T4K3.news

Markets Edge Higher on Putin Talks Hopes

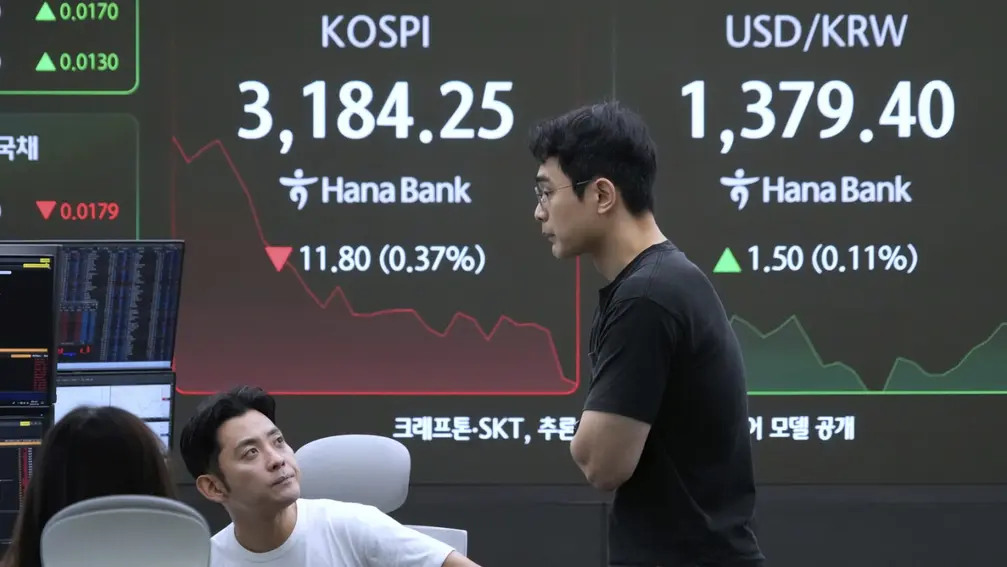

Futures rise in the US and Europe as traders watch for possible diplomacy with Russia and its effect on Ukraine and energy supplies.

Equity futures in the US and Europe rise while oil slips as investors weigh a potential meeting between US and Russia and its effect on Ukraine and energy supply.

Markets Edge Higher on Putin Talks Hopes

Futures for US and European stocks rose modestly on August 11, with S&P 500 futures up about 0.2% and European benchmarks up around 0.3%. Oil fell roughly 0.7%, marking a seventh decline in eight days, as traders priced in the possibility that talks between Washington and Moscow could ease conflict and affect crude flow. Treasuries in Asia saw no cash trading due to a holiday in Japan.

Gold prices declined as attention turned to a potential meeting between US and Russian leaders. In Asia, markets edged higher following the overnight moves, but liquidity remained thin as Japan observes a holiday.

Key Takeaways

"Diplomacy could calm a volatile market"

market strategist comments on potential effect of talks

"Oil moves with every diplomatic whisper"

commodity trader remarks on price sensitivity to talks

"Markets still face a wall of uncertainty"

editorial note on geopolitical risks ahead

Markets are testing how much relief comes from diplomacy versus concrete policy steps. A potential meeting between US and Russian leaders introduces optimism but also a warning that headlines can quickly shift sentiment. Investors should weigh the risk of volatility if talks stall or falter.

Diplomacy can calm nerves, but it does not guarantee stability. The coming days will reveal which narratives investors trust and which fears they discount.

Highlights

- Hope travels faster than policy

- Markets chase headlines not certainty

- Diplomacy is a hedge against chaos

- Oil moves with every diplomatic whisper

Geopolitical risk around Putin talks

The topic involves high level geopolitical talks that can move markets and provoke public reaction. There is potential for sudden volatility and political backlash depending on outcomes.

Market dynamics will keep shifting as officials speak and actions follow

Enjoyed this? Let your friends know!

Related News

Markets rise as Ukraine talks loom

Markets mixed ahead of tariff deadline

Bitcoin reaches record high ahead of Trump's inauguration

Gold prices rise as tariffs enter the market

Transfer news intensifies as deadline approaches

Wall Street reaches new record amid profit reports

Elon Musk awarded shares worth $29 billion

Global markets surge after US-EU trade agreement