T4K3.news

Editorial note

US offshore leases expand while UK windfall tax faces criticism

An editorial look at Washington's offshore lease expansion under Big Beautiful Gulf 1 and Britain's windfall tax and its effects on investment

US expands offshore leases as UK windfall tax hits investment

The White House has scheduled the inaugural sale under the Big Beautiful Gulf 1 law for December this year. More than 30 federal lease sales are planned over the next 15 years. The plan sets a minimum pace: the Gulf of America must hold at least two offshore lease sales by 2039, starting in 2026, and Alaska's Cook Inlet at least six offshore sales before 2032. There will also be quarterly onshore sales in western states.

In Britain, operators warn that the windfall tax remains punishingly high. Ithaca Energy and other operators urge changes to the 38 percent Energy Profits Levy or its removal. The levy is designed to kick in when oil and gas prices rise; it would expire if prices stay below set thresholds for six months. Oil has traded under those levels for months, complicating investment signals. Projections suggest current net zero policies could cost up to 1,000 industry jobs per month through 2030, a figure critics say reflects a broader mismatch between climate goals and energy security.

Key Takeaways

"We are expanding access to public energy resources"

White House energy official describing the Gulf 1 plan

"Windfall taxes have deterred investment and harmed energy security"

Ithaca Energy spokesman reacting to UK levy

"The real test is whether new revenue funds can balance jobs and climate goals"

Energy analyst assessing policy tradeoffs

"This policy race mirrors a global tug of war over energy security and climate goals"

Policy commentator on international energy debates

The US strategy uses a long horizon to signal stability in access to public energy resources. By scheduling more than 30 lease sales over 15 years, Washington bets that predictable procurement can fund programs and spread risk, even as prices swing and environmental rules evolve. The approach treats public land as a long-term revenue stream and a tool for energy sovereignty, not a mere catalyst for near-term drilling.

The UK situation exposes a clash between revenue needs and market confidence. A steep windfall tax can quickly drain investor appetites and raise the cost of capital for new projects, undermining energy security just as prices rise. The contrast between US expansion and UK tax policy highlights a wider debate: should governments use fiscal instruments to harvest windfall profits or to nurture steady investment in a low-carbon transition? The answer will shape jobs, prices, and political support for years to come.

Highlights

- We are expanding access to public energy resources

- Windfall taxes deter investment and harm energy security

- The real test is whether new revenue funds can balance jobs and climate goals

- This policy race mirrors a global tug of war over energy security and climate goals

Political and budget risk from offshore sales and windfall taxes

The US expansion relies on price stability and sustained policy support, while the UK levy raises concerns about investment, job security, and public reaction. Both cases invite political scrutiny and potential backlash from industry, climate groups, and workers if expectations diverge from outcomes.

Policy clarity and market signals will determine whether these plans translate into real energy security and steady jobs.

Enjoyed this? Let your friends know!

Related News

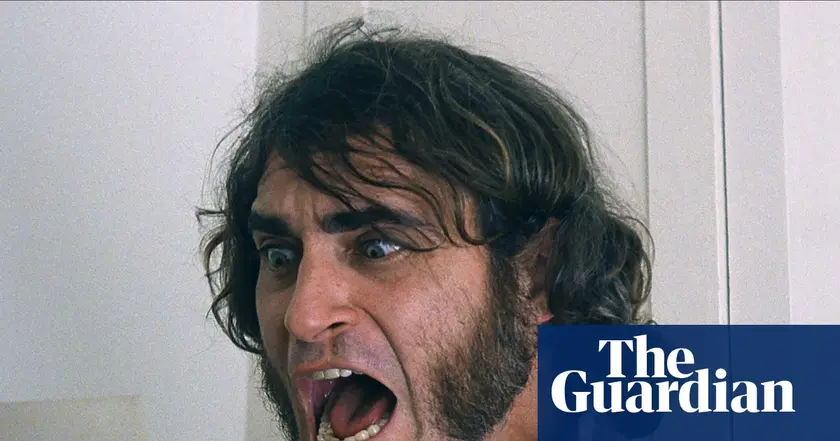

Waypoint Writers Resign After Article Removals

Portland Updates Local Wins Global Drama

ChatGPT outlines paths from $10 to $1 million

Southwest Airlines Changes Seating Policy

HuffPost fact-check Catherine Zeta-Jones claim

Science Magazine Retraction Sparks Controversy

Bezos Blueprint at Center of War Of The Worlds Critique

Elon Musk plans new political party as tensions with Trump rise