T4K3.news

US tariffs on steel and aluminium hit UK manufacturers

The US has raised tariffs to 25 percent on goods containing steel and aluminium, increasing costs for British exporters and prompting calls for government intervention.

Industry leaders urge government to intervene after the US increases tariffs to 25 percent on steel and aluminium, reversing prior expectations of a lower rate.

US tariffs on steel and aluminium hit UK manufacturers

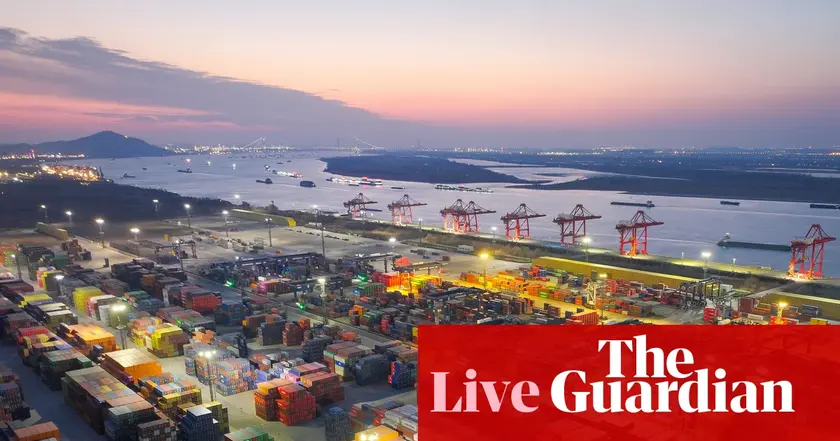

The United States has raised the tariff on hundreds of products that contain steel or aluminium to 25 percent, affecting UK exporters to the US. The move, announced recently, could add hundreds of millions of pounds in extra costs for British manufacturers each year. The rising charges touch sectors from construction machinery to automotive parts and reach across the supply chain.

JCB, the Midlands based digger maker, is highlighted as a potential hard-hit business. Other affected areas include renewables equipment makers, especially in the wind turbine supply chain, along with producers of pumps, compressors, and even furniture. Industry groups warn of significant risks and are urging the UK government to step in, noting that tariffs between the UK and US had previously been assumed to be about 10 percent under the Trump administration.

Key Takeaways

"The tariff jump adds a new cost layer for British firms."

Factual note on impact on production costs

"Industry groups are calling for urgent government intervention."

Industry response to policy move

"Tariffs can become a tax on growth if left unchecked."

Editorial warning about longer-term effects

"Manufacturers feel the squeeze as costs rise."

Emotional reflection on business strain

The tariff jump shows how quickly international policy can ripple through a modern economy. UK manufacturers have spent years building resilience through diversified suppliers and new markets; a sudden 25 percent fee on inputs and finished goods tightens margins and could force price increases. The episode also exposes gaps in long-range planning for post-Brexit trade.

This could push policymakers to seek relief measures or exemptions, while business leaders weigh cost pressures against the need to stay competitive abroad. In the bigger picture, the move underscores how contingent and fragile global supply chains remain, and how swiftly policy can alter investment sentiment in manufacturing and energy sectors.

Highlights

- Britain must not bear the cost alone

- Policy that shifts costs to manufacturers rarely works

- This is a test of the government's resolve to defend industry

- Supply chains stretch as tariffs rise

Tariffs raise political and economic risk for UK industry

The 25% tariff shift heightens cost pressure on manufacturers, risks inflation, and strains transatlantic trade relations. It also puts political pressure on UK policymakers to act quickly to shield industry and jobs.

Markets will monitor government moves as the policy landscape in transatlantic trade shifts

Enjoyed this? Let your friends know!

Related News

Bioethanol plant closure in Hull

Tariffs hit Indian foundries

Trump states 50-50 chance for EU trade deal

EU US tariff deal reached

EU steel tariff remains at 50% in latest US trade talks

Canada lifts most tariffs on US goods

FTSE 100 hits new high on tariff cues

Stock markets fall sharply after Trump tariff announcement