T4K3.news

European Central Bank maintains interest rates amid trade uncertainty

The ECB held firm on interest rates, navigating inflation and U.S. trade discussions.

The European Central Bank pauses interest rate cuts while navigating trade disputes with the U.S.

European Central Bank keeps interest rates steady amid trade uncertainty

The European Central Bank (ECB) has decided to maintain its current interest rates after cutting them four times earlier this year. Inflation in the euro area stabilized around the ECB's target of 2%, prompting the central bank to hold rates steady. Geopolitical instability, particularly concerning trade negotiations between the EU and the U.S., has contributed to this cautious approach. The potential for a 15% tariff rate on EU imports to the U.S. remains a major concern as the bloc seeks to finalize a trade agreement.

Key Takeaways

"The environment remains exceptionally uncertain, especially because of trade disputes."

This statement from the ECB highlights the tensions impacting economic policymaking.

"The last cycle is done, bringing inflation down, but we remain alert to medium-term changes."

Philip Lane emphasizes the ECB's awareness of external economic shifts that could influence their decisions.

The ECB's decision to hold interest rates suggests a wait-and-see strategy amid heightened trade tensions. The central bank has repeatedly indicated that it is nearing the completion of its work to control inflation, yet the prospect of tariffs adds a layer of unpredictability. As inflation levels stabilize, influencing factors such as currency strength and external trade relationships will likely weigh heavily on future policy decisions. Traders are concerned that additional tariffs could hinder economic growth, indicating that the ECB may need to act sooner rather than later if the trade situation deteriorates further.

Highlights

- The decision shows the ECB's balancing act between inflation and trade risks.

- Stable rates reflect the ECB's cautious approach to economic uncertainties.

- Trade talks could determine the future of ECB's monetary policy.

- A significant pause in rates signals careful consideration by the ECB.

Concerns over trade disputes impact monetary policy

The ongoing trade negotiations with the U.S. raise significant risks for economic stability in the EU, potentially leading to tariff increases that could hinder growth.

The ongoing trade situation poses serious questions for the ECB's future actions.

Enjoyed this? Let your friends know!

Related News

Supreme Court overturns convictions of two City traders

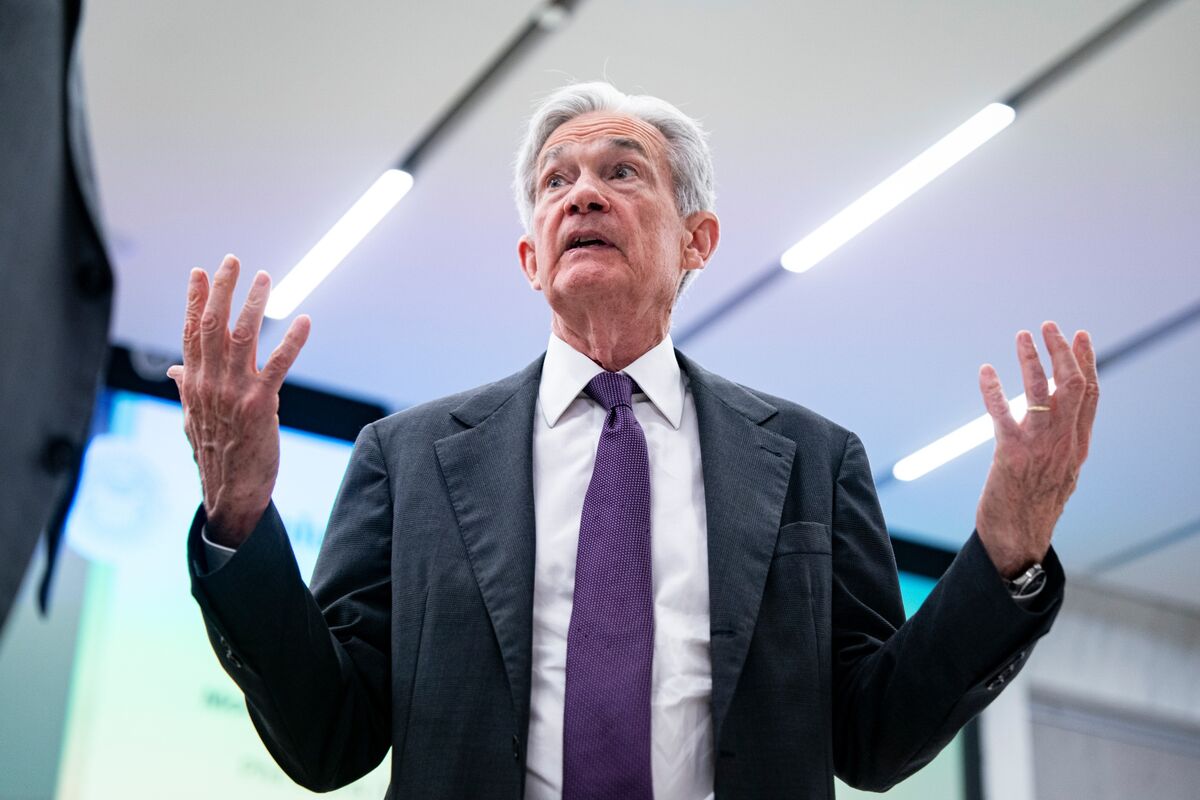

Federal Reserve Meeting Highlights Political and Economic Crosswinds

Federal Reserve maintains interest rate amid economic uncertainty

Pound Sterling Declines Against Euro

Bank of England expected to lower interest rates by 0.25%

Stock markets gain after Trump's trade threat reversal

Jerome Powell's remarks will influence market expectations

Trump intensifies pressure on Federal Reserve Chair