T4K3.news

State Farm executive fired following scandal over rate hike discussions

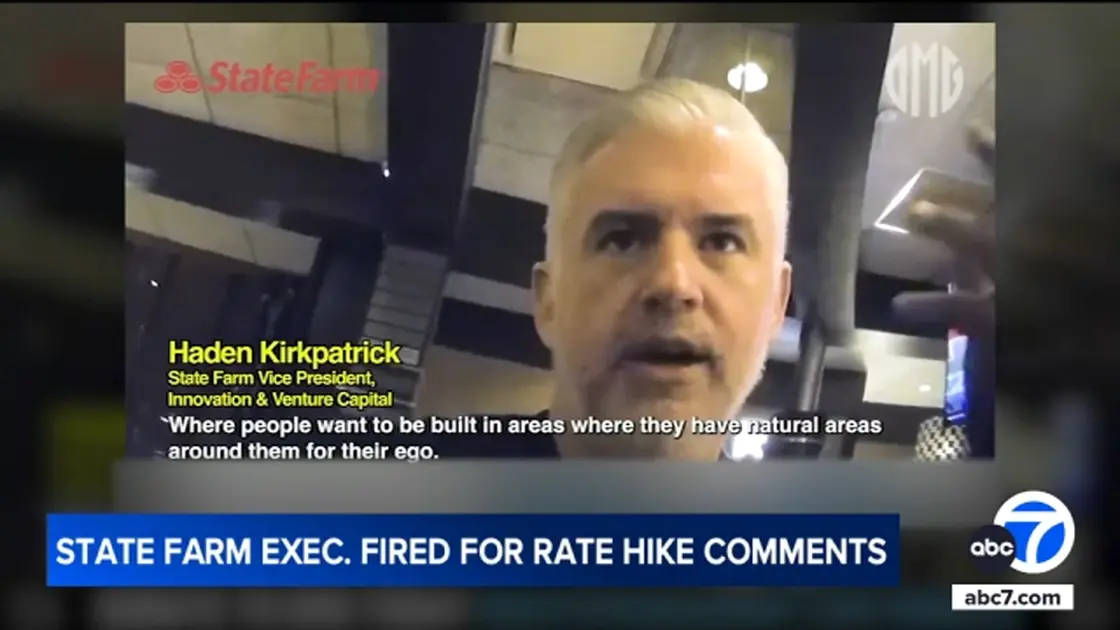

Haden Kirkpatrick was dismissed after secret recording reveals troubling comments about wildfire victims.

State Farm executive Haden Kirkpatrick was dismissed after a secret recording revealed discussions about rate hikes following wildfires.

State Farm executive dismissed after revealing rate hike discussions

State Farm recently fired executive Haden Kirkpatrick after a secret recording surfaced from a Tinder date. In the recording, Kirkpatrick discussed plans for rate hikes connected to the Southern California wildfires that affected many homeowners. He made controversial comments about fire victims in the Pacific Palisades, suggesting the area should not have houses due to its desert-like conditions. This dismissal comes amid State Farm's request for a substantial 22% rate hike, citing significant financial losses in the last decade. In response to the situation, State Farm firmly stated that Kirkpatrick's remarks do not reflect their views or commitment to California residents.

Key Takeaways

"These assertions are inaccurate and do not reflect our position regarding the victims of this tragedy."

State Farm's official statement distancing themselves from Kirkpatrick's comments

"Where the Palisades are, there should never be houses built there in the first place."

Kirkpatrick's remarks in the recording reflecting a controversial viewpoint on fire-prone areas

"This only raises more questions about how companies handle rate increases during crises."

The California Department of Insurance's response to the scandal

This incident highlights the tensions between insurance companies and policyholders, particularly in the aftermath of natural disasters. Kirkpatrick's recorded statements appear to convey a troubling approach to profit-making at the expense of vulnerable clients. As State Farm seeks to increase rates, this scandal raises questions about ethics in the insurance industry. California's Department of Insurance has demanded clarity from State Farm, indicating that the public deserves transparency regarding how rates are determined, especially during crises that impact homeowners severely.

Highlights

- Unethical discussions may taint State Farm's reputation for good.

- Rate hikes after disasters challenge the integrity of insurance.

- Firing an executive over a Tinder date is unheard of yet crucial.

- California deserves answers, not hollow commitments from insurers.

Public reaction may affect State Farm's reputation

The incident raises concerns about ethical practices in insurance, particularly how they treat disaster victims. Increased public scrutiny may lead to loss of trust.

The fallout from this incident could reshape how insurance companies handle claims and rates in disaster-prone areas.

Enjoyed this? Let your friends know!

Related News

Elon Musk awarded shares worth $29 billion

U.S. Tariff Strategy Discussed on Face the Nation

Chipotle faces labor tensions

Trump threatens Jerome Powell with dismissal

Colbert Responds to Trump's Comments

Legal experts debate potential Trump action on Fed Chair

Trump dismisses head of Bureau of Labor Statistics

US Dollar Weakens After Trump Comments on Fed Chair