T4K3.news

Meme Traders Return with Large Bets Against S&P 500

Retail investors are again targeting shorted stocks, echoing the 2021 GameStop excitement.

Retail investors are once again flocking to heavily shorted stocks, reminiscent of the 2021 GameStop saga.

Meme Traders Revisit GameStop Strategy to Challenge S&P 500

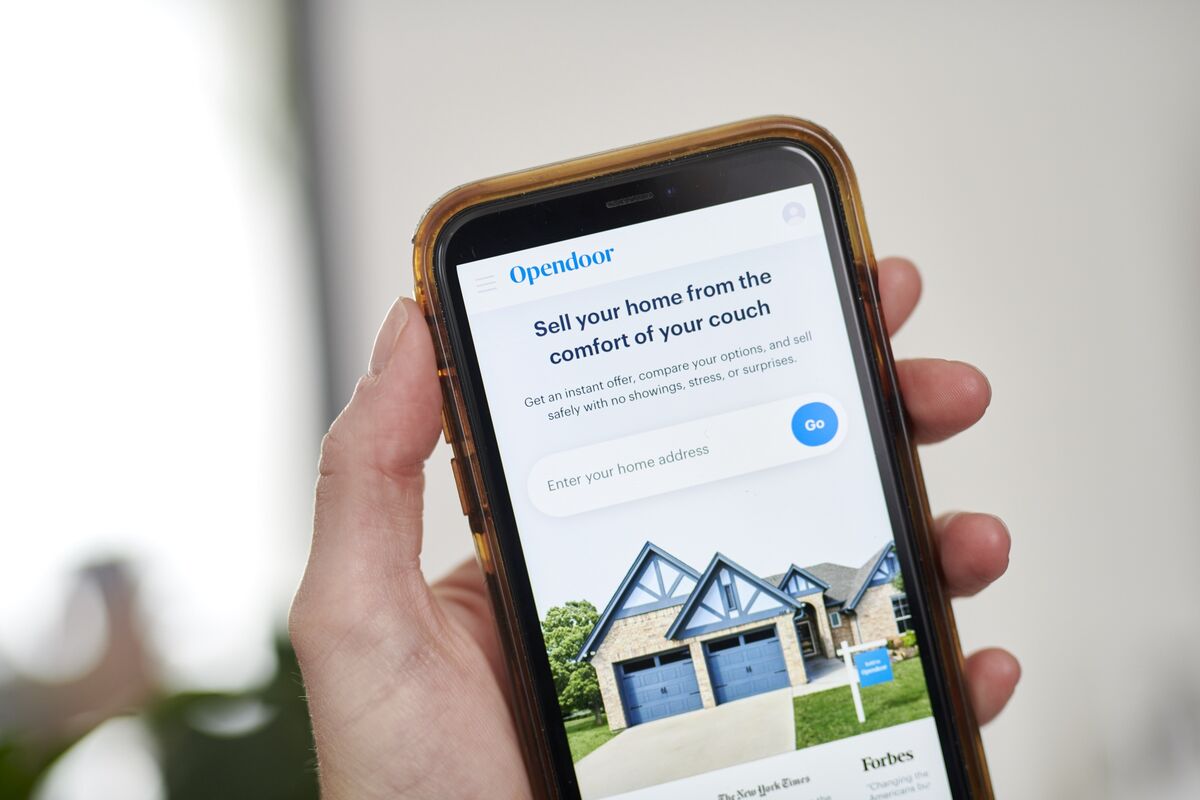

Retail investors are on the rise again, with activity reminiscent of the 2021 GameStop frenzy. Some investors are placing substantial bets on struggling companies. A conservative investor invested $20,000 in Opendoor Technologies Inc. A 20-year-old student decided to invest $2,000 in Kohl's Corp. options. Notably, one trader revealed that they selected stocks based on suggestions from ChatGPT. This sudden influx into these heavily shorted stocks happens even as the S&P 500 reaches new highs, capturing the attention of those attracted to the high-risk, high-reward nature of day trading.

Key Takeaways

"This is not just gambling, it's a calculated risk to beat the market."

A trader's perspective on the current meme stock frenzy.

"I can't ignore the potential for massive gains with these stocks."

A young investor's opinion on meme stocks.

This resurgence of meme trading highlights a fascinating trend where retail investors are undeterred by traditional market performance. Rather than focusing on stable growth, many are drawn to the excitement and the potential for quick profits. As the S&P 500 continues to climb, the chase for short squeezes reveals a risk appetite among younger traders who see social media as a powerful tool for stock selection. This could lead to greater market volatility and raises questions about the sustainability of such trading strategies.

Highlights

- Investing is not just numbers. It’s also about the thrill.

- The market is a playground for those who dare to take risks.

- Meme trading is more than a trend; it’s a movement.

- Social media is the new trading floor for retail investors.

Concerns Over Market Volatility and Risky Investments

The resurgence of meme trading among retail investors could lead to greater volatility in the stock market as individuals chase short squeezes. This behavior raises concerns about the sustainability of these trades and the potential for significant financial losses.

As meme trading continues to evolve, its impact on market stability remains to be seen.

Enjoyed this? Let your friends know!

Related News

:max_bytes(150000):strip_icc()/GettyImages-2226699333-6e8ce3ffae0e4274b86ad24510648aa5.jpg)

S&P 500 and Nasdaq Close at Record Highs

S&P 500 reaches record peak after quick recovery

Palantir Stock Price Rises 73% in 2025

Surge in meme stocks concerns investors

Retail traders drive up GoPro and Krispy Kreme shares

Buffett moves to Treasury Bills as Apple and Bank of America stakes shrink

Piper Sandler recommends two high-yield stocks