T4K3.news

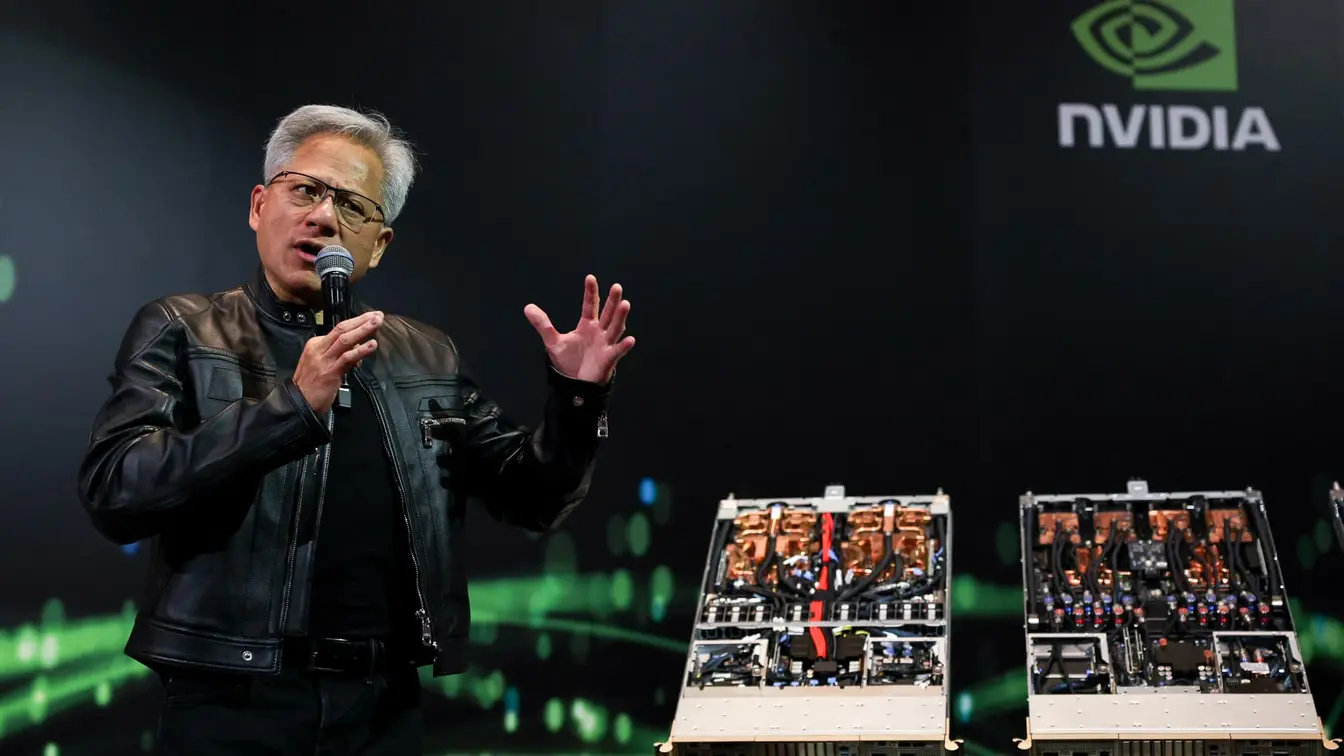

Nvidia lifts price target

Analyst raises price target to 215 ahead of Q2 earnings as demand for AI hardware remains strong

Nvidia is set to report Q2 FY26 results on August 27 with a bullish stance from a top analyst who raised the price target.

Nvidia lifts price target to 215 ahead of Q2 earnings

Nvidia is scheduled to release its Q2 FY26 results on August 27. Wall Street is looking for about 1.00 dollars per share on roughly 45.7 billion dollars in revenue. Ahead of the report, KeyBanc analyst John Vinh reiterates a Buy rating and raises the price target to 215 dollars from 190, citing strong July results and ongoing demand for AI products, along with higher server rack shipments thanks to improved manufacturing yields.

Vinh notes growth in Nvidia s Blackwell GPU family, with B200 supply up about 40 percent in the quarter and a further 20 percent expected in the third quarter. The company has begun rolling out Blackwell Ultra, which could account for about half of Blackwell shipments by October. Server rack yields have improved, now near 85 percent, supporting a higher full year rack shipment forecast of 30,000 from 25,000. On the top line, Vinh has raised Q2 revenue to 47.1 billion dollars, while he trims the third quarter forecast to 50.4 billion dollars from 53.5 billion dollars to exclude revenue from China as export licenses are still pending and a possible 15 percent tax on AI exports plus Beijing pressure for domestic chips could dampen results. He adds that including China revenue could lift guidance by two to three billion dollars.

Key Takeaways

"AI demand keeps the upgrade story alive"

editorial takeaway on market sentiment

"China policy risk could tilt the outlook"

regulatory influence on earnings

"Supply gains turn forecasts into real results"

supply chain improvements

"Export licenses will shape the quarterly timing"

regulatory and timing risk

The analysis shows Nvidia remains a bellwether for AI driven demand, with supply chain progress and new GPU lines supporting upside. Yet the outlook carries cross border risk. Export license delays and potential China policy changes could shape quarterly results more than the stock price suggests today. Investors should watch how much the company writes off for China versus the strength coming from data center accelerate growth and new hardware cycles. The key tension is clear: strong fundamentals exist, but policy and regulatory moves could rewrite the near term picture.

Highlights

- AI demand keeps the upgrade story alive

- China policy risk could tilt the outlook

- Supply gains turn forecasts into real results

- Export licenses will shape the quarterly timing

China exposure creates policy and investor risk

Nvidia s earnings outlook hinges on licensing and possible export taxes. Revenues tied to China could boost results, but delays or policy changes may dampen the upside. This area attracts political and investor scrutiny and could provoke public reaction.

The next earnings print will test how much policy risk Nvidia can weigh against its hardware and AI software momentum.

Enjoyed this? Let your friends know!

Related News

Nvidia stock set for new high after China license deal

Wall Street Analysts Lift Multiple Stocks on Monday

Nvidia earnings preview boosts investor expectations

Stock Markets Climb as Earnings Reports Approach

SMCI faces limited upside amid AI server competition

AMD stock declines despite strong quarterly results

S&P 500 Declines Amid Rising Inflation

Stocks Retreat as Investors Await Key Technology Earnings