T4K3.news

US data credibility under scrutiny

The firing of the BLS chief sparks a national discussion on data integrity and its impact on markets and policy.

A debate over the integrity of official US economic data unfolds after the firing of the BLS commissioner, raising questions about credibility and oversight.

US data credibility tested after firing of BLS chief

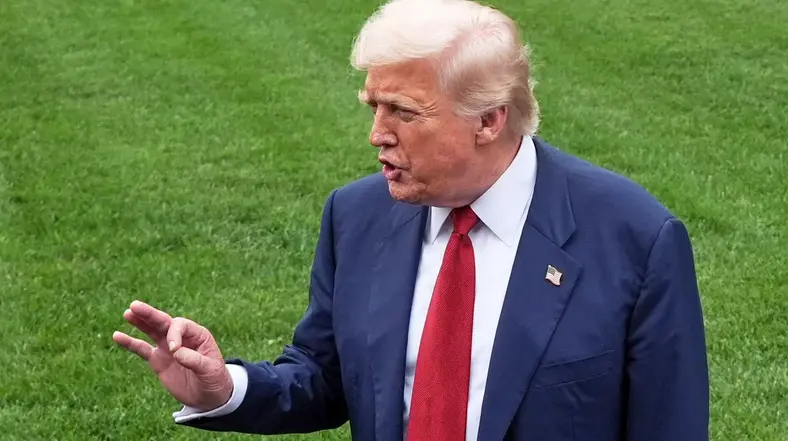

President Donald Trump fired Erika McEntarfer, the commissioner of the Bureau of Labor Statistics, after a jobs report that showed slower growth than expected. The White House says the move aims to strengthen data rigor, not politics, but critics warn of a slippery slope toward data manipulation. Historical examples from Greece and Argentina show how false numbers can punish a country in financial markets, yet the United States remains the world’s largest economy and a global benchmark for data quality.

Analysts say there is no evidence of data rigging in the United States. Still, large revisions to past figures have raised questions about how the BLS collects data and builds its models. Budget cuts threaten data collection and slow final releases, which could affect confidence. The United States has other sources, such as the Census Bureau and the BEA, to provide a fuller picture and cross-check the numbers.

Key Takeaways

"There’s no substitute for credible government data."

Comment on data reliability from a rating analyst.

"We’re the largest economy in the world. We are by far the greatest financial center in the world."

Robert Shapiro on the US data status.

"There’s no way for McEntarfer or others to rig the data."

William Beach on data integrity.

"The US for a long time has been kind of the gold standard for data."

Michael Heydt on data legacy.

This episode tests the independence of a key national institution at a moment when political tensions run high. The stakes go beyond one report and touch the trust households and investors place in official numbers. If credibility frays, markets could rely more on private data or more volatile revisions, complicating policy and borrowing costs. Yet the article also stresses that the US still leads in data quality and has multiple agencies to triangulate numbers, suggesting the system can endure with stronger funding and clearer safeguards. The bigger question is whether a culture of transparency will outpace political maneuvering.

Highlights

- Trust in numbers is the quiet engine of markets

- Data credibility is the first currency in a data driven economy

- Transparency is the shield that keeps markets calm

- A nation’s credibility rests on its statistics arm

Political backlash risk

Firing the BLS chief and debates over data integrity raise political sensitivity and could affect investor sentiment and public trust.

Trust in data is built over time, not in a single report.

Enjoyed this? Let your friends know!

Related News

Backlash grows over Trump pick to lead labor statistics

Gold prices decline as inflation data shifts Fed rate outlook

Trump expands DC authority amid Gaza journalist deaths

Trump dismisses head of Bureau of Labor Statistics

Wall Street Journal warns on BLS leadership

France blocks reintroduction of acetamiprid

BLS leadership change