T4K3.news

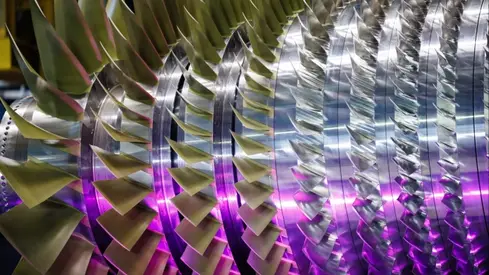

Siemens Energy records highest order backlog

Siemens Energy reports a record order backlog of nearly €136 billion driven by data centre demand.

Siemens Energy reports a historic order backlog driven by the increasing need for electricity from data centres.

Siemens Energy posts record orders amid booming data centre demand

Siemens Energy has reached a record order backlog of nearly €136 billion, largely fueled by high demand for electricity from data centres in the US. This increase has allowed the company to predict revenue growth between 13 and 15 percent for the year. Chief executive Christian Bruch emphasized that data centres are responsible for about 60 percent of their gas turbine orders. The need for energy is not just driven by AI advancements but also by aging electrical infrastructure and the push towards electric vehicles and heating systems powered by renewable sources. The company’s shares, although previously impacted by issues related to the performance of its wind turbines, have rallied significantly this year. Siemens Energy also announced its highest quarterly intake of orders, contributing to the significant backlog.

Key Takeaways

"Enormous demand for electricity for data centres in particular are now driving very high demand for our products."

Christian Bruch comments on the impact of data centre growth on sales.

"Given the strong operating performance we can compensate for the additional burden, but it is still a painful process."

Christian Bruch reflects on challenges faced due to US tariffs and trade agreements.

The surge in orders at Siemens Energy highlights a crucial market shift toward renewable and reliable energy sources, spurred by technological advancements and regulatory pressures. As global energy demands escalate, the focus on data centres signals a pivotal change in priorities within the energy sector. This boom, however, is not without challenges. US tariffs and trade agreements have complicated operations, and the company has had to navigate a recovery following technical setbacks earlier this year. The pressure to meet growing demand while managing regulatory landscapes will test Siemens Energy's adaptability and long-term strategy.

Highlights

- Record orders reflect the insatiable demand for electricity from data centres.

- We are witnessing a dramatic shift towards renewable energy solutions.

- Siemens is positioned to lead the power needs of the AI era.

- The rebound in shares signifies confidence in our strategic direction.

Risks related to political and financial factors

Siemens Energy faces financial uncertainty due to tariffs and trade agreements that could impact profitability. Recent growth amid record orders may mask underlying economic challenges that could arise from regulatory pressures, affecting investor confidence.

Siemens Energy's ability to adapt to changing market demands will be critical for future growth.

Enjoyed this? Let your friends know!

Related News

GE Vernova raises price target to $700 after earnings victory

July 2025 Services PMI indicates slow growth

Trump establishes Rwanda migrant deal amid Labour turmoil

Technology firms focus on data centre efficiency

Bitcoin reaches record high ahead of Trump's inauguration

Premier League season kicks off amid record spending

Idaho Implements New Vaccine Policies Amid Trust Crisis

US tariff rates reach highest level since 1930s