T4K3.news

Powerball Jackpot Climbs to 750 Million

No winner in the latest draw yet; the prize could rise again before the next drawing on Monday night.

The prize climbs as no winner is found, but taxes and state rates shrink the final take for any winner.

Powerball Jackpot Reaches 750 Million

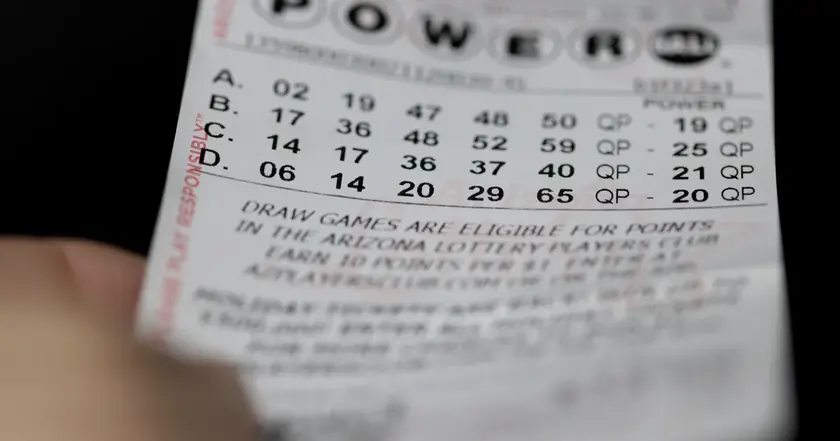

Powerball’s latest draw produced no winning ticket, pushing the advertised jackpot to 750 million. A winner who matches all six numbers could take a lump sum of about 338.6 million or pursue 30 annual payments that average around 25 million before taxes. If the lump sum is chosen, federal withholding of 24 percent would trim the amount to roughly 257.3 million, and the top federal rate would bring the after tax sum to about 213.3 million. State taxes would also apply, with rates ranging from 0 percent in California and Texas to as high as 10.9 percent in New York.

The Power Play option adds extra value on smaller prizes. In this draw, three players matched five white balls and won 1 million in New York and Maine, and 2 million in South Dakota with the Power Play option. The next drawing is Monday at 10 59 p.m. EDT and can be watched on the Powerball site. If no one wins, the prize will grow again. The Powerball has a history of massive jackpots, including a 2.04 billion prize in 2022.

Key Takeaways

"the winner could receive a jackpot of $750 million paid out in 30 annualized payments"

Payout structure for the main prize

"federal withholding taxes of 24% would immediately bring their winnings down to 257.3 million"

Federal tax impact on the lump sum

"the odds of matching the five white balls without the Powerball are about 1 in 11.7 million"

Odds for the top prize without Powerball

"three players matched all five white balls with Power Play earning $1 million, $1 million, and $2 million"

Smaller prizes awarded this draw with Power Play

The math of a lottery windfall is blunt. Many buyers chase the dream of a big lump sum, yet taxes largely determine what finally lands in a winner’s hand. Choosing between a lump sum and an annuity is not just a math problem; it reflects personal finances, risk tolerance, and plans for future spending. In practice, the lump sum is popular because it provides immediate flexibility, even as taxes erode the headline amount.

Beyond personal finance, the draw points to how tax policy and state rules shape wins. With federal and varying state rates, the true value of a prize shifts by jurisdiction, reminding players that the thrill of a big number comes with a routine, not glamorous, tax season.

Highlights

- Big prizes come with big tax bills

- Powerball dreams vs a shrinking paycheck after taxes

- Take the lump sum and the check looks smaller instantly

- Luck buys a ticket, taxes buy a life lesson

Financial risks from taxes on winnings

The article notes that taxes significantly reduce the advertised prize, with federal withholding and high marginal rates plus state taxes varying by location. This creates a complex financial outcome for any winner and can influence payout choices.

The lure of luck lives beside the realities of tax law and personal planning.

Enjoyed this? Let your friends know!

Related News

Powerball hits 700 million

Powerball Jackpot Update

Powerball reaches 605 million for Monday drawing

Powerball prize update

Powerball Jackpot Reaches 605 Million Ahead of Monday Draw

Powerball jackpot rises to 643 million

Powerball reaches 700M jackpot

Powerball Jackpot Hits $426 Million