T4K3.news

Tesla grants Musk shares worth $29 billion

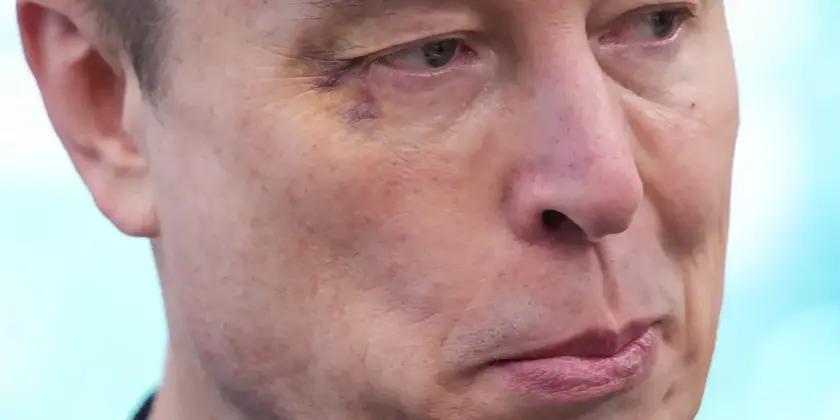

Tesla awarded CEO Elon Musk a significant stock grant amid challenges to its market performance.

Tesla's stock grant to Elon Musk raises concerns amid dwindling profits and political controversies.

Tesla rewards Musk with stock grant worth $29 billion

Tesla awarded Elon Musk a stock grant valued at $29 billion, aiming to retain him as CEO despite recent controversies affecting the company. This grant consists of 96 million restricted shares and comes after Musk's previous compensation package was revoked by a Delaware court. The electric vehicle maker noted Musk's leadership across several ventures, including SpaceX and xAI, and cited the significant increase in Tesla's market value. However, the company has faced challenges, with a 25% drop in shares this year due to backlash over Musk's political ties. Profits have also plummeted from $1.39 billion to $409 million in the most recent quarter, raising investor concerns amid fierce competition in the auto industry.

Key Takeaways

"Rewarding Elon for what he has done and continues to do for Tesla is the right thing to do."

Tesla justifies the stock grant as a necessary move to retain Musk's leadership amid criticism.

"We believe this grant will now keep Musk as CEO of Tesla at least until 2030."

Analysts suggest that the stock award could stabilize Musk's position, easing concerns among shareholders.

The substantial grant to Musk highlights ongoing tensions within Tesla as financial performance falters against a backdrop of political engagement. Though the company expects this move to stabilize leadership, the recent downturn in profits and share value suggests that shareholder confidence may remain uneasy. Musk’s political affiliations pose a risk, leaving both the company’s reputation and financial trajectory vulnerable. Analysts have expressed mixed feelings, with some believing the grant could alleviate investor concerns but others warn of potential backlash as the pressure to maintain performance grows amidst increasing competition.

Highlights

- Musk's stock grant signals Tesla's commitment despite financial headwinds.

- Controversy surrounds Tesla as profits dive and shares fall.

- Investors remain wary as Musk engages in political drama.

- Keeping Musk is crucial, but at what cost to shareholder value?

Concerns over Musk's political ties and company profitability

Musk's involvement in politics has contributed to declining profits and stock prices for Tesla, raising red flags among investors. Added to this is the risk of escalating competition in the electric vehicle market.

Tesla must now navigate these challenges while maintaining investor trust and market position.

Enjoyed this? Let your friends know!

Related News

Tesla to grant Musk $29 billion in shares

Elon Musk secures $29 billion compensation package from Tesla

Tesla awards Elon Musk $29 billion in shares

Musk's net worth drops significantly amidst Tesla's challenges

Elon Musk awarded shares worth $29 billion

Elon Musk raises concerns about Tesla control

Elon Musk's net worth drops following significant Tesla share decline

Elon Musk loses $15B after announcing new political party