T4K3.news

AI stock risk alert

Markets show signs of cooling as AI hype meets real profit questions. Investors should evaluate timing and risk before piling in.

AI hype cools as leaders warn of risk and markets show signals similar to the dotcom era.

AI stock bubble signals caution for investors

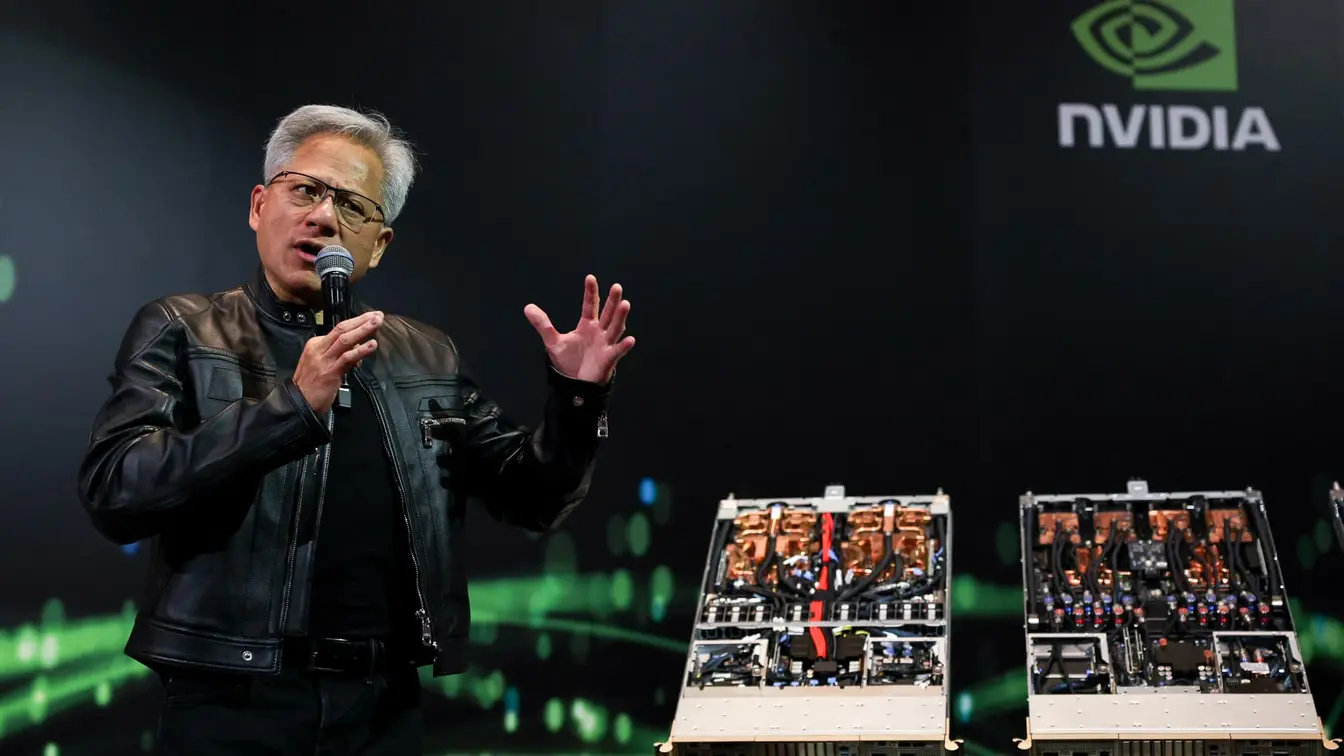

OpenAI chief executive Sam Altman questioned whether investors have become overexcited about AI, saying his view is yes. The comments arrive as AI-linked stocks show modest wobbling: Nvidia slipped about 3.6% since his remarks, Palantir down around 15%, Broadcom down 6.3%, AMD down 11%, and Astera Labs down 8.3%. In the UK, the L&G AI ETF fell about 1.4%. A separate MIT study found that 95% of attempts to apply AI in business have delivered little or no profit impact so far, tempering optimism. Mustafa Suleyman of Microsoft’s AI division warned that AI is becoming so human-like that people experience delusions and urged safeguards. The market reaction has been calm rather than dramatic, with investors awaiting the next data points.

Valuation concerns also echo the dotcom era. The cyclically adjusted price-to-earnings ratio (Cape) sits near 38, a level last seen during the late 1990s surge, suggesting that prices may be stretched relative to current earnings. Yet industry watchers point to potential productivity gains if AI can cut costs and lift revenue, with firms like Morgan Stanley highlighting possible major benefits. Nvidia’s earnings and broader AI demand remain a key test for whether the current mood can regain momentum or fade further into a wait-and-see stance.

Key Takeaways

"Are we in a phase where investors as a whole are overexcited about AI? My opinion is yes."

Altman acknowledges hype in AI funding

"I do think some investors are likely to get very burnt here, and that sucks"

Altman warns of potential losses for investors

"95 per cent of attempts to harness AI by companies so far had delivered little or no benefit to the profit-and-loss account"

MIT finding on AI adoption impact

"AI was becoming so human-like that people were suffering from delusions"

Suleyman calls for safeguards against AI overreach

The piece frames AI as a test case for market psychology as much as for technology. The risk is not the science itself but how investors price it now and how quickly profits materialize. The dotcom lesson—big hype followed by a harsher reality—still travels with new tech, and today’s multiples suggest a similar risk profile. Policymaker patience, macro conditions such as higher interest rates, and the pace of AI deployment will all shape the outcome. The coming weeks, especially with Nvidia’s results, will reveal whether AI can justify optimistic forecasts or whether the market will retract once the data disappoints.

Beyond numbers, the story presses a broader question: can companies translate AI into durable profits, or will the gains stay concentrated among a few tech leaders? The debate matters because it touches jobs, policy, and the practical value of new tools in everyday business. The answer will influence how aggressively investors and firms pursue AI in the months ahead, and how regulators balance innovation with risk.

Highlights

- Investors may be burnt here and that sucks

- A kernel of truth is not a full business model

- Market pricing is chasing profits not yet in the books

- AI delusions rise as profits lag behind hype

Investor risk from AI hype

The piece highlights potential losses for retail and institutional investors if AI enthusiasm fades. The parallels to dotcom bust and the ongoing debate about economic value versus hype raise concerns about market volatility and policy responses.

The coming quarters will test whether AI can deliver durable gains or fade under the weight of hype.

Enjoyed this? Let your friends know!

Related News

Crypto bets shift to real world utility and AI infrastructure

Jim Cramer reveals top ten stock insights for July 25

Nvidia faces China risk ahead of Q2 earnings

Google alerts Gmail users about AI scam

Perplexity backs £25bn bid for Google Chrome

Federal Reserve keeps rates steady amid tech earnings

Palantir Stock Alert

CoreWeave stock drops after earnings