T4K3.news

European stocks mixed ahead of Trump Zelensky talks

Markets opened mixed as leaders head to Washington to discuss Ukraine with Trump

European shares opened mixed as leaders travel to Washington to discuss Ukraine with U.S. President Donald Trump.

European stocks mixed ahead of Trump Zelensky talks

European stocks opened mixed and edged little changed after the opening bell, with the pan European Stoxx 600 showing little directional movement across sectors. Major bourses in London, Frankfurt and Paris posted varied early moves as traders awaited a high level meeting in Washington involving regional leaders and U.S. President Donald Trump to discuss a possible peace deal in Ukraine.

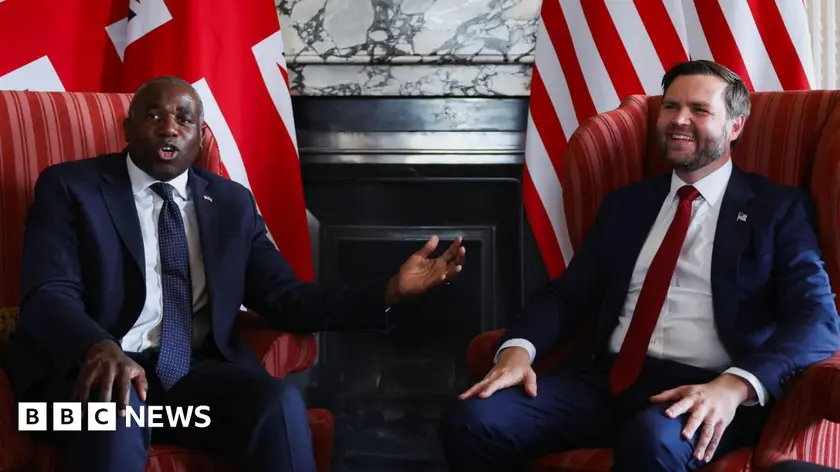

Zelenskyy joined German Chancellor Friedrich Merz, French President Emmanuel Macron and British Prime Minister Keir Starmer on the trip to the White House to push for a diplomatic path. Trump publicly floated the idea that the conflict could end quickly if Zelenskyy agrees, wording seen as a pressure tactic amid ongoing fighting on the ground. Last week’s Trump Putin summit ended without a ceasefire, and reports have circulated that Putin would back a truce only if concessions were made in the Donbas. U.S. envoy Steve Witkoff signaled that security guarantees could be part of a broader settlement.

Extended trading mood in Asia was firmer overnight as markets braced for the talks, while U.S. futures pointed to modest gains in early trading on hopes for lower rates later in the year. There are no major earnings due on Monday and traders will also watch Spanish and EU trade balances for fresh signal on demand and momentum in the euro area.

Key Takeaways

"Stability will come only through verifiable steps."

emphasizes need for credible commitments

"Markets prefer clarity over grand gestures."

captures market sentiment

"Diplomacy has to show real progress to ease nerves."

reflects emotional response to talks

The week puts diplomacy at the heart of market thinking. If the Washington talks yield credible steps toward peace, markets could reprieve from uncertainty and reflect a cautious optimism. If not, the relief rally could fade quickly as investors reassess political risk and the durability of any commitments. The dynamic underscores how geopolitics now often drives asset prices more than company results, and how credibility in policy promises matters as much as the promises themselves. European policymakers may find it harder to chart budgets and growth plans when the outcome of the Ukraine talks remains unclear.

Highlights

- Markets want clarity not bravado

- Diplomacy now moves markets more than headlines

- Peace talks must prove real steps not empty promises

- Investors seek concrete plan over rhetoric

Political risk rises as peace talks take center stage

The upcoming White House meeting ties markets to diplomacy, creating sensitivity around any shifts in strategy or commitments. If the talks falter, investors could react quickly to rising political risk and public expectations.

Diplomacy will test patience as markets watch the clock

Enjoyed this? Let your friends know!

Related News

Oil and gold rise before crucial talks in Washington

Futures Fall as Trump Ukraine Meeting Looms

Trump plans talks with Putin as sanctions loom

Markets rise as Ukraine talks loom

Putin signals Donetsk focus in Alaska talks

Ukraine peace talks advance in Washington

Oil and stocks slip ahead of Zelenskyy Trump talks

Markets mixed ahead of tariff deadline