T4K3.news

Pound Sterling Declines Against Euro

The GBP/EUR exchange rate has dropped below 1.15 as UK economic data disappoints.

Currency dynamics reveal ongoing struggles for the Pound against the Euro.

Pound Sterling Faces Continued Pressure Against Euro

The Pound to Euro exchange rate has slipped as traders react to economic signals from the UK, revealing persistent weaknesses. Recently, the GBP/EUR fell to 1.1460, breaking below the crucial 1.15 level and raising concerns about a potential further decline to 1.14. Analysts at Nomura have expressed surprise at the European Central Bank's hawkish stance, prompting them to revise their forecast for the Euro's strength against the Pound. They now expect the Euro to strengthen further based on contrasting economic indicators and central bank policies. The shifts reflect a deepening divergence, with the Bank of England anticipated to cut interest rates amid ongoing economic challenges and weaker data from the UK, while the Eurozone shows signs of resilience and a more stable outlook.

Key Takeaways

"Underperformance is weighing on GBP/EUR."

George Vessey highlights the Pound's struggles as it falls continuously.

"The direction of conventional monetary policy remains towards loosening."

A note from Lloyds Bank emphasizes the expected easing from the Bank of England.

"With the eurozone showing signs of resilience, the policy divergence could keep pressure on the currency pair."

George Vessey underscores the contrasting economic outlooks between the UK and Eurozone.

"The scale of the change in tone was surprising."

Dominic Bunning of Nomura notes the unexpected hawkish stance from the ECB.

The ongoing struggles of the Pound Sterling against the Euro highlight a broader narrative in the currency market. Economic indicators suggest that the UK is failing to gain the growth momentum anticipated earlier this year, leading to expectations of further interest rate cuts by the Bank of England. In contrast, the Eurozone appears to be stabilizing, with the European Central Bank less likely to implement further cuts, further widening the policy divergence. This situation places continuous downward pressure on the Pound, and traders are adapting their strategies accordingly, increasingly leaning towards buying Euros on any signs of weakness in the Pound.

Highlights

- The Pound faces tough times as the Euro gains ground.

- The Bank of England's cuts loom as economic data disappoints.

- Traders are shifting their bets from Pound to Euro amid uncertainty.

- Monetary policy divergence could mean further weakness for GBP.

Potential Economic Instability Signals Risk

The ongoing economic struggles of the UK and expectations for interest rate cuts by the Bank of England create a risky environment for the Pound's value.

The path ahead for the Pound depends on upcoming economic data and central bank decisions.

Enjoyed this? Let your friends know!

Related News

Pound Sterling forecast indicates temporary recovery

Euro Surges as Dollar Declines

Beef prices reach all-time highs

Ryanair reports a profit jump in first quarter results

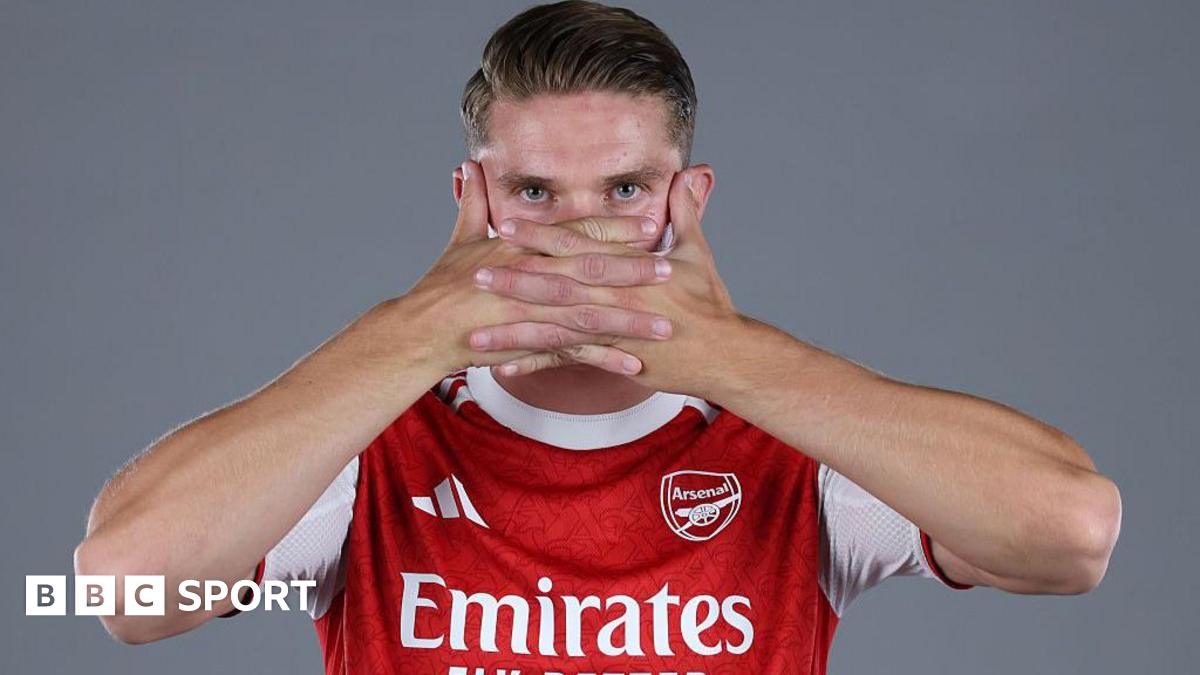

Viktor Gyokeres joins Arsenal for 73 million euros

Stellantis anticipates $2.68 billion net loss

FTSE 100 closes lower on volatile trading day

Dividend stocks emerge as strong income source