T4K3.news

Americana not a bomb, indie film economics explained

Lionsgate uses a light marketing plan and a 30-day theatrical window to reach profitability across theaters and streaming.

This analysis explains why Americana's release challenges the simple box office narrative and what it reveals about indie film economics today.

Americana Reframes Indie Box Office Economics

Americana, a Bron Studios financed Western that stars Sydney Sweeney and Paul Walter Hauser, was acquired by Lionsgate for about $3 million and released to roughly 1,100 theaters. The opening reported around $500,000, far from a blockbuster, but the film is not meant to be a big wide release. The deal includes foreign pre-sales that help offset risk and positions the title within Lionsgate Premiere, a label built for lower-budget arthouse and genre titles with lean marketing. The math hinges on longer-term revenue from downstream windows rather than a single weekend.

The bigger point is that indie acquisitions drift in a tougher market. The industry has a glut of unsold titles as streamers pare back demand and buyers seek lower risk. Americana's strategy demonstrates a model where a modest domestic take can still be profitable across TV and digital windows, given careful budgeting and flexible release timing. This approach reflects a broader trend: a no one-size-fits-all reality, where success is measured by the whole lifecycle, not the opening weekend.

Key Takeaways

"Indie hits live in the long game, not in opening weekend."

Commentary on indie release economics.

"A star can open doors, but a smart financier closes the deal."

Financing and distribution strategy.

"The math of small releases is about windows, not walls."

Release strategy.

"Streaming windows are the new value line for modest budget films."

Streaming strategy.

This case invites a shift in how success is judged for indie films. The star power helps, but the value lies in the ability to monetize across platforms and markets, and in partnerships that survive a slow theatrical start. The economics favor a long tail over a single splash, especially when foreign deals and streaming revenue are part of the plan.

For actors and directors, these dynamics push them toward collaborations with mid-sized studios that can supply both distribution muscle and streaming leverage. The risk remains that investors grow wary when early numbers lag, even if the long tail shows promise. The industry’s real test is whether these models can scale to bigger projects without eroding creative ambition or fan trust.

Highlights

- Indie hits live in the long game, not in opening weekend.

- A star can open doors, but a smart financier closes the deal.

- The math of small releases is about windows, not walls.

- Streaming windows are the new value line for modest budget films.

Budget and investor risk in indie releases

The Americana case shows how a modest budget and careful foreign pre-sales can still attract theatrical distribution. However, the broader indie market faces pressure from an acquisitions slump, rising production costs, and reliance on streaming deals that may delay or limit revenue. This creates potential backlash from investors and concerns about public reaction to limited theatrical runs.

The next wave will reveal whether these carefully staged indie plays can become standard practice for mid-budget films.

Enjoyed this? Let your friends know!

Related News

Weapons dominates weekend box office

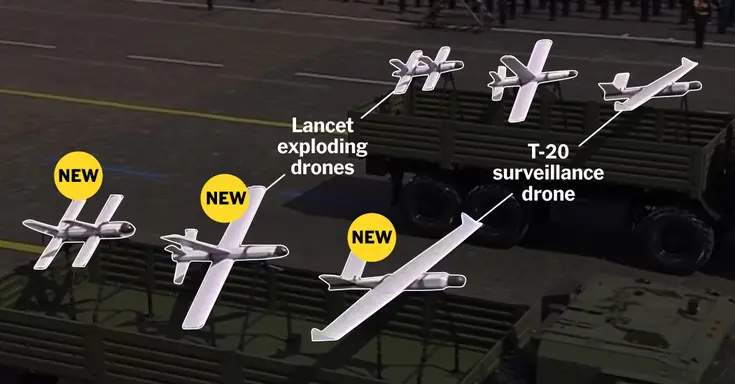

Russia Builds a Wartime Edge

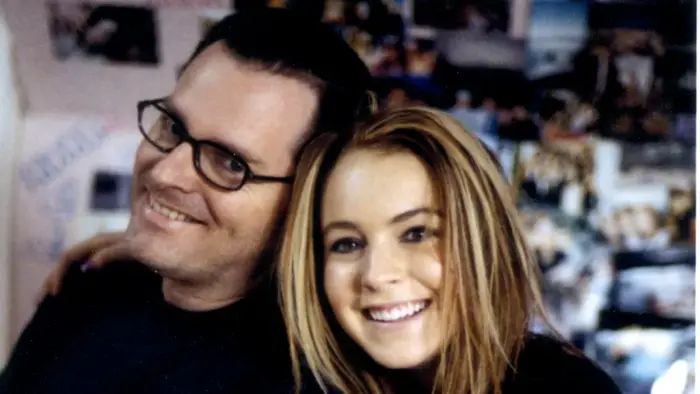

Mark Waters Excluded From Freakier Friday Sequel

Documentary Investigates Iconic Vietnam Photo Controversy

Lionsgate bets on long tail profits for Americana

Mission: Impossible Director Discusses Key Character Death

Sweeney Jeans Ad Sparks Online Backlash

Indie games go mobile and Gamescom previews set the pace