T4K3.news

Calls grow for Powell to resign over Fed independence

Prominent economist urges Jerome Powell to step down to preserve Federal Reserve's integrity amid political attacks.

The Federal Reserve's independence from political pressure faces unprecedented threats amid attacks on its chair.

Economist calls for Powell's resignation to protect Fed integrity

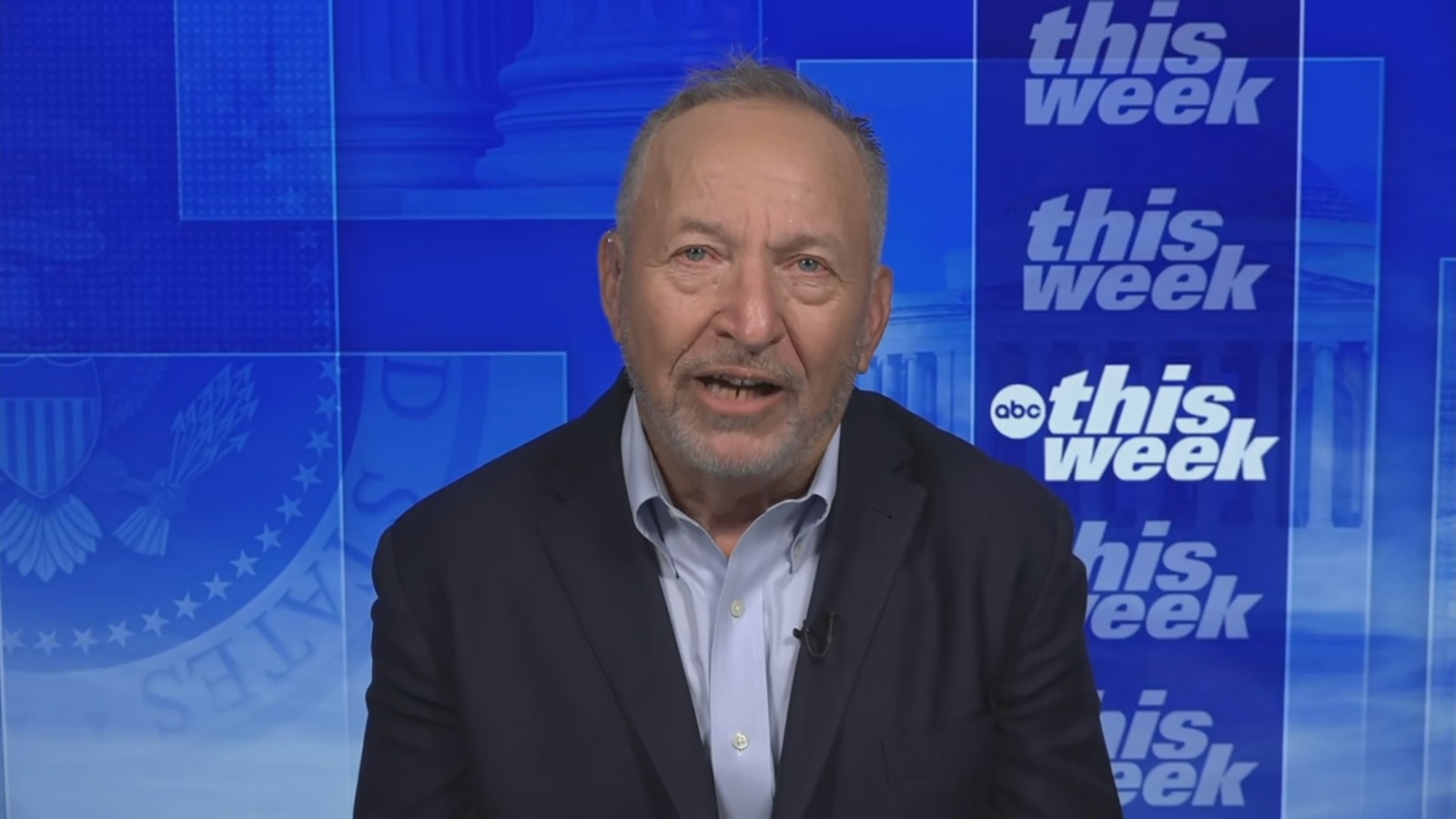

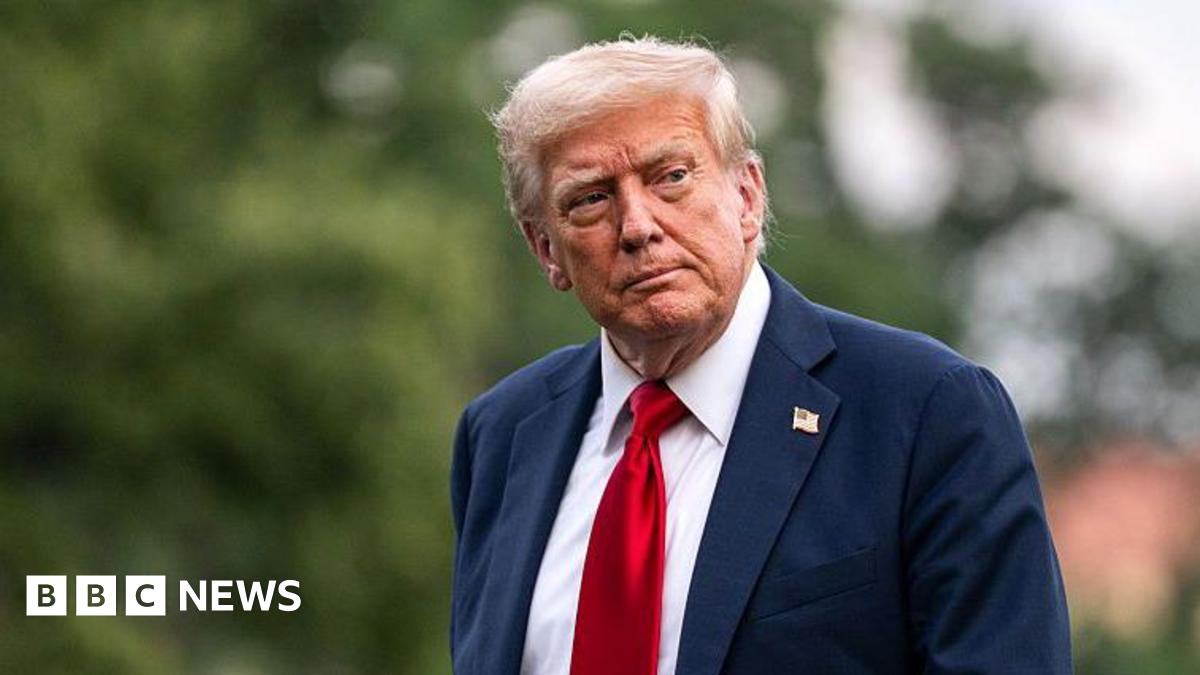

Jerome Powell, the chair of the Federal Reserve, is under intense scrutiny as President Donald Trump publicly criticizes him for not lowering interest rates. Prominent economist Mohamed El-Erian suggests that Powell should resign to preserve the central bank’s independence. El-Erian argues that continued attacks could weaken the institution. While other economists, including former Fed official Alan Blinder, oppose this view, they express concern that a resignation may set a dangerous precedent. Trump has stated that his administration will soon replace Powell, which adds to the uncertainty surrounding the Fed's future independence. Prominent figures, including Janet Yellen, emphasize that market confidence hinges on the Fed's nonpartisan stance, which is currently under threat.

Key Takeaways

"The longer Powell stays in power, the more that process will continue, fundamentally threatening the independence of the Fed."

Mohamed El-Erian argues for Powell's resignation to protect the Fed.

"I couldn't disagree more vehemently with El-Erian."

Alan Blinder defends Powell's strength against Trump's criticism.

"If Powell steps aside, it creates a terrible precedent for the future."

Blinder emphasizes the risks of Powell resigning in reaction to pressure.

