T4K3.news

Powerball Jackpot Tops 605 Million After Taxes

The next Powerball drawing is Monday night and the winner would face taxes that cut the final take from the headline 605 million to about 172.2 million if taken as a lump sum.

The next Powerball drawing is Monday night and taxes cut the final take for a potential winner.

Powerball Jackpot Reaches 605 Million After Tax Bite

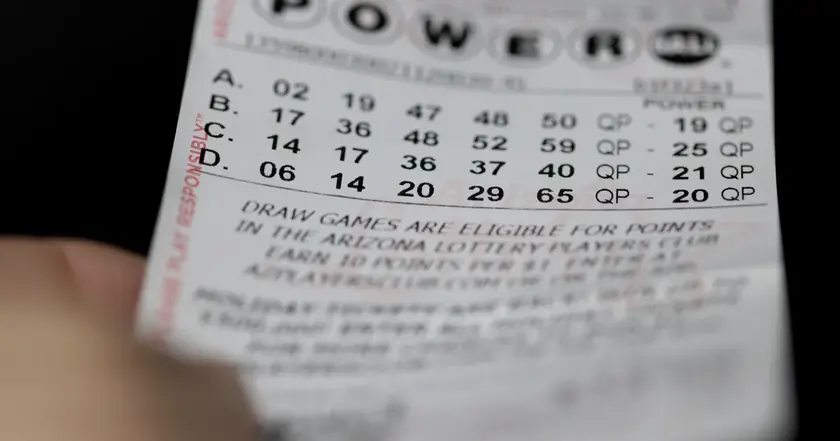

The Powerball jackpot has climbed to 605 million after Saturday's drawing produced no winner. The next drawing is Monday night. The winning numbers were 23, 40, 49, 65, 69 and Powerball 23. A winner would face a choice between receiving the full 605 million as 30 annual payments over 29 years or taking a lump sum of 273.4 million upfront.

If the choice is the lump sum, federal withholding of 24 percent reduces the amount to about 207.8 million. After applying the top federal marginal rate of 37 percent, the take would be about 172.2 million. If the winner selects the annuity, the annual payments would average over 20 million before taxes but drop to about 12.7 million per year after taxes. State taxes could reduce the total further depending on where the winner lives.

Key Takeaways

"What you win is not what you take home"

Comment on the tax bite

"An annuity looks steady until taxes arrive"

Opinion on how payments change after taxes

"Luck plus a tax bill is a tough combo"

Highlight about the tax reality

"The biggest number on the page is not the final amount"

Emotional closing note

Tax rules turn a lottery dream into a financial decision. The headline number suggests instant wealth, but the cash reality is far smaller after federal withholding and the top marginal rate. Winners often misread the payout because the big number on the page is not the amount that lands in their bank. The choice between lump sum and annuity matters for long term planning and risk, and it is shaped by tax policy and state rules.

The story also reveals the tension between public celebration and personal responsibility. Large prize talk can spark interest in how money is taxed, how it affects spending, and how communities benefit or miss out as funds flow through state programs and private accounts. In short, the math of one ticket has consequences far beyond the winner alone.

Highlights

- Tax day comes for luckiest players too

- What you win is not what you take home

- An annuity sounds steady until taxes arrive

- The math behind the prize is the real winner

Tax and Budget Sensitivities in Lottery Payouts

The article discusses federal tax withholding and marginal rates on lottery winnings, raising budget and public reaction considerations. This topic can draw out opinions and controversy about fairness and policy.

The numbers remind us that luck comes with a tax bill that never goes away.

Enjoyed this? Let your friends know!

Related News

Powerball jackpot tops 500 million

Powerball reaches 605 million for Monday drawing

Powerball Jackpot Update

Powerball Jackpot Reaches 605 Million Ahead of Monday Draw

Powerball reaches 700M jackpot

Powerball reaches 565 million

Powerball Jackpot Climbs to 750 Million

Powerball Jackpot Hits $426 Million