivities and investor backlash. The policy environment and geopolitics could drive market sentiment in unpredictable ways.

The week ahead will reveal whether data or policy drives the next market move.

Enjoyed this? Let your friends know!

Related News

Markets rise as Ukraine talks loom

Bank of England to cut interest rates to four percent

Markets hold after weak data and tariff shocks

Markets mixed ahead of tariff deadline

Stock market approaches record high

S&P 500 rises as earnings season delivers surprising results

Mixed economic reports raise recession concerns

Markets Edge Higher Ahead of Inflation Data