T4K3.news

China grapples with significant industrial overcapacity

Overcapacity in sectors like EVs and real estate is damaging China's economy and impacting global trade.

China's industrial overcapacity is straining its economy while impacting global markets.

China’s overcapacity crisis threatens global economic stability

China's industrial model faces a critical shortcoming as overcapacity undermines its economic health. The country can produce electric vehicles at a rate three times that of local demand, resulting in aggressive price cuts and substantial losses. This scenario extends beyond electric vehicles to other sectors, creating widespread financial strain, particularly evident in a prolonged decline of factory prices. Trade tensions are rising as historically low prices for Chinese exports prompt nations to respond with tariffs, potentially jeopardizing jobs abroad. Within its own borders, overcapacity is causing significant profit destruction and persistent deflation, with experts noting that the consumer goods segment has seen its most severe price drops since the 2008 financial crisis. The push for excessive production marks a fundamental contradiction in Beijing's approach, as it seeks to maintain a robust industrial policy amid a volatile global landscape.

Key Takeaways

"Overcapacity is not a uniquely Chinese problem, but China is nevertheless in a league of its own."

This highlights the extraordinary scale of China's overcapacity issues in the global context.

"To improve economic performance, China needs to switch to a more consumer- and services-based model."

This suggests a fundamental change in China's economic strategy is essential for future stability.

China's struggle with overcapacity reveals deep-rooted flaws in its economic strategy. While the government's industrial ambitions push the country toward high-tech supremacy, the resulting inefficiencies diminish overall profitability. Overbuilt sectors like housing and infrastructure face shrinking demand, and the push to dominate global markets leads to trade friction. This precarious situation raises concerns over economic stability both domestically and internationally. The current trajectory of heavy investment in unprofitable areas could escalate financial instability and provoke backlash from both local economies and international trading partners. The outcome hinges on whether China can shift toward a more sustainable growth model that embraces consumer needs rather than mere production output.

Highlights

- China's overcapacity is creating a ripple effect across global markets.

- Trade tensions mount as low-price exports reshape international dynamics.

- The country is on a precarious path toward economic instability.

- A shift towards consumer needs is critical for China's future.

Concerns Over Economic Stability

The ongoing overcapacity in various sectors poses risks to both China's economy and global markets, potentially leading to widespread instability.

China's path forward will require an urgent reassessment of its economic priorities.

Enjoyed this? Let your friends know!

Related News

US and China engage in pivotal trade discussions in Stockholm

California almond growers face new tariffs

Motorola's US smartphone production effort faced challenges

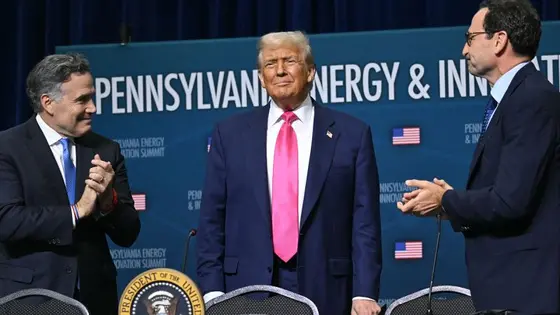

Trump announces $90 billion investment in Pennsylvania AI hub

Six-month pause in superhero movie releases confirmed

China supports firms impacted by U.S. tariffs

Stocks Retreat as Investors Await Key Technology Earnings

Japan sells 11 frigates to Australia for $6.5 billion