T4K3.news

Michael Saylor defends Bitcoin acquisition strategy

Saylor claims owning 3% to 7% of Bitcoin supply is reasonable amid firm’s ambitious plans.

Michael Saylor's comments come after Strategy's significant Bitcoin purchases raised eyebrows in the market.

Michael Saylor defends Bitcoin strategy amid firm’s aggressive acquisitions

Michael Saylor, chairman of MicroStrategy, recently reassured investors regarding his firm's ambition to own a substantial share of Bitcoin. In a CNBC interview, he explained that planning to acquire between 3% and 7% of Bitcoin's total supply is reasonable and compares it to other large investors, such as BlackRock. Currently, Strategy holds about 628,791 BTC, equating to 3% of the total supply. The firm recently reported a profitable second quarter, highlighting net income of $10 billion after previous losses. Despite some concerns regarding share dilution from recent funding methods, which included stock sales, Saylor emphasized his commitment to responsible capital management going forward. He is focusing on yield-bearing perpetual preferred stocks to finance future BTC purchases to prevent further dilution of share value.

Key Takeaways

"I don’t think owning 3% to 7% of Bitcoin supply is too much. BlackRock has more than that."

Saylor highlights that his firm's stake in Bitcoin is comparable to that of other major investors.

"Strategy is misunderstood and undervalued $MSTR"

Saylor suggests that there are misconceptions in the market regarding the value of MicroStrategy shares.

"The upshot is that MSTR is not just buying bitcoin anymore, but instead engineering a corporate treasury machine."

Wall Street analysts emphasize the innovative financial strategy being executed by MicroStrategy.

"To prevent further dilution, we will only sell MSTR shares when the mNAV is above 2.5x."

This shows Saylor's commitment to maintaining shareholder value by careful management of stock sales.

Saylor's comments reflect a broader strategy among institutional investors diving into Bitcoin. By positioning MicroStrategy as a key player in the crypto space, Saylor aims to highlight the potential profitability of significant BTC holdings. His viewpoint can spur more companies to consider similar strategies, thus escalating the competition for Bitcoin. Furthermore, by indicating a focus on preferred stocks with BTC backing, the firm is navigating a challenging market landscape carefully, looking to balance investment with minimal dilution. This strategy may also signal a growing acceptance of Bitcoin among traditional financial entities, reinforcing its legitimacy.

Highlights

- Owning a piece of Bitcoin is a calculated risk, not a gamble.

- MicroStrategy is on track to create a Bitcoin-denominated cash flow.

- Aggression in Bitcoin acquisition is a sign of belief, not recklessness.

- There’s potential upside in being misunderstood and undervalued.

Concerns over capital management tactics

Saylor's aggressive acquisition strategy has raised concerns over potential share dilution and reliance on debt, which some investors may view as risky.

As institutional interest in Bitcoin grows, Saylor's stance may reshape investment strategies moving forward.

Enjoyed this? Let your friends know!

Related News

Michael Saylor Indicates Intent to Buy More Bitcoin

Michael Saylor Calls STRC a Game-Changer

MicroStrategy increases stock offering to $2.8 billion

Trump Media announces $2 billion Bitcoin investment

Bitcoin Reaches New All-Time High

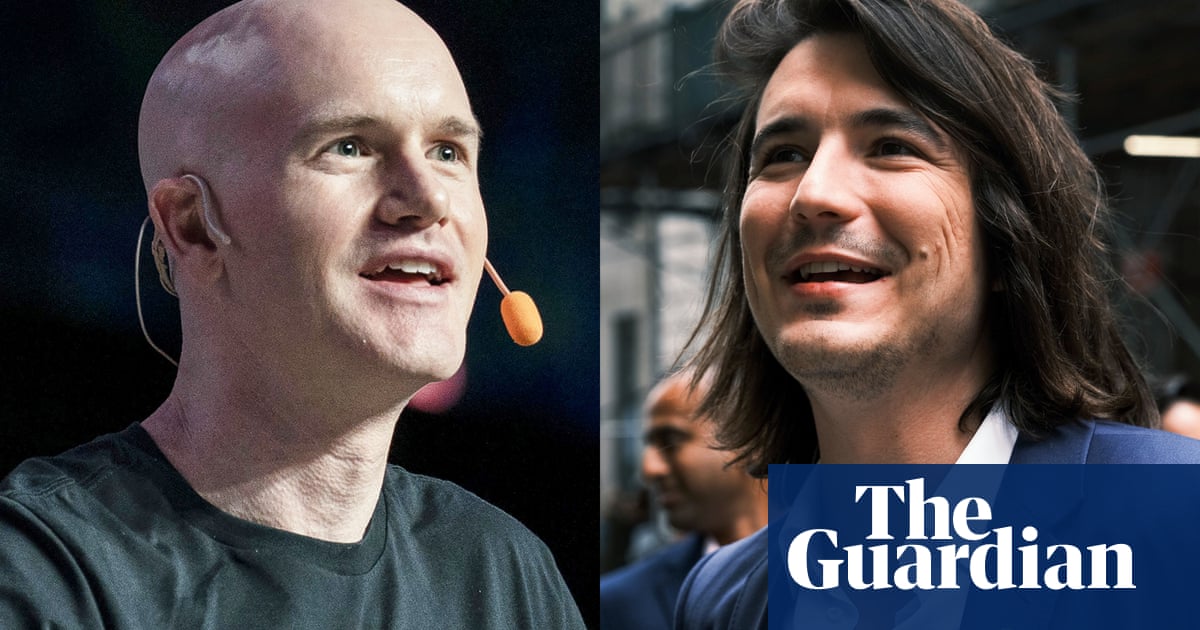

Trump meets with crypto executives to discuss strategy

Stellar's Price Set for Rise After Trump's Crypto Bill