T4K3.news

Government may recover VAT from school advance fees

Tax experts warn that more than £500m paid by parents could face VAT claims.

New analysis highlights potential taxation risks for private schools.

Government may recover VAT from private school advance fee schemes

Tax experts warn that the UK government could reclaim VAT from advance fee schemes used by private schools, which collected over £500 million last year. Parents sought to avoid a new 20% VAT on school fees by paying upfront before its implementation in January. However, the effectiveness of these schemes is under scrutiny by HMRC, especially if they lack clear contractual details regarding fees. High-profile schools like Winchester and Eton may face legal challenges, as the situation raises critical questions about compliance. Tax expert Dan Neidle suggested that if these schemes do not meet VAT requirements, significant financial ramifications could follow. While the overall impact on VAT revenue may be limited to short-term losses, estimated around 5-6% for one year, the stakes are high for both parents and institutions. Schools have encouraged early payments in anticipation of policy changes following the upcoming election, further complicating the situation for many families and schools.

Key Takeaways

"We reckoned there’s a high chance that didn’t work from a VAT perspective."

Dan Neidle comments on the feasibility of advance fee schemes regarding VAT compliance.

"Removing tax breaks for private schools is expected to raise £1.8 billion a year by 2029-30."

A government spokesperson outlines the financial implications of changing VAT policies.

This development shines a light on the financial strategies employed by wealthy private schools in response to changing tax policies. As more parents sought to secure savings by pre-paying fees, these schools may have unintentionally entered a legal grey area. The looming possibility of HMRC investigations adds urgency and concern to a situation that could reshape funding for education. If the government effectively enforces VAT on these schemes, it could lead to a re-evaluation of how private education is funded. The implications stretch beyond taxes; they could also influence the competitive landscape of education in the UK, especially as state schools strive for improvements with additional funding projected from these tax adjustments.

Highlights

- Will private schools face a legal storm over advance fees?

- Tax strategies may backfire on parents and schools alike.

- Legal battles could reshape funding in UK education.

- Changes in tax policy may impact private schools significantly.

Potential legal challenges for private schools

The scrutiny of advance fee schemes used by private schools presents risks of legal action and financial penalties for both institutions and parents.

The response from private schools and parents will be crucial in the coming months as this issue unfolds.

Enjoyed this? Let your friends know!

Related News

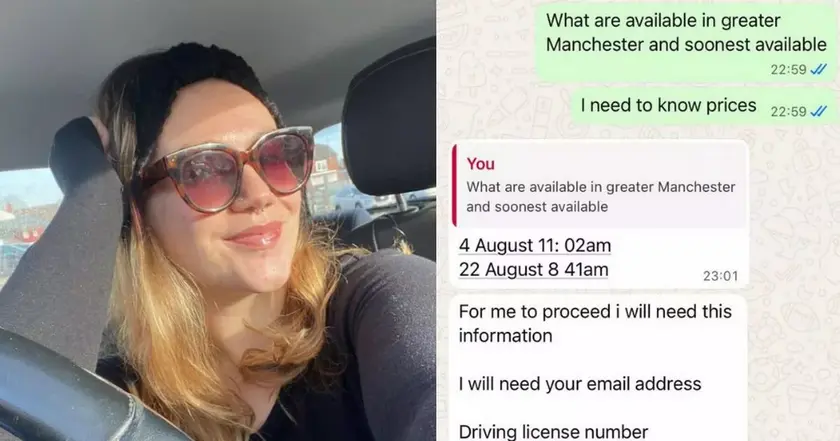

Learner drivers face soaring costs for driving tests

AI tools expand in workplaces

IMF advises UK to reconsider pension and NHS treatment policies

Voting Rights Act faces pivotal legal challenges

YieldMax Announces New Distributions on Major ETFs

Nvidia and AMD face new export rules

New family outing discounts available this summer

Mortgage approvals increase as housing market stabilizes