T4K3.news

Novo Nordisk shares rally after Mash approval

FDA approves Mash treatment using Wegovy, lifting shares in Copenhagen while profit outlook comes under pressure

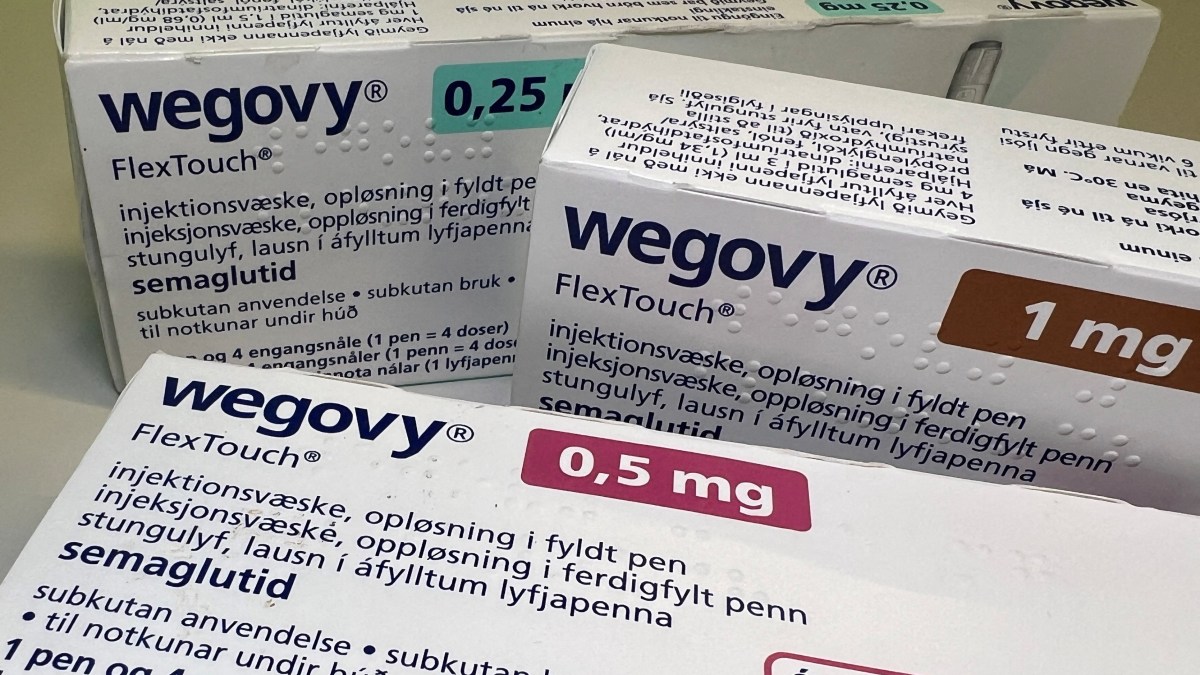

FDA approval expands Wegovy use to treat Mash in adults with liver fibrosis, while Novo Nordisk trims profit outlook and faces competition

Novo Nordisk shares rally after Wegovy approved for Mash treatment

Novo Nordisk shares rose in Copenhagen after the US FDA approved semaglutide injections Wegovy and Ozempic for Mash in adults with liver fibrosis.

The decision opens a new growth path for the company as it seeks to diversify beyond weight loss and diabetes, but the stock had already moved in a volatile direction after a profit forecast cut last month.

The Mash label adds a potential revenue stream while the company navigates a tougher competitive landscape led by Eli Lilly and its Mounjaro product.

Key Takeaways

"Wegovy gains a new route to growth"

A punchy line about the expanded use

"Investors will watch how payers respond"

Edge of the market dynamics and coverage

"The Mash approval reshapes the competitive map"

Industry shift and rival responses

The approval signals a push to expand the use of a well known drug in a new disease category, which could help stabilize Novo Nordisk sales if payers cover the Mash treatment. However, investors will closely watch how quickly doctors adopt the therapy and how reimbursement will shape pricing.

Beyond the switch in uses, the bigger test is whether the company can translate regulatory wins into durable profits. The Mash indication comes as the weight loss market remains crowded and margins face scrutiny from investors and payers alike. The coming months will show if pipeline momentum and cost controls can offset competition.

Highlights

- Wegovy gains a new route to growth

- Investors will watch how payers respond

- Regulatory wins can lift shares long term

- The real test is payer coverage and uptake

Investor and financial risk from new indication

The Mash approval introduces a potential revenue boost but comes with near term earnings pressure due to a profit forecast cut and ongoing competition. The stock remains sensitive to payer decisions and market uptake.

What matters next is how payers respond and whether Novo Nordisk can translate regulatory gains into steady earnings.

Enjoyed this? Let your friends know!

Related News

Novo Nordisk gains liver disease approval for Wegovy

Wegovy approved for liver disease

Dow Jones Edges Lower as Markets Hover Near Record Highs Ahead of Powell Speech

Eli Lilly shares fall 14% after trial disappointment

Eli Lilly's weight-loss pill trial misses expectations

Ozempic vulva reports prompt safety review

Novo Nordisk stock falls 33% after CEO change and outlook cut

Wegovy earns MASH approval