T4K3.news

Protection reminder for scam victims

If you receive a suspicious call, contact your bank directly using a number from your card or official website, and report to Action Fraud through official channels.

A West Derby mother loses £10,500 after scammers pose as Action Fraud and pressure her to transfer funds to a fake holding account, leaving her with almost nothing.

Mother left with £1.61 after scammers drain £10,500

Vicki Jones, a 44 year old mother from West Derby, fell victim to a phone scam that pretended to be from Action Fraud. Over a five hour call, the caller claimed to check security and convinced her to move about £10,500 into a fake holding account. The scammers appeared to know her name, address and even details about her bank accounts. They used a withheld number and instructed her to use a card reader and take a selfie to verify identity. She was told the process would help close down compromised accounts and avoid further losses, a move that ultimately emptied her own funds.

The next morning, after speaking with a friend and seeing warnings online, Jones realized she had been deceived. She contacted her bank, only to be told there was no investigation and no tier three digital fraud team. Action Fraud later cautioned that it does not call victims and urged reporting through official channels. The case is under investigation by Action Fraud and Merseyside Police continues to stress phishing awareness. Jones says she does not yet know if she will recover the money, including funds meant for her daughter’s future education and holiday plans.

Key Takeaways

"They rang me to say that there had been unusual activity on my account and they had stopped a few payments."

Shows how the scam created urgency and a false sense of seriousness.

"Obviously hindsight is an amazing thing but they'd already put me in a panic."

Illustrates the emotional impact on the victim.

"I am not usually a naive person."

Underlines that anyone can be targeted.

"I just don't want anybody else to go through this absolute nightmare."

Expresses a plea for awareness and prevention.

This incident shows how scammers mimic official bodies to create urgency. The call length and personal knowledge of Jones’ finances lowered her guard, a pattern experts say is growing as criminals refine social engineering. It also reveals gaps in how people verify alarms about their money, and how banks respond when someone reports potential fraud. Public agencies and banks must do more to reinforce official channels and quick verification steps for customers faced with suspicious calls.

The broader lesson is that households can be overwhelmed by fear and complexity. Scammers exploit the moment of vulnerability, and their tactics evolve with technology and social media. A stronger layer of consumer protection and clearer, accessible guidance for quick back-channel verification could limit future losses and rebuild trust in official fraud-fighting mechanisms.

Highlights

- Dont rush to trust a caller who claims to protect your money

- Hindsight wont recover the money that is gone

- If it sounds official verify it with the bank

- Scammers win when you panic and act on fear

Financial risk and potential backlash

The incident highlights how convincing phone scams can be and the need for stronger verification practices. It also raises questions about consumer protection and how quickly institutions respond to reported fraud.

Public awareness remains the strongest shield against evolving fraud.

Enjoyed this? Let your friends know!

Related News

Amazon warns 200 million customers about scams

Amazon alerts 220 million Prime users of scams

Escobar Phone creator pleads guilty to fraud charges

Belgian man discovers romance scam after long journey

Nigerian nationals arrested for dating scams

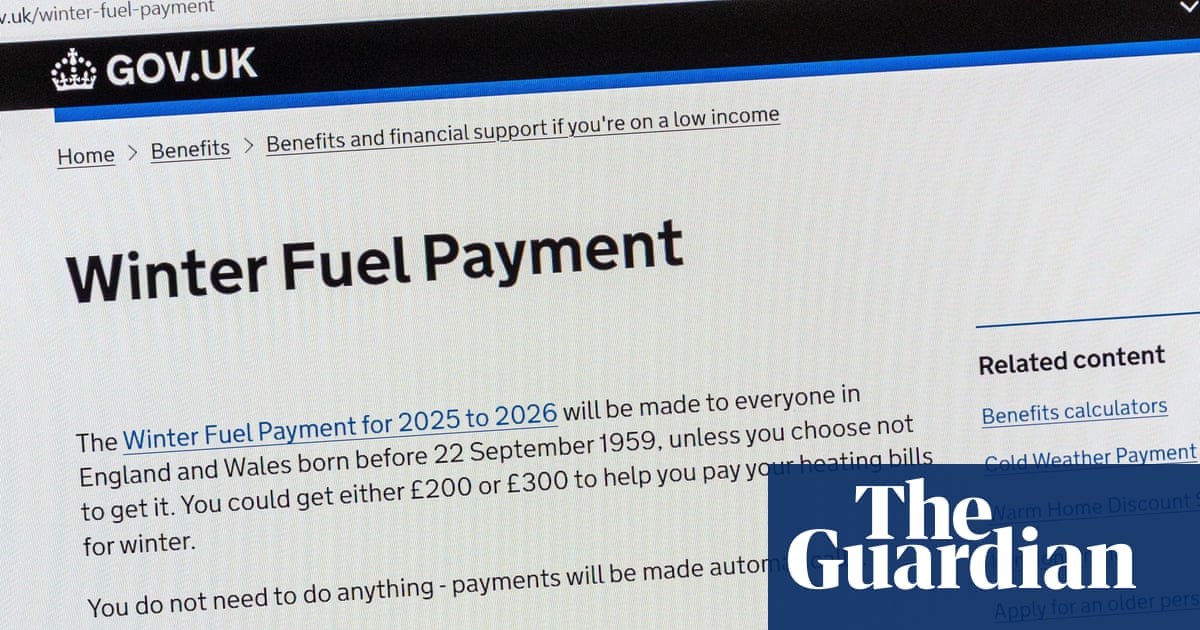

Scammers target pensioners with fake fuel allowance texts

Ticket fraud alert

NY AG sues Zelle parent over fraud