T4K3.news

Rumble explores 1.2B Northern Data deal

Rumble is weighing a stock-based bid to acquire Northern Data, expanding into AI infrastructure and data centers.

Rumble weighs a stock deal to buy Northern Data, moving from video sharing into AI infrastructure.

Rumble Expands into AI Infrastructure with 1.2 Billion Northern Data Deal

Rumble is exploring a 1.2 billion dollar bid to acquire Germany's Northern Data AG, a move that would push Rumble beyond video sharing into AI infrastructure. If completed, Rumble would gain Northern Data's Taiga cloud unit and Ardent data centers, along with a large stockpile of Nvidia GPUs. The deal would be structured as a stock exchange, with NDTAF shareholders receiving 2.319 new Rumble Class A shares for each NDTAF share, leaving NDTAF holders with about 33.3% of the merged company. The implied value is roughly 18.3 dollars per share, about 32% below the last Frankfurt close. Northern Data's board is reviewing the offer and open to continuing discussions.

Rumble reported second quarter 2025 revenue of 25.1 million dollars, up 12% from a year earlier, while monthly active users fell 3.8% to 51 million. The company attributes the MAU decline to slower news and political commentary outside the U.S. election cycle. In reaction, Rumble stock rose in pre-market trading while Northern Data shares in Germany declined more than 20%. The deal does not guarantee a closing and would require board approval and regulatory clearance.

Key Takeaways

"Northern Data's board is reviewing Rumble's potential offer and is open to continuing discussions."

board stance on talks

"The deal would turn Rumble into an AI infrastructure player with data centers and GPUs."

impact assessment

"If the merger closes, governance and dilution will be key tests for both sides."

valuation and governance

Strategically, the move signals a broader trend: platforms seeking AI infrastructure to diversify growth beyond advertising. Taiga and Ardent would give Rumble a data center footprint and a ready pool of GPUs, which could power new monetization avenues. The challenge lies in integrating a hardware-led business with a consumer platform, while the GPU supply cycle and Nvidia's chip pricing add another layer of risk. Valuation will be a sticking point, given the offer values NDTAF below its recent price and creates a sizable minority stake for NDTAF holders. If talks progress, governance, oversight of the GPU assets, and execution milestones will determine whether the deal unlocks meaningful upside or simply adds complexity to Rumble's model.

Highlights

- Rumble bets big on AI hardware and cloud scale

- A bold pivot from video to data centers

- Valuation gaps will test investor confidence

- Taiga and Ardent could redefine Rumble's future

Investor and regulatory risk in Rumble Northern Data deal

The proposal relies on a stock swap and a large asset purchase that requires board approval and regulatory clearance. The offer is below the last close, creating dilution and governance questions for NDTAF holders. Public reaction to Rumble's AI strategy could influence the deal timeline and outcome.

Future talks will reveal whether this pivot can deliver real AI infrastructure scale.

Enjoyed this? Let your friends know!

Related News

Trump signals peace talks with Russia ahead of Alaska summit

Kremlin presses Donetsk surrender in ceasefire offer

Peace terms collide with battlefield reality

Putin signals Donetsk focus in Alaska talks

New studies explore sunlight benefits for health

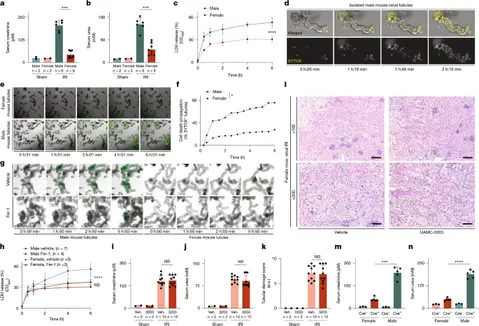

Estrogen protects kidneys from ferroptosis

Elon Musk awarded shares worth $29 billion

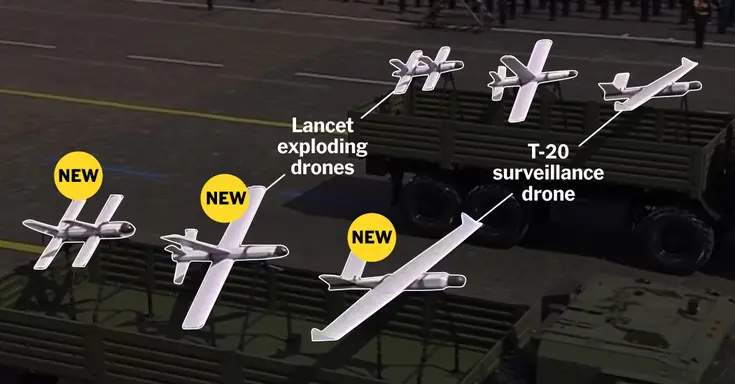

Russia Builds a Wartime Edge