T4K3.news

Fraud leaves Merseyside mum with £1

A scam call drained £10 500 from a Merseyside mother's accounts, leaving just £1.61. Action Fraud is investigating.

A Merseyside mother describes a phone scam that drained £10 500 from her accounts leaving only £1 in her balance.

Fraud leaves Merseyside mum with £1 after £10 500 scam

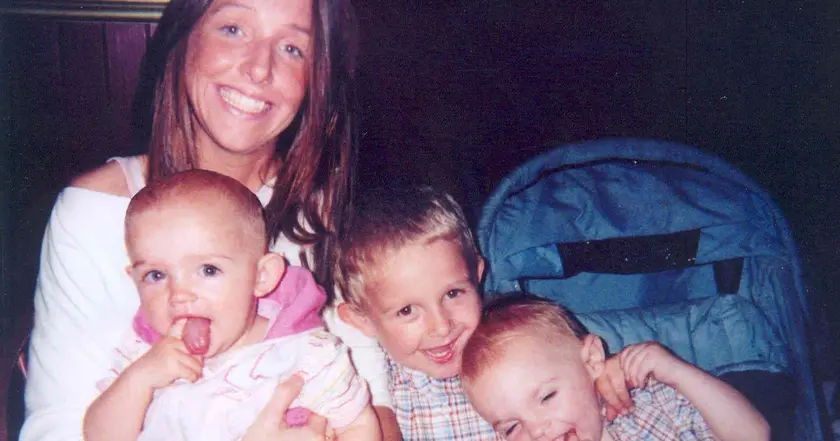

A Merseyside mother, Vicki Jones, says a fake bank call cost her £10 500 and left her with £1.61. The callers posed as bank staff, claimed there was unusual activity, and urged her to move funds to a new holding account. They used a withheld number and convinced her they were guiding her to a secure line. After more than five hours on the phone, she had moved the money and only realized the scam after a friend showed her a TikTok warning. She later learned there was no tier three digital fraud team and that Action Fraud is examining the case.

Action Fraud says it never contacts victims unless they request it and it never asks for banking details. The incident underscores how social engineering can mimic legitimate banking procedures and create panic. The authorities are urging people to verify callers and to report suspicious activity to prevent further losses, while the case is investigated by Action Fraud with the NFIB involved in the review.

Key Takeaways

"They rang me to say that there had been unusual activity on my account"

Vicki recounting the call

"I truly believed that I was at risk"

Vicki describing her mindset during the call

"Action Fraud can confirm that it received NFRC250807542366 on 8 August 2025 and it is currently being assessed by the National Fraud Intelligence Bureau"

official update from authorities

"Don't get caught out. Stop, Think Fraud, and make sure you report suspicious-looking emails or messages if you receive them"

Detective Sergeant Gavin's guidance

This case shows how scammers blend familiar bank language with fear to push victims into risky moves. It highlights a gap between public understanding of how to verify callers and how banks communicate security alerts. In a world of rapid digital threats, awareness and clear guidance are essential. Public campaigns plus smarter bank verification can reduce losses and rebuild trust.

There is a broader question about how quickly institutions respond when people report possible fraud. Faster alerts, better verification during calls, and easier access to help lines could save money and reduce distress for families who face this kind of loss.

Highlights

- Action Fraud will never contact victims unless they request it

- Don't get caught out Stop Think Fraud and report suspicious messages

- I believed I was at risk and moved money to protect my daughter's savings

- Public awareness is the first defense against scams

Fraud risk to consumers

The report highlights a real world instance of social engineering that led to a large financial loss and calls for stronger consumer protections and clearer pathways for reporting suspected fraud.

As scams grow more convincing, communities rely on vigilance and solid guardrails to protect savings.

Enjoyed this? Let your friends know!

Related News

Housing fraud case in Wolverhampton

Phone scam drains thousands from West Derby mother

Protection reminder for scam victims

Merseyside jails 66 criminals in July

35 death notices published in Stoke on Trent this week

Funeral notices reveal cherished lives in Devon

Family calls for justice in Lucy Hargreaves murder case

Shoplifting case tests leniency