T4K3.news

New rule boosts ISA savings for bereaved partners

The Additional Permitted Subscription allows spouses to enhance their ISA allowance significantly after a partner's death.

A little-known rule can enhance a saver's ISA allowance after losing a partner.

Obscure rule allows savers to increase ISA allowance significantly

A little-known rule can help bereaved spouses or civil partners boost their Individual Savings Account allowance significantly after the death of a loved one. The Additional Permitted Subscription (APS) allows them to inherit an extra tax-free allowance equal to the value of the deceased partner's ISAs at the time of death. This means that the annual ISA limit can rise from the standard £20,000 to potentially six figures, depending on the deceased's ISA balance. Claims must be made within three years of death, creating opportunities for meaningful financial relief amidst emotional hardship. Recent data from Hargreaves Lansdown shows a notable increase in APS claims, reflecting growing awareness of this provision.

Key Takeaways

"These inherited allowances aren’t always well understood, but can be incredibly valuable."

Sarah Coles from Hargreaves Lansdown emphasizes the importance of understanding APS benefits.

"Claims must be made within three years of your partner’s death."

This rule requires timely action for those eligible to access the additional allowances.

"The APS process can be slow and paperwork-heavy, so acting sooner rather than later is key."

Financial advisers warn that delays can complicate APS claims.

This unique rule may provide vital financial assistance to grieving spouses, particularly during tough economic times. While it presents a significant opportunity, the process can be complex and cumbersome, requiring timely action. Financial advisers emphasize that awareness of APS is critical and that individuals should carefully review their ISA providers, as not all support APS claims. As more people learn about this option, we might see further shifts in how bereaved savers approach their finances.

Highlights

- This rule can unlock tens of thousands in tax-free savings.

- Growing awareness of APS is changing how bereaved spouses save.

- Navigating APS requires careful planning and swift action.

- Financial relief could lie in a little-known inheritance provision.

Risk of misunderstanding APS process and requirements

The APS process can be complex and slow, potentially leading to missed deadlines for claims.

Understanding the APS can provide much-needed financial relief during tough times.

Enjoyed this? Let your friends know!

Related News

Inheritance tax changes will include pensions starting April 2027

Warning issued to savers over new ISA changes

Reeves announces new plans to deregulate UK economy

UK pensions overhaul announced by government

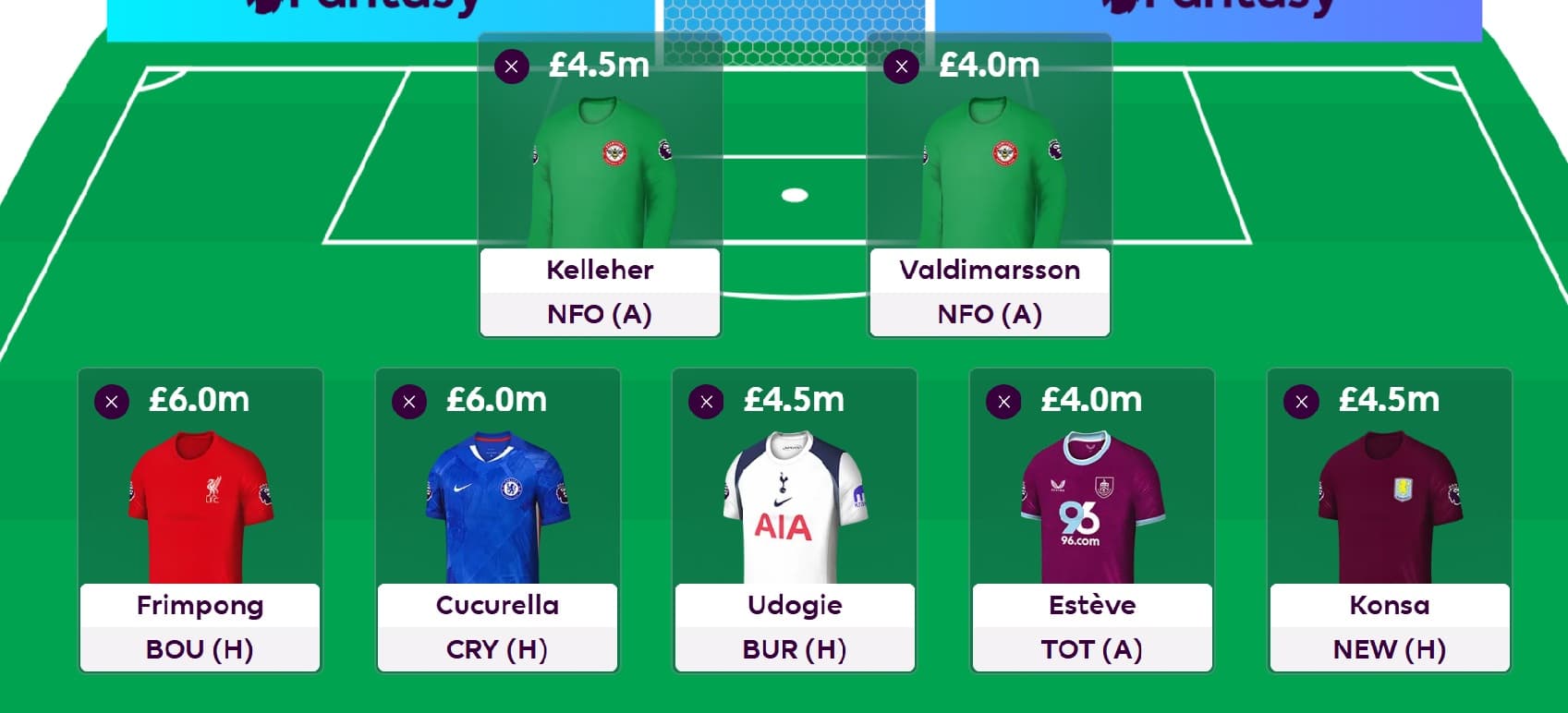

FPL expert unveils his 2025/26 squad

New initiative announced for UK households without driveways

FPL 2025/26 launches with new team strategies

Chancellor proposes new investment campaign