T4K3.news

UK pensions overhaul announced by government

Pensions minister Torsten Bell reveals plans to address the issue of declining retirement incomes.

Torsten Bell says government will revive the pensions commission to address income issues.

UK pensions face major reform amid declining retirement incomes

A significant reform of the UK pensions system will begin soon as the government aims to tackle the urgent issue of declining retirement incomes. Pensions minister Torsten Bell announced that the government would revive the Pensions Commission, citing the need for further changes since previous reforms began under Tony Blair's administration. Bell pointed out that many groups, including young people and low earners, are not adequately saving for retirement. He emphasized that 45 percent of working-age adults save nothing at all. The commission is set to explore options for improving pensions and aims to report within 18 months. Bell ruled out immediate increases in pension contributions while advocating for a long-term solution. Current trends show that private pension incomes could decrease significantly, risking future retirees facing financial strain.

Key Takeaways

"We are going to complete the job"

Bell emphasizes the need to continue reforming the pensions system.

"If we don’t do anything, too many of tomorrow’s pensioners will be poor in retirement."

Bell warns of the consequences of inaction on pension reforms.

"We are ruling out any increase in pension contributions in this parliament."

Bell assures stakeholders that immediate cost increases are off the table.

"Our job is to be sure you have a system delivering for lower and middle earners."

Bell discusses the focus of reforms to serve those most in need.

The looming overhaul of the pension system underscores a significant challenge facing the UK. The government is acknowledging that many individuals, especially from vulnerable demographics, are not saving enough for retirement. Bell's comments reflect a broader recognition of the inadequacies in the current pensions landscape. If left unaddressed, the reforms could affect millions, highlighting urgent needs for political consensus and actionable solutions. The attempt to balance immediate employer concerns with necessary reforms may prove difficult as public sentiment and economic pressures grow. In their quest for sustainable solutions, policymakers must ensure that all groups, including minority communities, are considered in the strategy.

Highlights

- Tomorrow's pensioners may face serious financial struggles.

- We cannot ignore the massive pension income problem any longer.

- If we carry on as we are, tomorrow's pensioners will be poorer.

- 45% of adults are saving nothing at all for their retirement.

Potential backlash from stakeholders over pension contributions

The plan to reform the pension system may face criticism, especially regarding potential increases in contributions and the impacts on employers.

The outcome of these reforms will shape the financial future of millions.

Enjoyed this? Let your friends know!

Related News

Chancellor plans major pension reforms

Pensions Commission revived to address retirement income crisis

UK government starts review of state pension age

New water ombudsman to be established in England and Wales

State Pension Age Review Announced

Trump and Starmer meet in Scotland for trade discussions

UK approves Sizewell C nuclear power plant

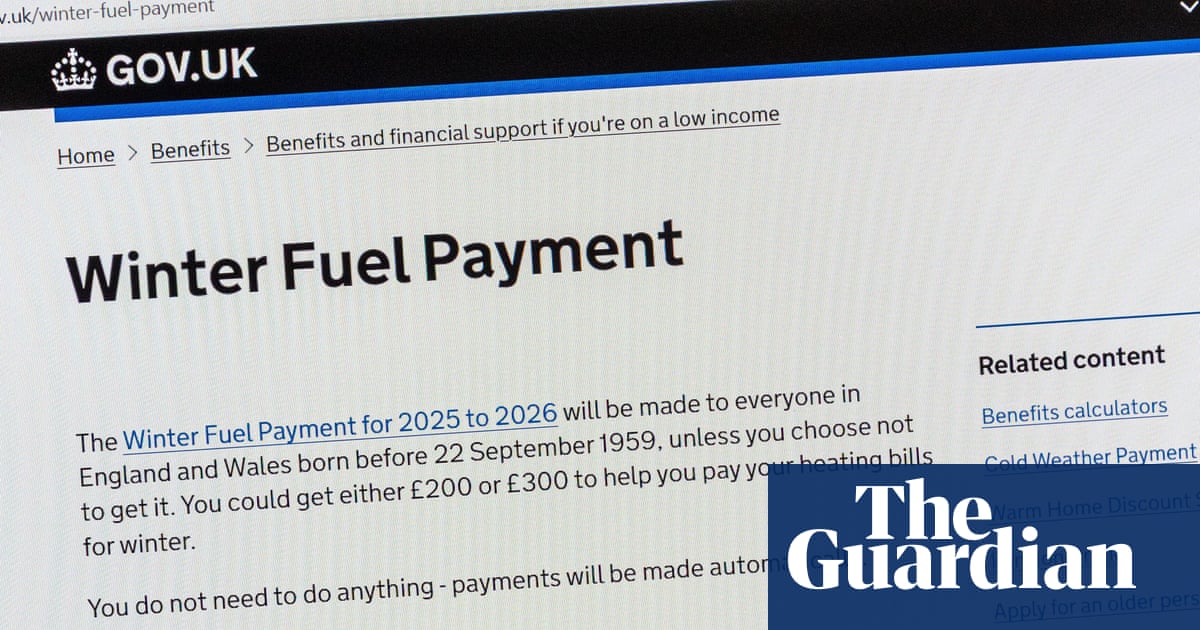

Scammers target pensioners with fake fuel allowance texts