T4K3.news

Nvidia stock could soar to $6 trillion valuation

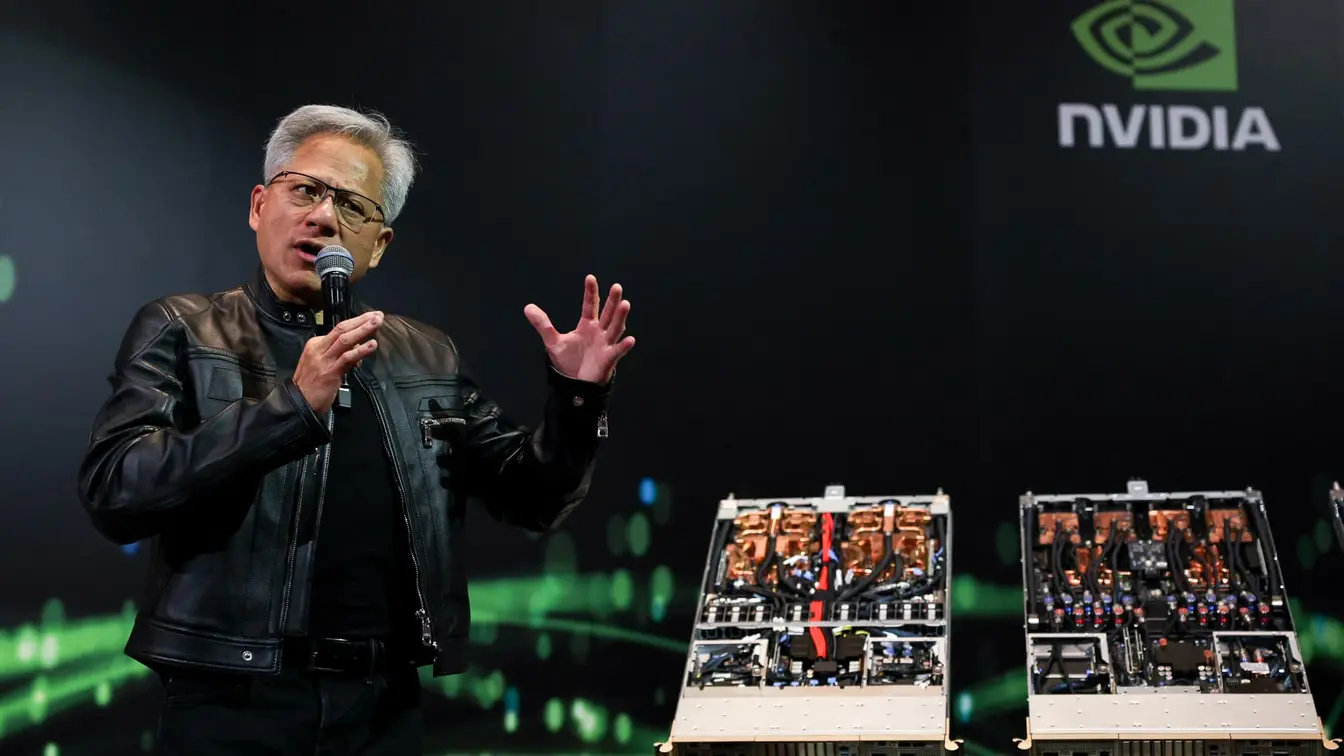

Nvidia is on track to potentially reach a $6 trillion valuation by 2026, driven by AI and data centers.

A new analysis suggests Nvidia may soar in stock value, driven by AI growth.

Nvidia could reach a $6 trillion valuation in three years

Nvidia's rapid ascent in the tech world shows no signs of slowing down. Current predictions indicate that the company could achieve a staggering $6 trillion market valuation within three years. Nvidia, known for its GPUs, has become essential in the booming artificial intelligence sector, which relies on its technology for various applications. The company's expected revenue growth will be supported by increased spending in data centers, a key area of investment for tech giants focused on AI development. This rise could lead Nvidia to generate around $250 billion in data center revenue alone by 2028, alongside substantial contributions from its other business segments.

Key Takeaways

"Nvidia could generate around $250 billion in data center revenue alone by 2028."

This highlights Nvidia's central role in the AI data center market.

"Currently, Nvidia's stock trades at nearly 60 times earnings."

This raises questions about the stock's long-term sustainability as growth continues.

As Nvidia positions itself at the forefront of the AI revolution, the implications for its stock price are significant. The projected growth in data center capital expenditures highlights a broader trend in tech investment that favors companies like Nvidia. However, this optimism comes with caution. The stock is currently trading at a high valuation, raising concerns about sustainability and market corrections. Investors need to weigh Nvidia's potential against its risks as the tech landscape evolves. Whether this growth trajectory holds true will depend on broader economic conditions and competition in the AI space.

Highlights

- Nvidia is at the heart of the AI revolution.

- A $6 trillion valuation is within Nvidia's reach.

- Investors should consider Nvidia as a top stock now.

- The future of data centers could hinge on Nvidia's technology.

Valuation concerns for Nvidia's stock

Nvidia's current high stock valuation may create risks for investors if growth expectations do not materialize. A downturn in market perception could impact stock performance significantly.

As Nvidia continues to lead in AI technology, its future will be closely watched by investors and industry experts alike.

Enjoyed this? Let your friends know!

Related News

Nvidia eyes 6 trillion market cap

Microsoft's market value reaches $4 trillion

Stocks Retreat as Investors Await Key Technology Earnings

Stock Markets Climb as Earnings Reports Approach

Microsoft becomes the world's second $4 trillion company

Jim Cramer reveals top ten stock insights for July 25

UnitedHealth dip fuels contrarian investment case

Stocks Decline as Powell Shares Outlook on Interest Rates