T4K3.news

SPAC bet on DeFi and AI set to raise $250 million

Chamath Palihapitiya’s SPAC plans to raise $250 million to back DeFi, AI, energy and defense ventures, trading on NYSE as AEXA.

Chamath Palihapitiya and Steven Trieu plan a $250 million SPAC to back DeFi AI energy and defense ventures under American Exceptionalism Acquisition Corp.

SPAC led by Chamath Palihapitiya bets on DeFi AI defense

Chamath Palihapitiya filed to raise $250 million for a new SPAC, American Exceptionalism Acquisition Corp, ticker AEXA, to be listed on the New York Stock Exchange. The vehicle would issue 25 million shares at $10 each, with Palihapitiya as chairman and Steven Trieu as chief executive officer. The focus areas are decentralized finance, artificial intelligence, energy and defense, signaling a bet on how traditional markets can connect with blockchain powered innovation.

Palihapitiya and Trieu argue that DeFi can disintermediate traditional finance and deliver value through lower friction, citing Circle Internet Group’s recent public listing to illustrate the potential. They acknowledge that mainstream crypto adoption has taken longer than expected but contend the shift now appears inevitable. The project adds to Palihapitiya’s mixed SPAC track record, where some mergers succeeded and others were liquidated, highlighting the inherent risks of the SPAC path.

Key Takeaways

"we believe that the next stage of development is the increased integration between traditional finance and decentralized finance"

Palihapitiya team framing the strategic bet

"disintermediate traditional finance intermediaries and provide clear value for customers via reduced friction"

Circle cited as evidence for DeFi potential

"the path toward mainstream acceptance of crypto and stablecoins has taken longer than expected, but that path now appears to be inevitable"

Strategic outlook on crypto adoption

The move shows how crypto ambition has moved from hype to a governance challenge. SPACs bring tight deadlines and valuation pressure, and branding the vehicle with a national theme adds prestige but also political sensitivity. Palihapitiya’s name draws attention, yet his uneven SPAC record softens the optimism and invites scrutiny about execution.

If regulators tighten crypto rules, the promise of DeFi rests on clear guardrails that protect consumers without stifling innovation. AEXA could push traditional finance players to test crypto enabled services, but failure would provide a cautionary tale about timing, valuation and policy risk. The real test lies in governance and delivery, not slogans or headlines.

Highlights

- we believe that the next stage of development is the increased integration between traditional finance and decentralized finance

- disintermediate traditional finance intermediaries and provide clear value for customers via reduced friction

- the path toward mainstream acceptance of crypto and stablecoins has taken longer than expected, but that path now appears to be inevitable

Crypto and SPAC risk under regulatory watch

The SPAC targets DeFi and crypto adjacent sectors, raising potential regulatory and financial risk. Investor appetite fronts heightened scrutiny, and strict SPAC timelines can amplify valuation pressure if targets falter.

The next chapter will test whether markets can align with new tech while keeping trust intact.

Enjoyed this? Let your friends know!

Related News

Elon Musk awarded shares worth $29 billion

AI Researcher Receives Record $250 Million Salary Offer

Stocks Decline as Powell Shares Outlook on Interest Rates

Meta's offers push AI salaries to new heights

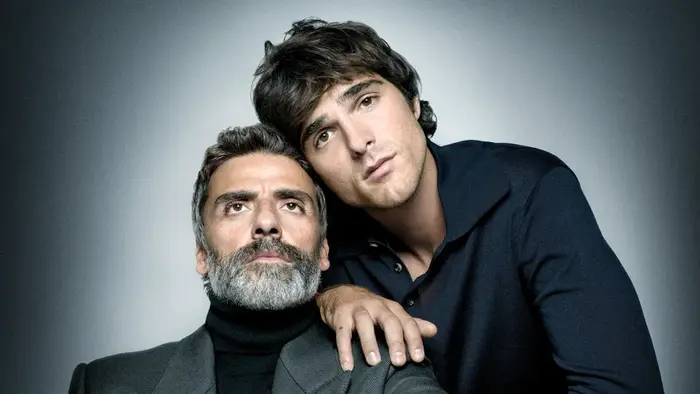

Frankenstein heads to Venice and beyond

Fartcoin gains attention in crypto community

XRP Set for 20% Price Rally Amid Regulatory Changes

ChatGPT outlines paths from $10 to $1 million