T4K3.news

Court orders Mike Lynch's estate to pay HP £700m

The court ruled that the estate must pay damages linked to Autonomy's sale.

The court determined that HP is owed over £700m stemming from the Autonomy acquisition.

Court rules on damages owed by Mike Lynch’s estate

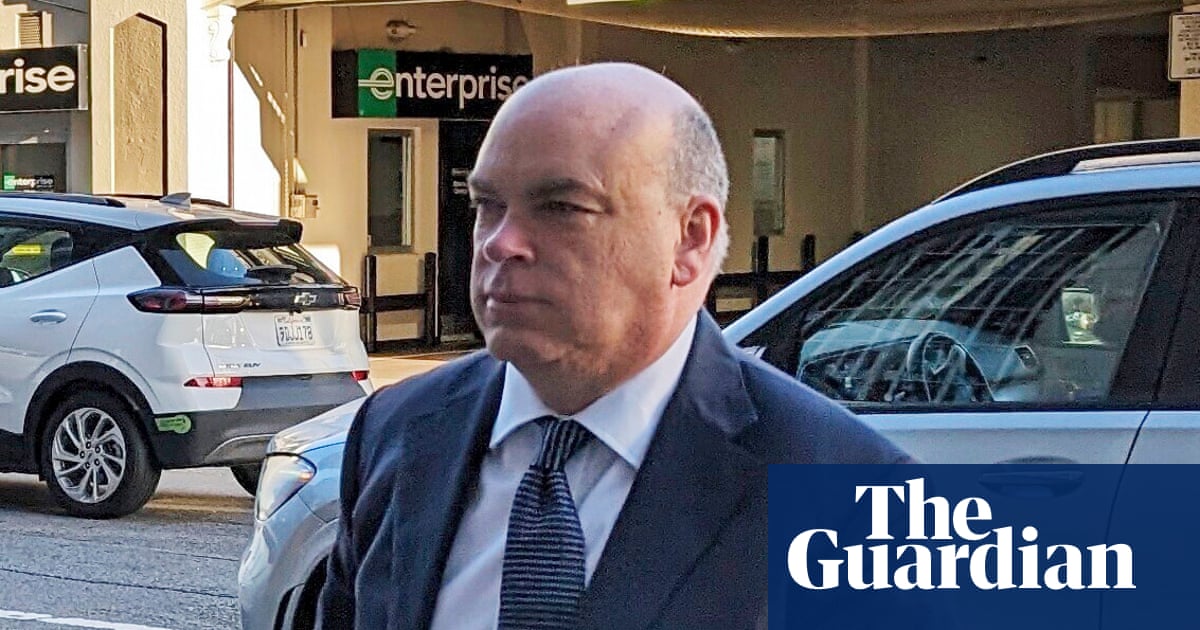

A UK court has ruled that the estate of Mike Lynch and his business partner must pay Hewlett-Packard over £700m due to lost investments in Lynch's software firm Autonomy. Lynch passed away last year after his superyacht sank near Sicily, shortly after being acquitted of fraud charges related to HP’s $11bn acquisition of Autonomy in 2011. The judge assessed that HP would not have proceeded with the purchase had the true financial status of Autonomy been disclosed clearly. While HP initially claimed about $4.55bn in damages, the judge described this estimate as exaggerated and determined the actual loss was much less. The Lynch family is considering an appeal against this ruling, reflecting the ongoing fallout from the high-profile case.

Key Takeaways

"Autonomy's true financial position and performance had not been properly and accurately disclosed."

This quote from the judge underscores the core issue of transparency in corporate transactions.

"I have concluded that there is more than a grain of truth in Dr Lynch’s submission."

The judge acknowledged the defense’s position regarding the original claim's validity.

The ruling highlights ongoing tensions in technology investment and corporate governance. As HP sought to reclaim losses from what it deemed an inflated purchase, it raises questions about the accountability of executives and their disclosures. The case illustrates how investments in technology can lead to substantial risks, where misleading financial information can significantly alter market dynamics and investor trust. This scenario is especially sensitive given the financial stakes involved and the notable public figures connected to the legal battles. Lynch’s legacy continues to be marred by the fallout from this acquisition, with the aftermath still unfolding.

Highlights

- HP wanted £4.55bn, but the judge says their claim was exaggerated by 80%.

- The tragedy of Lynch's life continues with financial burdens.

- Corporate trust is fragile; this case is a stark reminder.

- Lynch's estate faces bankruptcy from a ruling against a tech giant.

Financial risks from HP litigation

The ruling imposes substantial financial obligations on Lynch's estate, raising the risk of bankruptcy and public scrutiny.

This ruling marks a critical moment in a long saga surrounding corporate governance in tech.

Enjoyed this? Let your friends know!

Related News

High Court rules Mike Lynch estate owes HPE £700m

£700 million ruling against Michael Lynch's estate

Court upholds retrospective law affecting building safety

Department of Education Suspends IBR Student Loan Forgiveness

Joey Barton to pay Jeremy Vine over £200k after defamation case

Justin Sane Ordered to Pay $1.9 Million to Assault Victim

Council tenant faces eviction over garden fines

Trump issues executive order on college sports