"In the end, either the administration realizes that Fed independence is in its own interest, or it will need to be supported by Congress."

Bill English underscores the need for the Fed to remain free of political influence.

The debate surrounding Powell's position at the Fed illustrates deeper tensions between politics and economic policy. With Trump openly criticizing Powell's decisions, the independence of the Fed has never felt more vulnerable. This conversation raises questions about future monetary policy decisions and unpacks the delicate balance central banks must maintain in navigating political landscapes. As such, the future independence of the Fed could have significant ramifications for market stability and economic growth, especially amid rising inflation concerns.

Highlights

- A resignation would create a terrible precedent for the future.

- The attacks on Powell threaten the Fed's independence.

- Markets rely on the Fed's credibility to maintain stability.

- Powell has vowed to complete his term no matter the pressure.

Concerns over Fed's independence amid political pressure

Attacks from Trump could undermine the Fed’s credibility and its ability to operate independently. This poses significant risks to market stability and economic policy.

The future of the Fed hangs in a fragile balance as political pressures mount.

Enjoyed this? Let your friends know!

Related News

Mohamed El-Erian urges Jerome Powell to resign

Trump calls for Fed to lower rates amid leadership changes

Republican senators caution Trump against Fed chair dismissal

Trump escalates pressure on Fed Chair Powell

Federal Reserve governor resigns ahead of term completion

Trump pressures Fed to address rising renovation costs

Trump escalates Fed criticism amidst economic turmoil

Trump visits Federal Reserve amid scrutiny