T4K3.news

Thames Water appoints advisers to plan for potential collapse

FTI Consulting named to advise on possible special administration for Thames Water

FTI Consulting named as frontrunner to advise on placing Thames Water into a special administration regime if needed

Thames Water appoints advisers to plan for potential collapse

UK ministers have appointed FTI Consulting to advise on plans for Thames Water to be placed in a special administration regime if required. The utility serves about 16 million customers and faces intense debt pressures after its preferred bidder pulled out earlier this year. The appointment signals the government’s preparation for a possible rescue path, while a court would still need to approve any SAR move.

Officials say the move would keep water flowing while a rescue is organised, with costs potentially borne by the government and later recouped from customer bills under the Water Special Measures framework. The government has been trying to avoid triggering a SAR, but the option remains on the table as the Treasury weighs a potential four billion pound bill and how it would be funded.

Thames Water is negotiating with class A creditors and Ofwat on recapitalisation as it seeks to avoid a financial breakdown. The company has argued it cannot pay high fines for infrastructure failures while continuing to invest, a point raised by its chief executive, Chris Weston. A spokesperson said the focus is on a holistic recapitalisation and a market-led solution that targets investment-grade ratings and stabilises the business.

Public and industry voices are divided, with critics arguing privatization stores up risk while supporters point to the need for market-based fixes. The outcome will hinge on whether lenders, the regulator, and the government can coordinate a plan that protects customers and workers alike.

Key Takeaways

"Our focus remains on a holistic and fundamental recapitalisation."

Company statement on the rescue plan

"Thames Water has been sacrificed on the altar of privatisation."

GMB union reaction

"The government must intervene to protect Thames customers."

Union call for action

"The company remains financially stable, but preparations are under way."

Government spokesperson statement

The Thames Water case lays bare a core tension in modern utility services: who bears the risk when debt piles up and performance falters. If a special administration is used, the public may bear much of the cost through future bills, even as customers receive uninterrupted service in the short term. That arrangement tests the logic of privatized risk, where private lenders and regulators shoulder the private losses while taxpayers pick up the shortfall.

Beyond this immediate squeeze, the episode underscores a broader shift in how governments manage large infrastructure networks. It raises questions about accountability for funds, speed of reform, and how long private ownership can be relied on to deliver essential services without public overhead.

Highlights

- Our focus remains on a holistic and fundamental recapitalisation.

- Thames Water has been sacrificed on the altar of privatisation.

- The government must intervene to protect Thames customers.

- The company remains financially stable, but preparations are under way.

Budget and political risk around Thames Water rescue

The potential SAR plan could shift costs to government and, later, to customer bills. It also involves political scrutiny over privatisation and the reliability of water services, making it a sensitive policy issue with budget implications.

The coming weeks will reveal how far private finance is prepared to go in supporting essential services.

Enjoyed this? Let your friends know!

Related News

Thames Water contingency plans approved

Thames Water rescue plan moves forward

Thames Water could face government intervention

Abingdon reservoir cost rises

Meghan Markle's Netflix deal reportedly collapses

UK abolishes Ofwat to reform water regulation

Water companies sidestep Labour's bonus ban

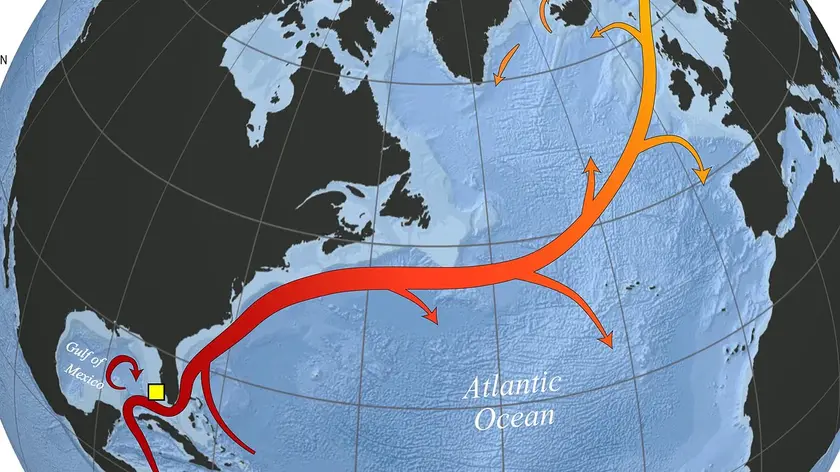

Gulf Stream Nears Tipping Point