T4K3.news

Nvidia eyes 6 trillion market cap

A look at Nvidia's AI driven growth and what it means for investors

A forward-looking take on Nvidia as AI powered data center demand argues for a major valuation milestone.

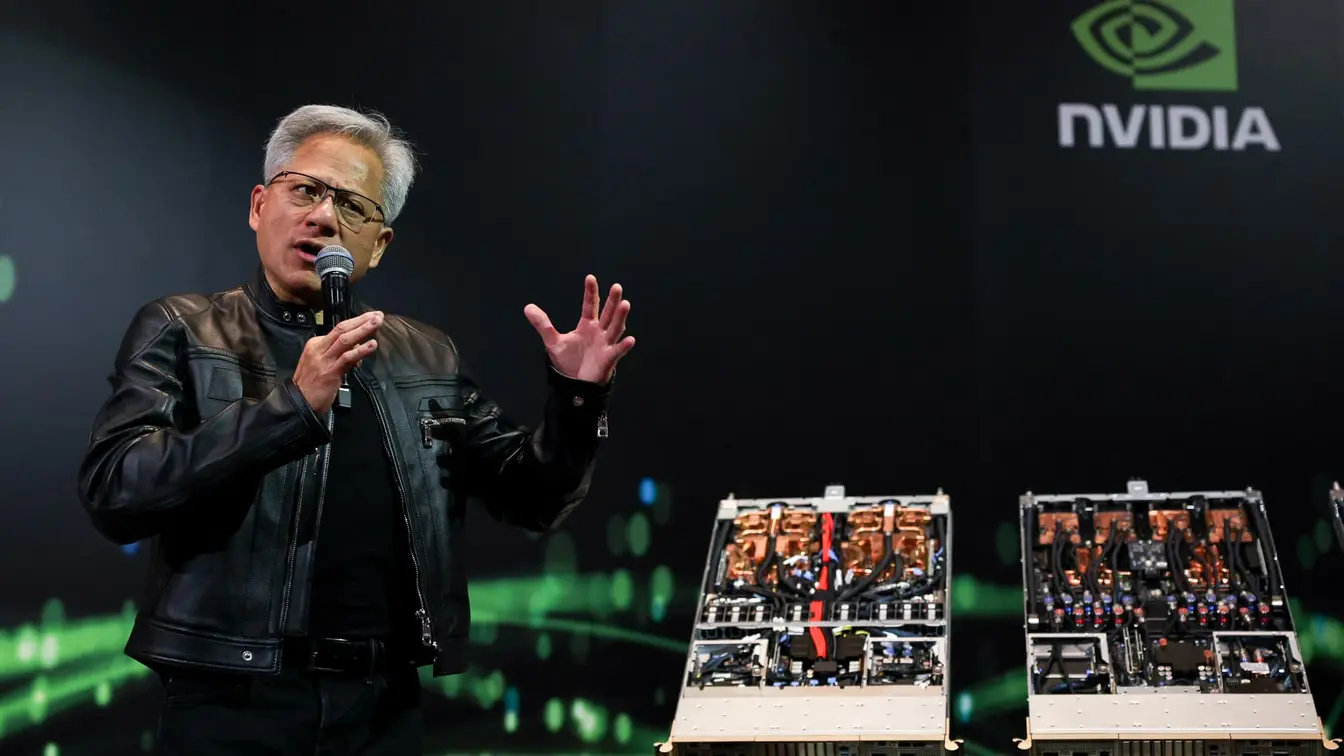

Nvidia Eyes 6 Trillion Market Cap Amid AI Demand Surge

Nvidia dominates the data center GPU market, owning a large share and a crucial role in AI workloads. In the fiscal first quarter ended April 27, the company reported revenue of $44 billion, up 69 percent from a year earlier, with the data center segment at $39 billion, up 73 percent. That performance helps explain why analysts see a clear path to a much larger valuation if AI spending remains robust and adoption accelerates.

Beyond the quarterly numbers, the AI opportunity is seen as a long term, megatrend. PwC estimates the AI market could reach $15.7 trillion by 2030, with Nvidia a central beneficiary thanks to its GPU leadership and ecosystem. Wall Street projections point to continued high revenue growth, while price targets around $250 hint at a potential climb toward a $6 trillion market cap if demand stays on track. The story comes with caveats: the stock has shown sharp pullbacks in the past and faces competitive pressure from rivals such as AMD and Intel, plus potential supply chain and capital expenditure shifts that could temper the pace of gains.

Key Takeaways

"AI demand is rewriting the rulebook for growth"

editorial emphasis on growth driver

"Chips that power thinking are trading at a steep price"

valuation concern

"A data center race backed by hyperscalers is the main game"

trend

"Execution will determine if these lofty targets hold"

risk

The article frames Nvidia as the linchpin of a broader AI hardware cycle, a positioning that amplifies both upside and risk. If hyperscale spending remains resilient, Nvidia could ride a multi year expansion in data center capacity. But the same setup makes the stock vulnerable to a sudden change in AI investment appetite or to faster than expected competition eroding margins.

This piece also highlights the tension between hype and reality in mega cap tech bets. A target that implies a multi trillion dollar leap invites scrutiny of valuation and execution. For investors, the question is whether the AI surge will translate into durable profits or if it will collapse under a too ambitious price today. The answer will hinge on sustained demand, disciplined capital allocation, and continued leadership in GPU technology.

Highlights

- AI demand is rewriting the rulebook for growth

- Chips that power thinking are trading at a steep price

- A data center race backed by hyperscalers is the main game

- Execution will determine if these lofty targets hold

Investment risk around Nvidia AI growth

The bull case rests on sustained AI spending and data center capex. The stock trades at a high multiple and has a history of sharp declines. If AI capex cools or competition intensifies, Nvidia's growth path could slow or diverge from expectations.

The AI era rewards patient, disciplined investors who can separate hype from durable advantage.

Enjoyed this? Let your friends know!

Related News

Nvidia stock could soar to $6 trillion valuation

Stock market trends for July 15 analyzed

Nvidia CEO Huang sells $50 million in stock

Stocks Retreat as Investors Await Key Technology Earnings

Stellar's Price Set for Rise After Trump's Crypto Bill

Microsoft reports impressive quarterly earnings

Jim Cramer reveals top ten stock insights for July 25

NVIDIA approaches record market cap fueled by AI demand