T4K3.news

Chancellor considers raising gambling taxes

Chancellor may increase gambling taxes to combat child poverty, potentially lifting 500,000 children out of poverty.

A potential increase in gambling taxes could fund vital support for children in poverty.

Chancellor considers raising gambling taxes to combat child poverty

The Chancellor has not ruled out increasing taxes on the gambling industry after the Institute for Public Policy Research (IPPR) suggested such a move could raise £3.2 billion. This revenue could be used to lift 500,000 children out of poverty by eliminating the two-child benefit cap. Currently, the cap restricts financial support to families with more than two children, a policy seen as detrimental to many. Former Prime Minister Gordon Brown supports the proposal, contrasting the potential income from taxing gambling with the serious social issues tied to child poverty. However, the Betting and Gaming Council warns that these changes could negatively impact the industry and lead gamblers towards unregulated markets.

Key Takeaways

"The gambling industry is highly profitable...It only feels fair to ask this industry to contribute a little more."

Henry Parkes argues for higher taxes from the lucrative gambling industry to tackle poverty.

"Taxing the betting industry to support our children won't be a gamble. It will be an investment in their future."

Gordon Brown emphasizes the need for responsible fiscal measures to support disadvantaged children.

The discussion around gambling taxes touches on deeper societal issues. On one hand, the potential tax revenue represents a proactive approach to tackling childhood poverty, which is on the rise. However, the implementation may not be straightforward. Critics within the gambling sector claim increased taxes could harm both the economy and vulnerable consumers by pushing them into illegal gambling rings. The balance between generating revenue and ensuring responsible gambling practices remains a crucial debate.

Highlights

- Taxing gambling may not be a gamble but an investment in our children's future.

- Raising gambling taxes could fund children's needs, but at what cost?

- The numbers in child poverty are alarming and must be addressed now.

- Support for families hangs in the balance between gambling revenue and policy.

Tax increase proposal raises economic concerns

The push to raise gambling taxes is controversial, with warnings of potential negative impacts on the industry and consumers. Critics argue this could lead more individuals to unregulated gambling markets, threatening consumer safety and revenues.

As the government prepares for its autumn budget, the impact of these decisions on child welfare will be closely monitored.

Enjoyed this? Let your friends know!

Related News

Gordon Brown calls for increased gambling taxes

UK faces rising fiscal deficit with urgent need for council tax reform

Economic confidence reaches historic low amid tax worries

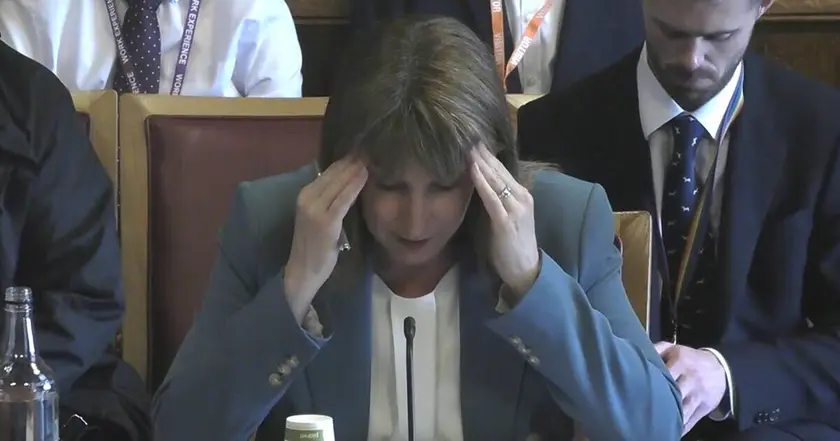

Rachel Reeves may face tax increases to address budget gap

Rachel Reeves announces record £2.2 billion inheritance tax receipts

Government borrowing in UK rises significantly

IMF advises UK to reconsider pension and NHS treatment policies

Starmer downplays tax hike warnings