T4K3.news

Vertex stock plummets after pain drug trial failure

Vertex Pharmaceuticals' stock fell over 14% following the failure of its VX-993 pain treatment trial.

The recent failure of Vertex's experimental drug trial led to a significant stock decline.

Vertex stock drops sharply after pain drug trial failure

Vertex Pharmaceuticals’ stock fell by more than 14% in pre-market trading after the company announced the failure of its experimental pain treatment drug, VX-993, in a Phase 2 clinical trial. This setback raises concerns about the sustainability of investor confidence in the company’s drug pipeline, especially as the results overshadowed Vertex's strong second-quarter earnings report. Despite reporting a revenue increase of 12% to $2.96 billion, driven by its cystic fibrosis drug Trikafta, the failed trial has left investors uneasy about Vertex's future projects. The company has decided not to pursue VX-993 further for treating acute pain following bunion surgery. Analysts have mixed responses to the company's stock, maintaining a Moderate Buy consensus but acknowledging the impact of this recent development.

Key Takeaways

"This setback raises concerns about the future of the program and investor confidence."

The quote highlights the central concern regarding investor reactions to the failure of the trial.

"Vertex maintained its full-year revenue forecast of $11.85 billion to $12 billion, matching analysts’ expectations."

This statement reflects the company's financial stability despite the recent trial failure.

"The drastic drop in stock signals a troubling trend for the company that has thrived mostly on cystic fibrosis drugs."

This observation underscores the vulnerability of companies reliant on successful drug trials.

"Investor confidence may waver as the company moves forward with other treatments."

This quote indicates the potential fallout and uncertainty within the investor community following the trial failure.

The drastic drop in Vertex's stock signals a troubling trend for the company that has thrived mostly on its highly successful cystic fibrosis drugs. The failure of VX-993 introduces uncertainty surrounding future innovation and product pipelines, suggesting that investors may need to recalibrate their expectations. While Vertex enjoyed strong financial results, the failed pain treatment reflects a more significant risk in the pharmaceutical sector: even established companies can struggle with clinical trials. As they aim to expand their portfolio, maintaining investor trust will be crucial for Vertex's long-term growth.

Highlights

- Vertex faces a major setback with its pain treatment trial failure.

- Strong financials can't mask the risk from drug trial failures.

- Investors react strongly to clinical trial outcomes in biotech.

- The journey for Vertex will be perilous without robust pipeline approval.

Investor confidence at risk after trial failure

The failure of VX-993 raises serious concerns about Vertex's future projects and may impact investor sentiment as they rely more heavily on successful trials.

Vertex's ability to navigate future trials will significantly influence its market position.

Enjoyed this? Let your friends know!

Related News

Vertex's pain drug fails clinical trial

Sarepta Faces Class Action Over Elevidys Safety Claims

Eli Lilly shares fall 14% after trial disappointment

Heart failure risk linked to pregabalin study

Pregabalin linked to higher heart failure risk in seniors

Cancer drugs may reverse Alzheimer's effects

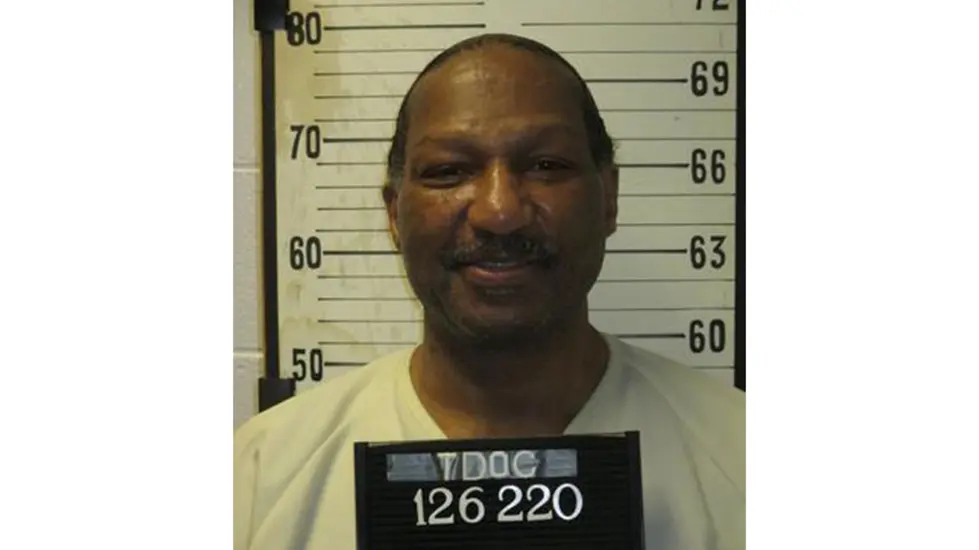

Tennessee moves forward with controversial execution

New gene therapy shows promise for treating knee pain