T4K3.news

US ends tariff exemption for low-value packages

All packages under $800 will now incur duties starting August 29.

New tariff rules will impact the cost of low-value imported goods.

US ends tariff exemption for low-value overseas packages

The United States government is set to end a longstanding tariff exemption for low-value commercial shipments. Effective August 29, packages valued at or under $800 that come outside the international postal network will now attract full duties. This decision follows an executive order signed by Donald Trump and is part of a broader strategy to address national emergencies and protect American businesses. Recently, the White House noted that a new spending bill will officially repeal the legal foundation for this exemption starting July 1, 2027. The change means goods shipped via postal services will incur either an ad valorem duty based on the effective tariff rate of the origin country or, for a temporary period, a specific duty ranging from $80 to $200, based on the country’s tariff policy.

Key Takeaways

"Trump is acting more quickly to suspend the de minimis exemption to deal with national emergencies."

This statement highlights the urgency behind the new tariff strategy.

"Goods shipped through the postal system will now face full duties based on country of origin."

This change directly impacts how international shipments will be taxed.

The decision to eliminate the de minimis exemption signals a significant shift in U.S. trade policy, particularly aimed at curbing imports from countries like China and Hong Kong, which have heavily relied on this privilege. By reinstating tariffs, the government may aim to funnel more revenue and protect local industries, yet there are concerns about how this will affect consumers and small businesses. The potential increase in prices for everyday goods could resonate, prompting public backlash as higher costs burden consumers already facing inflation. This policy adjustment reflects ongoing tensions around global trade, especially as the U.S. seeks to navigate its economic priorities amid international competition.

Highlights

- Tariffs are back on low-value imports to protect American businesses.

- The end of de minimis could raise prices for consumers everywhere.

- This is a bold move in the face of ongoing trade tensions.

- Local industries may benefit but consumers might face higher costs.

Tariff policy raises concerns

The decision to remove the de minimis exemption could lead to price hikes for consumers and backlash from businesses that rely on low-cost imports.

The ripple effects of this change will unfold as international trade dynamics shift.

Enjoyed this? Let your friends know!

Related News

Trump ends global tariff exemption for low-cost goods

Trump Ends Tariff Exemption for Small Packages

Trump ends de minimis exemption for global low-cost goods

Mortgage approvals increase as housing market stabilizes

:max_bytes(150000):strip_icc()/GettyImages-2227723550-e694a4f3ee1d4e72bdefbf6236937641.jpg)

Stocks Retreat as Investors Await Key Technology Earnings

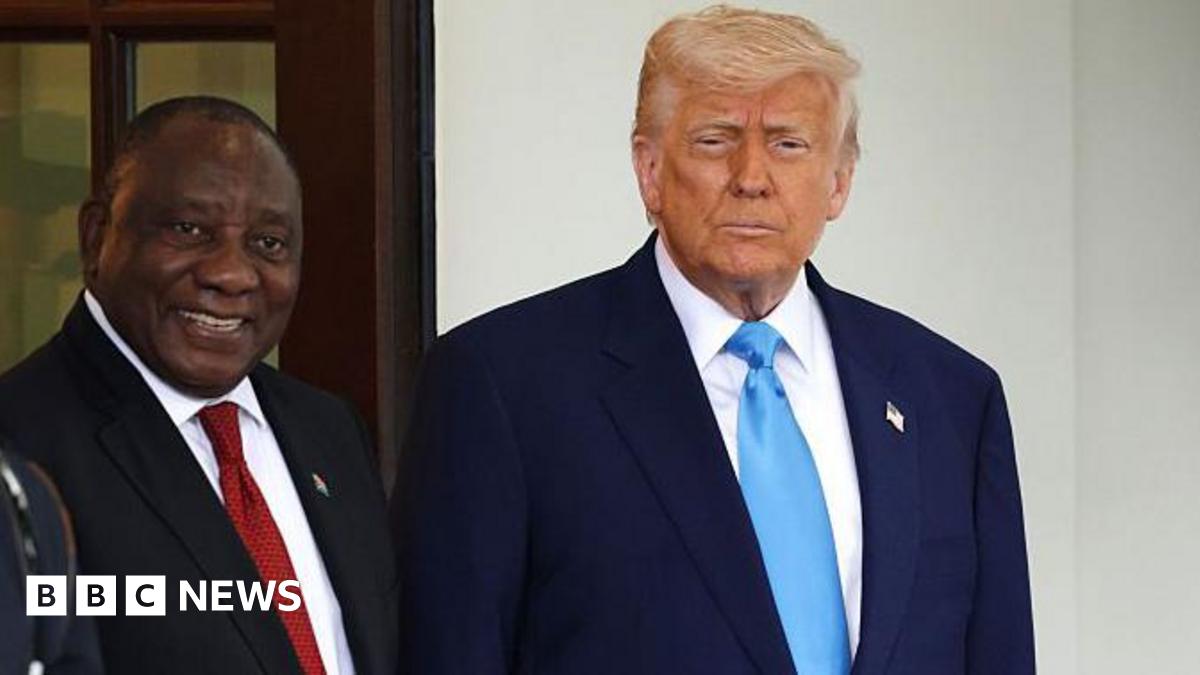

Trump announces 30% tariffs on South Africa

Walmart raises prices as tariffs take effect

Donald Trump marks six months in office with drastic policy changes