T4K3.news

Fed independence under strain

Powell signals a possible rate cut as independence comes under political pressure

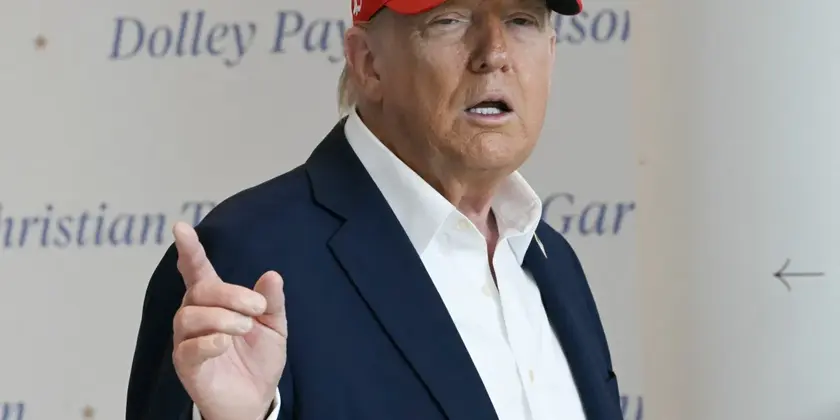

Powell signals a possible September rate cut while independence faces political pressure and the risk of board changes.

Fed independence under strain as rate cut debate intensifies

Powell signaled that the Federal Reserve could cut its key interest rate at the September meeting, a shift that would mark a new phase after a period of tighter policy. The decision comes as growth shows signs of slowing, inflation remains a concern, and tariffs could push prices higher. The Fed's policy rate sits at 4.3 percent and first half growth ran at about 1.2 percent, down from 2.5 percent a year earlier.

Independence remains central to the Fed's credibility. Cleveland Fed president Beth Hammack told the AP she is laser focused on delivering good outcomes for the public and tuning out noise. The possibility of leadership changes and ongoing political pressure introduces another source of risk for policy decisions, as investors watch how the board handles calls for easier policy while inflation remains stubborn.

Key Takeaways

"I'm laser focused on delivering good outcomes for the public."

Beth Hammack on independence and focus

"We’re still having a civilized internal discussion about the merits of the issue."

Adam Posen on the independence debate

"The president has a long history of applying pressure to Chairman Powell."

Michael Strain on political pressure

Powell's move is less about what to do now and more about how to do it. A measured glide path could reassure markets that the Fed remains data driven, not captive to politics. Indpendence is the backbone of credible policy; if markets doubt it, volatility could rise and credibility could erode.

This moment tests the governance of a technocratic institution in a charged political era. The fate of nominees and the tone of the debate will shape credibility long after the next rate move. The Fed must balance public concerns about inflation with the need to support a slowing economy, all while keeping its independence intact for future policy decisions.

Highlights

- I'm laser focused on delivering good outcomes for the public.

- We’re still having a civilized internal discussion about the merits of the issue.

- The president has a long history of applying pressure to Chairman Powell.

- Independence is the Fed's shield against politics.

risk of political pressure on Fed independence

The piece notes threats to officials and leadership changes that could erode the Fed's perceived independence, a risk for credibility and market stability.

The coming weeks will test whether independence can survive political pressure and a shifting economy.

Enjoyed this? Let your friends know!

Related News

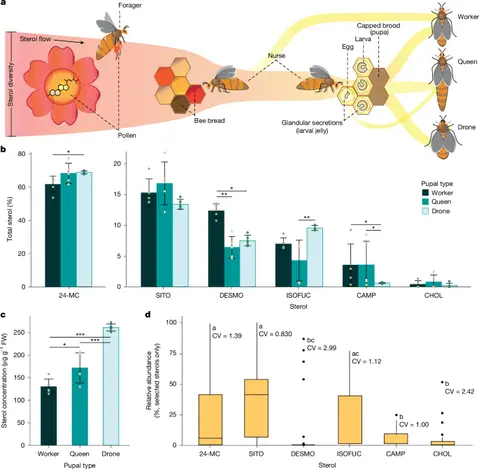

Engineered yeast helps bees during pollen shortages

BBC star chef closes top UK restaurant amid rising costs

Calls grow for Powell to resign over Fed independence

Trump intensifies pressure on Federal Reserve Chair

Trump's Comments on the Fed Cause Market Turmoil

Powell speaks at Jackson Hole amid rate-cut pressure

Republican senators caution Trump against Fed chair dismissal

Trump threatens to fire Fed governor Cook