T4K3.news

Yen Gains on BOJ Rate Hike Expectation

The yen strengthened as policy chatter suggested a BOJ rate hike while Asian stocks pulled back after a three-day rally.

Asian stocks retreat after a brief rally as expectations of a BOJ rate hike lift the yen and move currency markets.

Yen Gains on BOJ Rate Hike Expectation as Stocks Drift After Rally

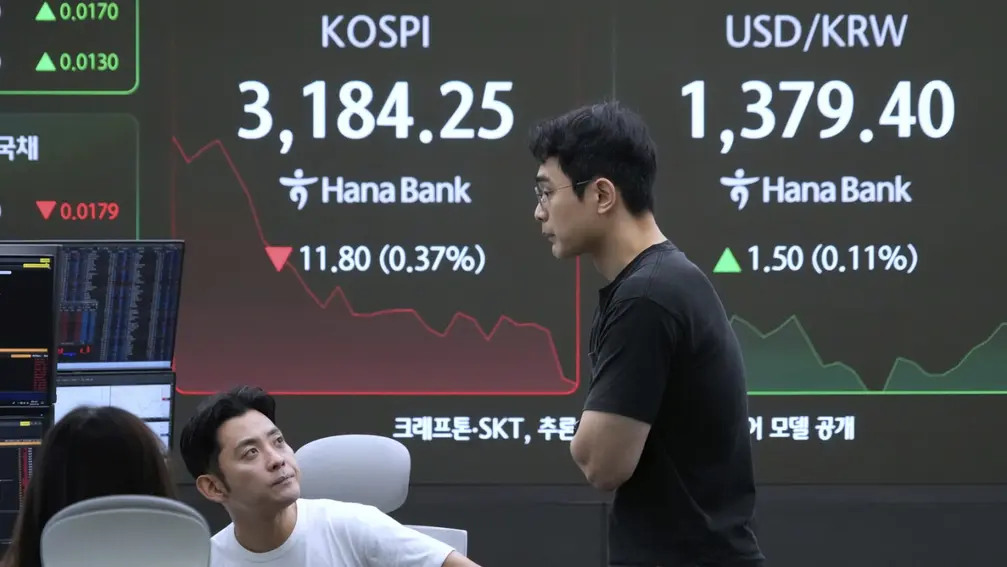

The yen rose as much as 0.7% against the dollar after policy chatter suggested the Bank of Japan may raise rates to curb inflation. The move came as Asian equities eased following a three-day rally, with traders weighing how a potential policy shift could affect Japan and its trading partners.

A broad dollar index slipped for a third day while the yen gained, and other regional currencies such as the rupiah and the ringgit strengthened against the greenback. Investors also watched calls for the Federal Reserve to ease policy, which could add to short-term volatility in global markets.

Key Takeaways

"Policy signals drive markets faster than headlines"

Editorial takeaway on policy impact

"Markets react to rate paths not promises"

Commentary on investor behavior

Policy divergence between the BOJ and major Western central banks is shaping currencies and asset prices. If the BOJ follows through with higher rates, exporters may feel pressure while import costs could rise, affecting inflation dynamics at home. At the same time, any hints of US policy easing could keep currency markets on edge, signaling that investors prize clarity over certainty in uncertain times.

Highlights

- Policy signals move markets faster than headlines

- Markets react to rate paths not promises

- Currency moves reveal policy tension in real time

- Investors chase hints not certainty

Policy driven market risk

The piece discusses rate hike and easing expectations which can create volatility in currency and equity markets. This may affect investors and businesses with exposure to international markets.

Policy signals will continue to steer markets as data and guidance arrive.

Enjoyed this? Let your friends know!

Related News

Dow futures rise before July CPI data

Global Stock Markets Rise on Trade Optimism

Federal Reserve holds interest rates steady amid inflation issues

Weak July job numbers spark fears of economic slowdown

UK economy grows as PMI rises WH Smith slides on accounting error

World shares rise as US inflation cools and tariff pause boosts markets

Reeves eyes broad tax hikes in Autumn Budget

Pixel 10 Series Preview