T4K3.news

Apple reveals better-than-expected Q3 earnings

Apple reported a revenue of $94 billion, surpassing analyst expectations of $89.3 billion.

Apple's latest earnings report reveals impressive iPhone sales and revenue growth.

Apple sees significant revenue growth in third-quarter report

Apple has announced its fiscal third-quarter results, reporting a revenue of $94 billion, surpassing analysts' expectations of $89.3 billion. Earnings per share reached $1.57, exceeding estimates of $1.43. The company's iPhone revenue was particularly strong at $44.58 billion, beating estimates of $40.06 billion. Greater China revenue also slightly surpassed predictions, coming in at $15.37 billion. CEO Tim Cook highlighted the company's overall growth, noting significant increases in iPhone, Mac, and services across all regions. Despite this positive outlook, Apple stock remains down 16% for the year due to ongoing challenges such as tariffs and competition in the AI sector. Analyst Thomas Monteiro emphasized the importance of this earnings beat, particularly in a typically slower quarter.

Key Takeaways

"Today Apple is proud to report a June quarter revenue record with double-digit growth in iPhone, Mac and Services."

Tim Cook celebrates the company’s revenue growth, underscoring success across product lines.

"Investors should not underestimate the fact that Apple delivered a massive revenue beat in its slowest quarter of the year."

Analyst Thomas Monteiro comments on the significance of Apple’s performance amidst industry challenges.

Apple's impressive Q3 performance signals a robust recovery and consistent demand for its flagship products. The strong earnings indicate resilience despite broader economic challenges, including tariff impacts. This notable growth in revenue is significant as it occurs in a quarter often regarded as slower for technology companies. However, uncertainties regarding both Apple's AI strategy and the influence of tariffs continue to pose risks. Investors are now keeping a close watch on Apple's next moves in this competitive landscape, especially as tech giants evolve rapidly around AI capabilities.

Highlights

- Apple is proud to report a June quarter revenue record.

- Investors should not underestimate Apple's massive revenue beat.

- This is the biggest revenue growth since 2021.

- Apple's strong performance continues amidst challenges.

Potential risks loom for Apple despite strong earnings

Despite impressive earnings, Apple faces ongoing challenges with tariffs and competition in the AI market, creating uncertainty. Investors are wary of the company's future direction amidst these pressures.

The focus now shifts to how Apple will navigate its challenges moving forward.

Enjoyed this? Let your friends know!

Related News

Apple Stock Shows Gains Amid Earnings Report

Stocks Retreat as Investors Await Key Technology Earnings

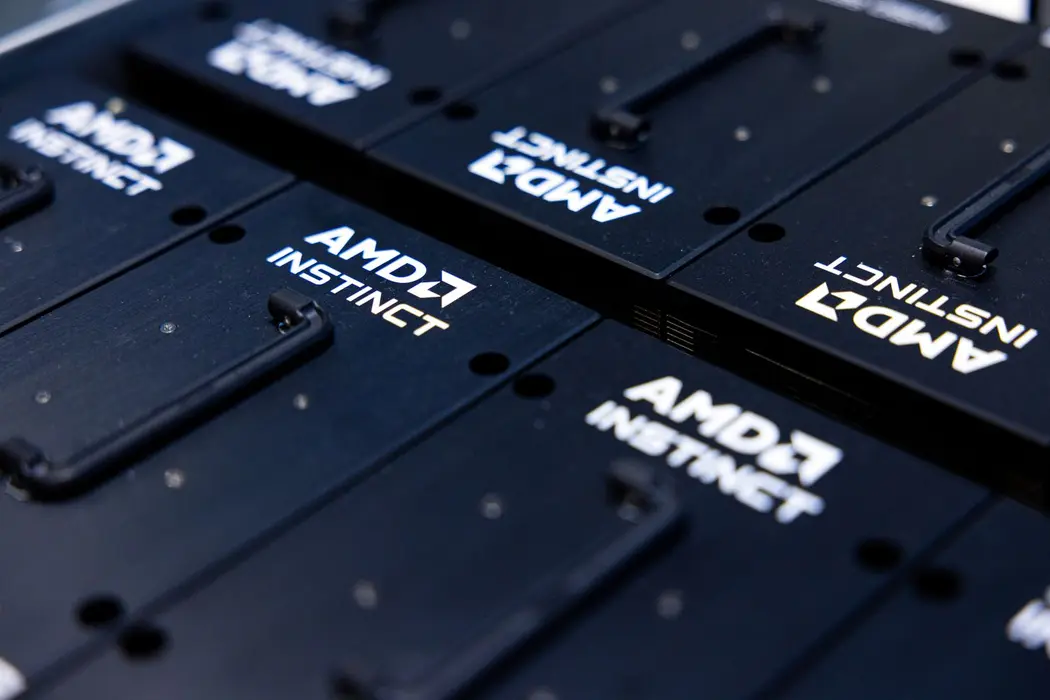

AMD stock declines despite strong quarterly results

Apple announces iPhone 17 lineup and AirPods Pro 3

Apple to Report Q3 Earnings Soon

Apple plans to grow AI investments significantly

Apple unveils Awe Dropping hardware lineup

Silicon Valley's AI Investments Surge