T4K3.news

Chip policy faces fresh political risk

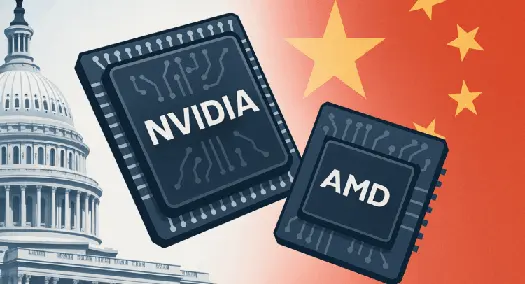

Senate Democrats urge a pause on the plan to sell AI chips to China, signaling possible changes to the export framework that could affect Nvidia and AMD.

Top Senate Democrats urge a pause on a plan that would let Nvidia and AMD sell AI chips to China, citing national security concerns.

Nvidia and AMD face fresh risk as Democrats oppose Trump China chip plan

Top Senate Democrats have asked President Trump to rethink a plan that would let Nvidia and AMD continue selling advanced AI chips to China if chipmakers share 15% of sales with the United States. In an open letter, they warn the policy could undermine U.S. national security goals and growth in key tech sectors. The proposal links access to the Chinese market with a revenue-sharing requirement, a move many in Washington see as a test of how tightly national security interlocks with global tech trade. China remains a major buyer of data-center chips, and any shift in policy could alter the competitive landscape for U.S. chip makers.

The letter signals that the policy fight is not over. If the plan is retained, Nvidia and AMD would keep a large China revenue stream, a factor many analysts say could support growth in the near term. If the plan is altered or blocked, the companies could face a material revenue hit, complicating their AI expansion plans and potentially weighing on stock performance. The outcome will depend on how lawmakers balance security concerns with the economic and strategic value of maintaining open access to a huge foreign market.

Key Takeaways

This episode sits at the crossroads of security, trade and tech leadership. It highlights how policymakers weigh the benefits of global AI supply chains against the risk of empowering a rival. The pushback from Senate Democrats adds a layer of political risk that could slow or reshape the policy, regardless of executive intent. For Nvidia and AMD, the policy uncertainty matters as much as any quarterly figure, because Beijing remains a crucial growth engine for AI hardware. If Washington tightens export rules, the firms may have to adjust forecasts and capital plans, even as demand for AI accelerators remains strong in other regions.

The broader implication is a reminder that AI’s hardware backbone is increasingly a political fixture. Policy shifts could ripple through investor sentiment, supplier relationships, and long-term strategy. In a sector where every percent of market share matters, the policy trajectory could redefine which players lead the next wave of AI expansion and where profits land in the years ahead.

Highlights

- Policy risk now shadows chip dreams.

- China growth fuels the boom, policy risk could rewrite the math.

- Investors crave clarity in a week of headlines.

- National security drives the street vote on chips.

Political and regulatory risk looms over chip policy

Senate opposition to the Trump plan introduces political and regulatory risk that could delay or reshape the China export framework for Nvidia and AMD, with potential impact on investors and market access.

Policy choices in the chip export debate will shape the pace of AI hardware development and the market’s confidence.

Enjoyed this? Let your friends know!

Related News

US weighs stake in Intel

Diplomacy and tech move in step

Government stake in Intel

FTSE 100 hits new high on tariff cues

Deportation deals

US considers 10 percent Intel stake in exchange for grants

Trump administration eyes 10% Intel stake

CHIPS Act equity stake under fire